Pyth creates “PYTH Reserve” and starts monthly buyback of PYTH token

- Pyth uses 33% of the DAO treasury in buyback.

- “PYTH Reserve” buys PYTH token on the open market.

- Pyth Pro reaches $1M ARR with real-time data.

Pyth Network has announced the start of a monthly buyback program for the PYTH token, allocating 33% of the DAO's treasury to recurring purchases. This initiative aims to align the asset's value with the adoption rate of the network's products, while also creating a policy for the continuous use of treasury resources.

The program is called “PYTH Reserve” and, according to the published plan, will use revenue associated with the treasury to purchase tokens on the open market. Purchases are expected to occur periodically, with execution and custody entirely on-chain, keeping the acquired assets within the reserve created by Pyth.

The first buyback, scheduled for this month, was estimated at between US$100.000 and US$200.000. The DAO treasury, in turn, was estimated to be around US$500.000 at the time of the announcement, indicating that the initial amounts should represent a significant portion of the cash available for this strategy.

Pyth also indicated that the volume of repurchases could grow from 2026 onwards, following the increase in revenue. The market's interpretation is that the greater the predictability of inflows into the treasury, the greater the capacity to sustain monthly purchases at higher levels, without depending on one-off decisions.

This move is happening in parallel with the expansion of the network's data portfolio. Pyth Pro, the most recent product, offers real-time information on cryptocurrencies and traditional assets and reached $1 million in annual recurring revenue (ARR) in its first month. The service reportedly surpassed 80 active subscribers, suggesting rapid commercial traction for a newly launched product.

The PYTH Reserve is governed, systematic, and transparent.

Monthly open-market PYTH purchases funded by the DAO.

Growth → revenue → purchasing power.

A self-reinforcing flywheel.

— Pyth Network 🔮 (@PythNetwork) December 16, 2025

In its long-term plan, Pyth aims for an ARR of $500 million, proposing to capture approximately 1% of a data market estimated at $50 billion. The network also projects that this sector could reach $100 to $125 billion by 2035, influenced by institutional adoption, tokenized assets, and the consumption of data with artificial intelligence.

In addition to Pyth Pro, the infrastructure includes Pyth Core, Pyth Entropy, and Pyth Express Relay, which together support over $2,3 trillion in transactions across more than 100 blockchains for over 600 applications. Pyth did not provide projections on the direct impact on the circulating supply, but highlighted that the goal is to strengthen the utility and value of the token.

Finally, buybacks are gaining traction among crypto projects in 2025, with ten initiatives accounting for 92% of buyback spending during that period, a trend led by Hyperliquid.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

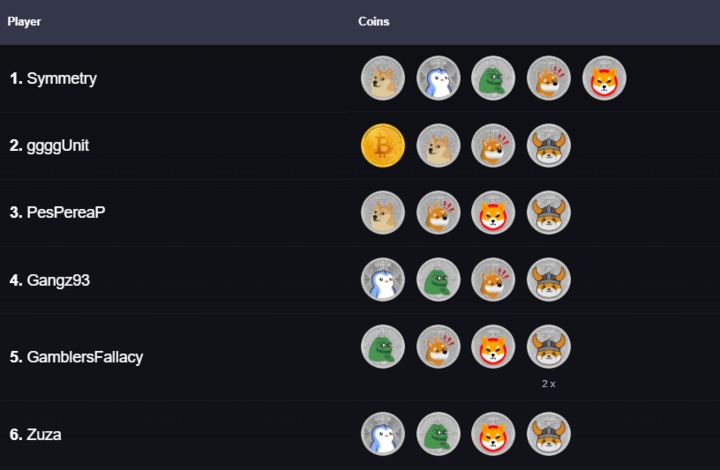

CoinPoker錦標賽|Symmetry成為首位集齊5枚CoinMasters硬幣的玩家

Saylor’s Long Bitcoin Bet Has Left Corporate Rivals Behind: Crypto Entrepreneur

Pi Coin Declines 25% in 20 Days as Investor Outflows Increase

2026 Digital Assets Outlook Report