The stablecoin market reaches a record $310.11 billion

The stablecoin market hits a historic milestone. For the first time, these fiat-backed cryptos surpass $310 billion in capitalization. A performance that cements their role as an essential pillar in the crypto ecosystem.

In brief

- The stablecoin market reached a historic peak of $310.117 billion on December 13, 2024.

- Tether’s USDT and Circle’s USDC dominate with 85% combined market share.

- The capitalization grew by 52.1% in one year, from $203.7 to $309.9 billion.

- Yield stablecoins lose ground with a 1.9% decline over 30 days.

A meteoric rise driven by industry giants

On Saturday, December 13, the stablecoin market crossed a symbolic milestone by reaching $310.117 billion in capitalization.

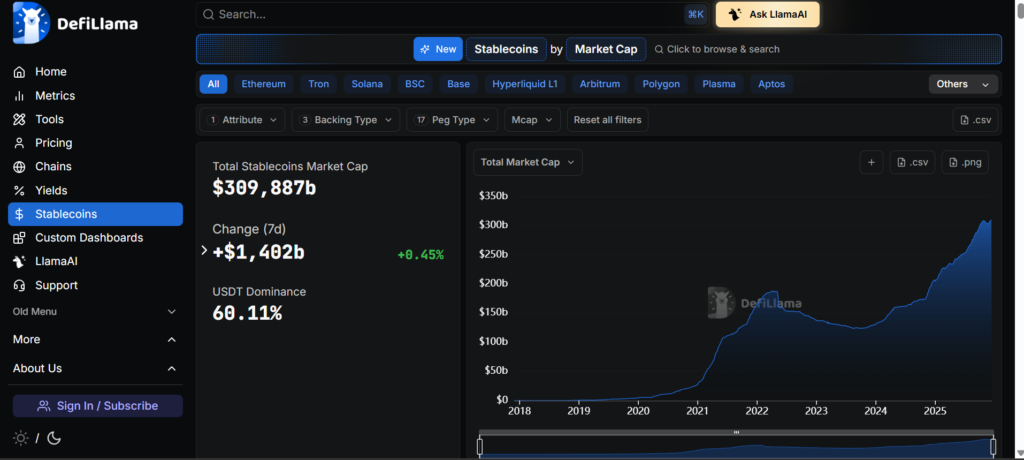

Currently stabilized around $309.9 billion according to DeFiLlama, this new record illustrates investors’ persistent confidence in these digital assets backed by traditional currencies.

Market capitalization of stablecoins. Source:

Market capitalization of stablecoins. Source: DeFiLlama .

Tether’s USDT maintains its position as the undisputed leader with $186.2 billion in capitalization, representing 60.10% of the total market.

Its rival Circle, with USDC, solidly holds second place with $78.3 billion and 25% market share. This two-headed dominance forms the backbone of a rapidly evolving ecosystem.

The sector’s growth impresses with its vigor. In twelve months, valuation jumped 52.1%, adding over $106 billion to overall capitalization. This expansion continued despite October’s turbulence, during which the market briefly retreated to $302.8 billion before rebounding strongly.

The issuance of new tokens fuels this momentum. Over the last seven days, Tether injected $593.3 million of USDT across several blockchains such as Tron, Solana, and Arbitrum. Circle followed with $555.5 million of USDC deployed on Ethereum, Solana, and Base. In total, the sector gained $1.79 billion in a week.

Yield stablecoins suffer a worrying setback

While traditional stablecoins thrive , their yield cousins face troubling turbulence.

Ethena’s USDe fell by 2.98% this week, while USDtb plunged 18.99%. These figures reveal growing disillusionment among investors toward these more complex products.

This disenchantment stems from October events when USDe temporarily lost its peg to the US dollar. This incident shook confidence and triggered massive sell-offs. Over thirty days, yield stablecoins’ capitalization shrank by 1.9%, with investors preferring the safety of non-yield products.

Weekly losses illustrate this flight to quality. alUSD collapsed 80.5%, smsUSD 68.1%, and sBOLD 13.6%. BlackRock’s BUIDL, despite being backed by a prestigious institution, dropped 13.24%. These setbacks contrast with the stability of market leaders.

Meanwhile, institutional adoption progresses quietly but surely. YouTube started paying its American creators in PayPal’s PYUSD , confirmed by May Zabaneh, crypto lead at PayPal.

This integration into Google’s ecosystem marks a significant step toward stablecoins’ normalization in the digital economy. PYUSD has also risen 13.33% in thirty days, reaching $3.86 billion in capitalization.

Crossing the $310 billion mark confirms the growing maturity of the stablecoin market, now established as an essential infrastructure of the crypto ecosystem. While yield products struggle to convince after October’s shocks , traditional stablecoins stand as preferred refuges, attracting institutions and individuals alike.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Emergence of CFTC-Regulated Clean Energy Platforms and Their Influence on Institutional Investment Approaches

- CFTC-approved CleanTrade, the first SEF for VPPAs/RECs, transforms clean energy markets by addressing liquidity, transparency, and regulatory challenges. - Its $16B trading volume and Cargill-Mercuria's first transaction demonstrate institutional adoption of standardized, verifiable renewable energy assets. - CleanTrade enables ESG alignment through project-specific carbon tracking, reducing emissions by 15% for investors while complying with IRA-driven $2.2T global investments. - By bridging financial a

Clean Energy Market Fluidity and the Rise of CleanTrade: Strategic Considerations for Investors in a Regulatory Environment

- CleanTrade, a CFTC-approved SEF, addresses fragmented pricing and low liquidity in clean energy markets by standardizing VPPA, PPA, and REC trading. - The platform’s $16B in two-month transactions demonstrates institutional demand for transparent, ESG-aligned tools to hedge energy risks and track carbon impact. - By centralizing renewable derivatives and aligning with regulations like SFDR, CleanTrade lowers barriers for investors and developers, accelerating decarbonization while boosting market efficie

The Rise of a Dynamic Clean Energy Marketplace

- Global clean energy investment hit $2.1 trillion in 2024, driven by decarbonization trends and institutional demand. - REsurety's CFTC-approved CleanTrade platform addresses liquidity gaps by standardizing VPPA/REC trading with oil-like transparency. - The platform processed $16 billion in two months, enabling risk mitigation and rapid capital reallocation amid policy shifts. - Advanced analytics and structured workflows transform clean energy assets into tradable instruments, attracting diversified inst

The Rise of a Dynamic Clean Energy Market and What It Means for Institutional Investors

- A liquid clean energy marketplace is emerging, enabling institutional investors to trade renewable assets with traditional market efficiency. - E-fuels and platforms like CleanTrade ($16B in notional value) address hard-to-decarbonize sectors while Enel's blockchain-based systems enhance scalability. - Regulatory reforms (e.g., EPA RFS) and industry M&A activity support market growth, though high costs and fragmented standards remain challenges. - 84% of institutional investors plan to increase clean ene