Stellar Lumens retreats for seven days and XLM tests critical support.

- XLM is approaching the support level seen in April.

- Derivatives show increased selling bias.

- Technical indicators maintain low pressure.

Stellar Lumens extended its correction and recorded its seventh consecutive session of decline, mirroring the broader weakness in the cryptocurrency market. As a result, the price of XLM has moved closer to support levels last seen in April, reigniting the attention of traders and analysts to the asset's short-term behavior.

Data from the derivatives market indicate that participants' positioning is becoming increasingly defensive. Information from the CoinGlass platform shows that open interest in Stellar futures contracts has entered a downward trajectory, reflecting a reduction in the notional volume of active positions. This movement usually signals a lower appetite for risk or the closing of positions in the face of selling pressure.

During the same period, liquidations of long positions exceeded liquidations of short positions, indicating that optimistic traders were forced out of the market as the price retreated. Simultaneously, the ratio between long and short positions shifted to favor bets on a price decline, reinforcing the prevailing cautious mood in the XLM market.

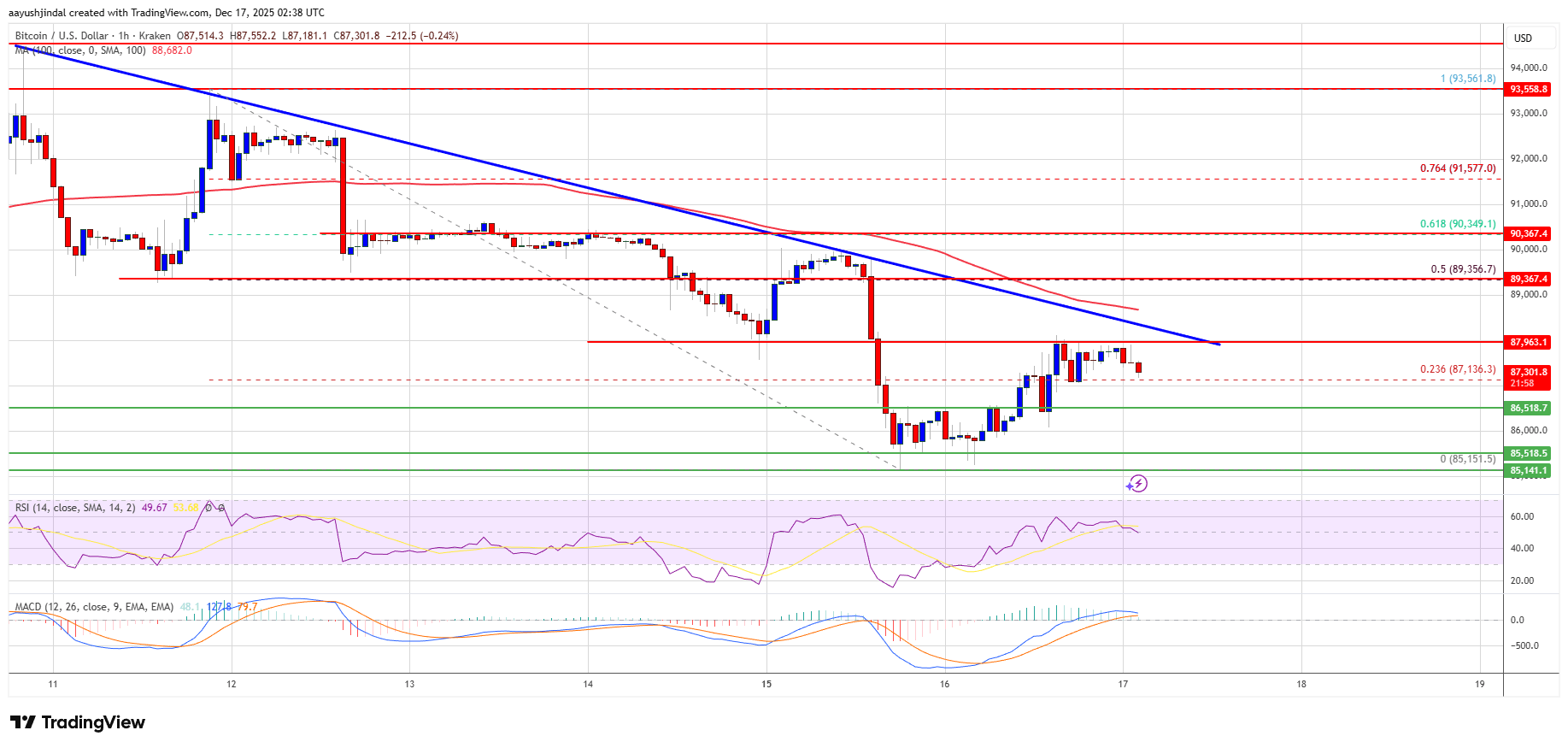

Technical analysis of the four-hour chart indicates that Stellar has retested the support region formed in June, after underperforming other relevant assets in recent weeks. Should the current structure be broken, the price may seek lower zones, including the yearly low, as suggested by historical trading levels.

Technical indicators also reflect this scenario. The Relative Strength Index (RSI) is approaching the oversold zone, suggesting a weakening of buying momentum. Meanwhile, the Moving Average Convergence/Divergence (MACD) indicator retreated after crossing below its signal line, maintaining the reading of continued downward movement in the short term.

In a potential recovery move, XLM may encounter resistance again at price ranges that previously acted as support. These regions tend to concentrate sell orders and may limit attempts at a rebound until the market shows clearer signs of reversal.

Stellar Lumens operates a payment network focused on international transfers and efficient settlement between different currencies. Despite the recent fluctuation in the token's price, the team behind the project has not released any specific statements about the movement. XLM's behavior is aligned with the volatility observed in the cryptocurrency market in recent sessions, with investors closely monitoring upcoming support tests.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Price Regroups After Losses—Is Directional Break Near?

Bitcoin’s Quantum Leap: Saylor Says Upgrades Harden Security, Reduce Supply, and Freeze Lost Coins

Ethereum Whale Boosts Long to 4,400 ETH at $2,720 Liquidation Price Amid $22.9M Hyperliquid Losses