Federal Reserve Policy Rate 50-100 Basis Points Above Neutral as Inflation Eases, Waller Signals Possible Rate Cuts

COINOTAG News reported on December 17 that the Federal Reserve Governor Waller said the policy rate sits roughly 50 to 100 basis points above the neutral rate. He noted that rate cuts could be considered if inflation prospects continue to ease, underscoring a data-driven monetary policy outlook.

In market terms, the stance implies a conditional easing path rather than abrupt shifts, which may influence crypto markets and overall liquidity. Traders will monitor inflation readings and the Fed’s projections to gauge whether the policy gap narrows, potentially supporting a gradual rotation toward higher risk assets as inflation cools.

For digital asset investors, the narrative highlights the importance of risk management and adaptive allocations amid shifting monetary policy. With FXStreet cited as a source, readers have a credible anchor for tracking how inflation trends shape the pace of future rate decisions and crypto market resilience.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

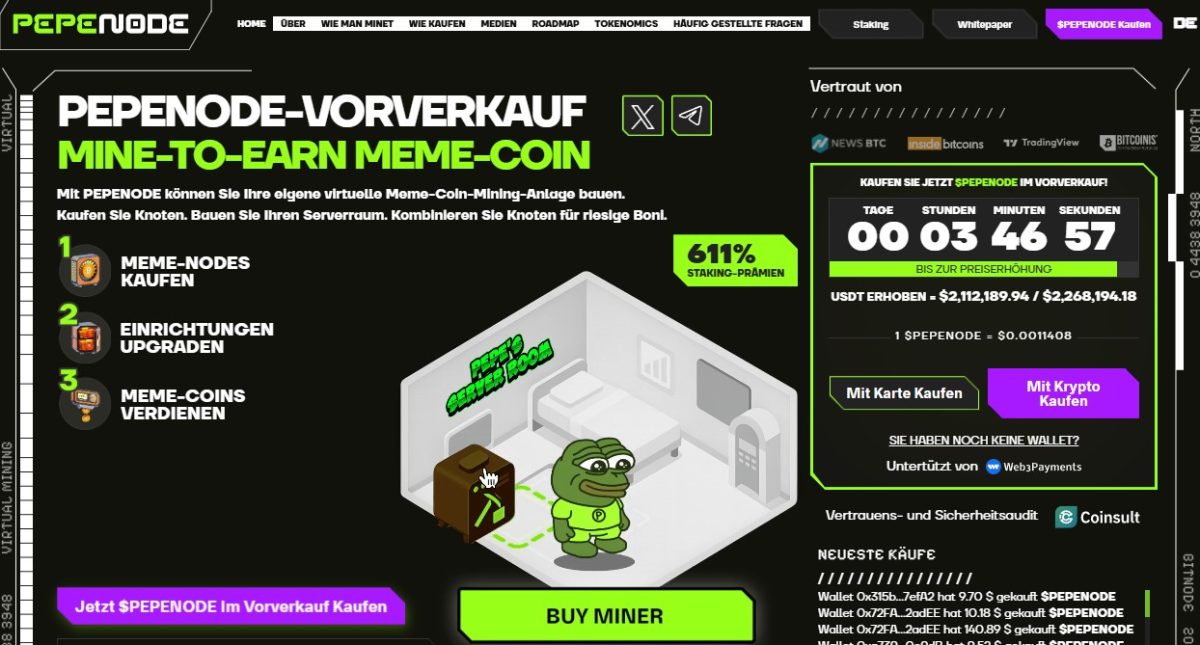

Ethereum Prognose: PepeNode als Ausweich-Play

Cardano price forms bullish divergence as NIGHT token demand jumps

Futures Liquidated: The Staggering $103 Million Hour That Shook Crypto Markets