Euro stablecoins surpass $1b, represent 0.006% of Eurozone money supply

Euro-denominated stablecoins have reached approximately $1 billion in total circulating supply, according to industry data, though the figure represents a minimal fraction of Europe’s broader monetary system.

- Euro-denominated stablecoins have surpassed $1 billion in circulation but still represent just 0.006% of the eurozone’s roughly $15.5 trillion M2 money supply.

- After limited activity in 2020–2021, issuance is now spreading beyond Ethereum to networks including Solana, Polygon, Arbitrum, Base, Avalanche, and Stellar.

- Euro stablecoins remain far smaller than dollar-based stablecoins and underrepresented relative to the euro’s real-world role.

The eurozone’s M2 money supply stands near $15.5 trillion, according to Token Terminal, placing euro stablecoins at roughly 0.006% of the underlying money stock.

Market capitalization data for tokenized euros shows limited activity through 2020 and 2021, followed by accelerated expansion beginning in late 2023 and continuing into 2024 and 2025, according to the report.

Ethereum accounts for the largest share of euro-denominated stablecoin issuance, though distribution has expanded across multiple blockchain networks including Arbitrum, Polygon, Base, Solana, Avalanche, and Stellar, the data shows.

The multi-chain expansion indicates that euro stablecoin issuance has moved beyond a single ecosystem, with issuers deploying tokenized euros across platforms focused on payments, settlements, and cross-border transfers.

The combined market capitalization remains substantially smaller than dollar-based stablecoins, which play a central role in cryptocurrency liquidity and global on-chain settlement, according to market observers.

Euro stablecoins have been in development for several years but remain largely underdeveloped relative to their potential addressable market, the data indicates. The gap between the euro’s real-world monetary presence and its on-chain representation could allow for expansion if regulatory clarity, institutional adoption, or payment integration increases.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

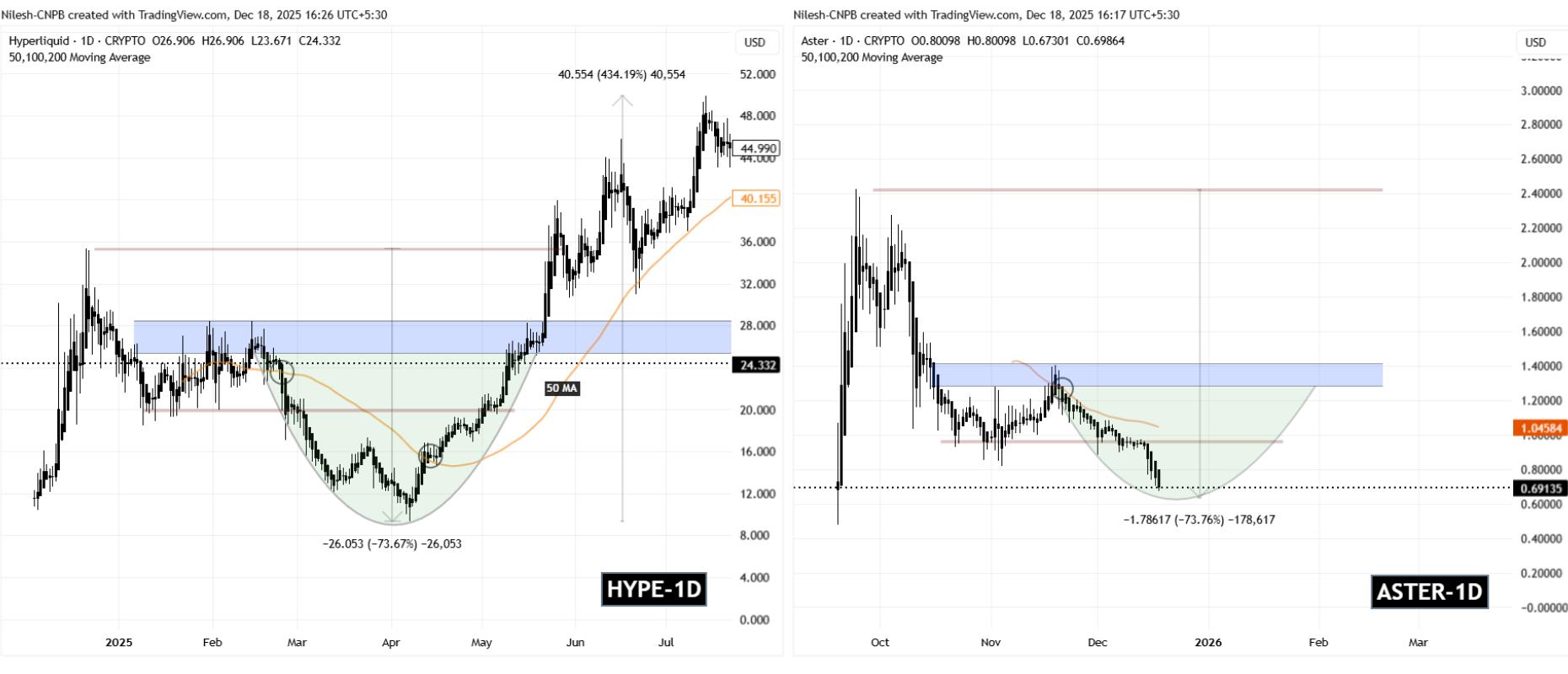

Is Aster ($ASTER) Nearing a Potential Bottom? A Key Emerging Fractal Suggests So!

XRP Algorithmic Trading Hits US Retirement Accounts with Digital Wealth Partners

Indian MP Proposes Bill for Asset Tokenization via Blockchain

Ethereum’s Future Gas Limit Increase: Rumors and Realities