Can Bitcoin Prices Recover in the Coming Days? Bitwise Explains

Bitwise consultant Jeff Park stated that the current structure of the Bitcoin market is not conducive to a strong price increase.

According to Park, the fundamental dynamics of the market are making it difficult for Bitcoin to make an upward breakout. Key reasons include early Bitcoin investors continuing to sell and a significant slowdown in demand for exchange-traded funds (ETFs) and digital asset products (DATs).

Jeff Park stated that for Bitcoin to break out of its current trend, the market needs to reach a higher and sustained level of volatility again. He emphasized that strengthening upward volatility is particularly critical, recalling his “volatility or death” statement in November, which signaled an unusual breakout. He noted that the increase in volatility at that time created a brief period of optimism in the market, but this expectation has weakened in the last two weeks.

According to Park's assessment, implied volatility has come under pressure again in recent weeks. Having reached approximately 63% in late November, implied volatility has rapidly declined to 44% in the last two weeks. This is a significant indicator that makes it difficult for Bitcoin to gain strong upward momentum in the short term.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

How iRobot Strayed from Its Original Path

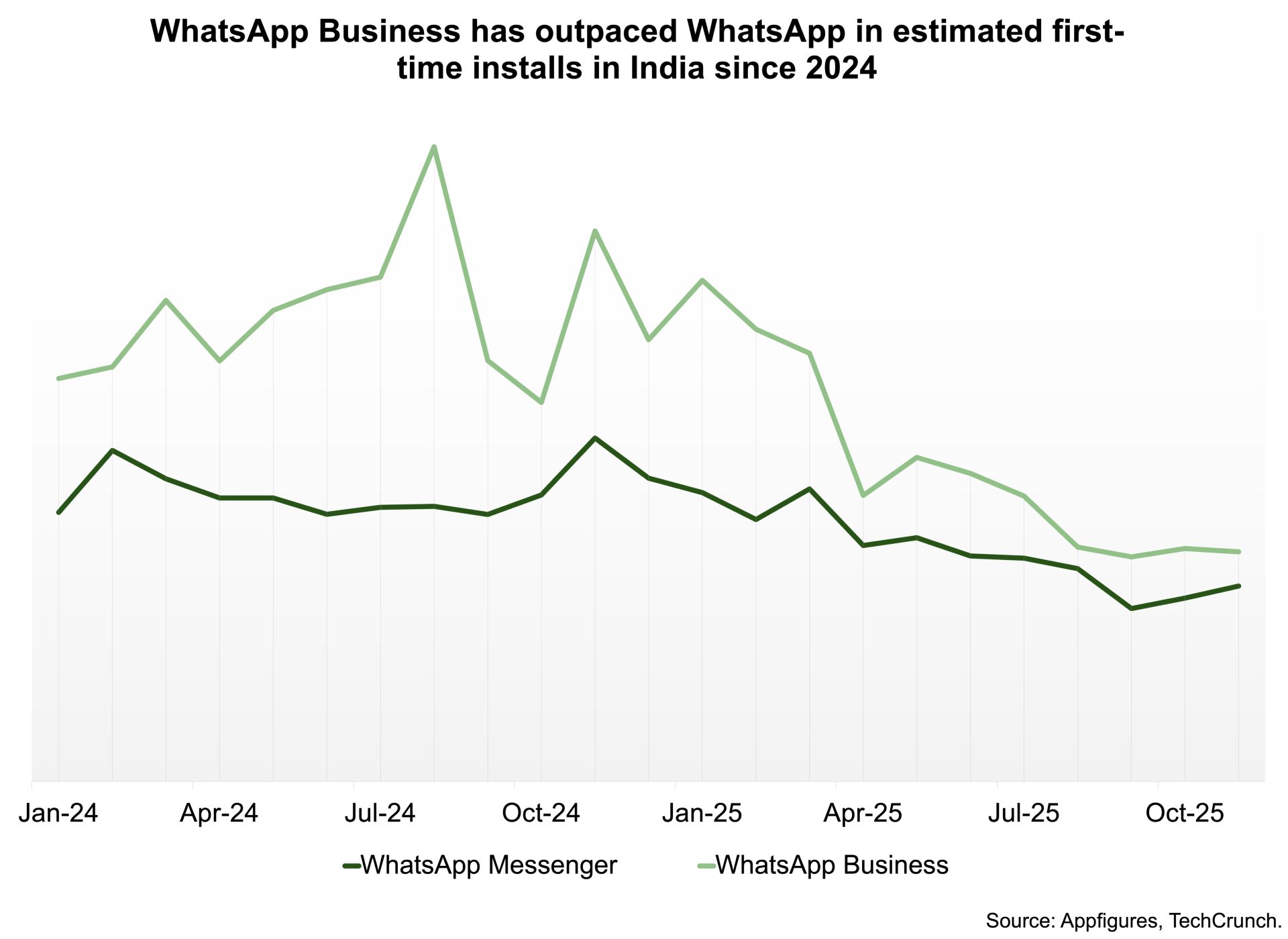

WhatsApp’s largest user base is now presenting its greatest challenge

Assessing Bitcoin’s Price Movement in Light of Macroeconomic Changes and Positive ETF Sentiment in November 2025

- Bitcoin faces macroeconomic headwinds in 2025, with Fed tightening causing a 15% crypto market cap drop, but ETF approvals drove 45% growth in institutional Bitcoin ETF AUM to $103B. - Institutional investors navigate $81k-$91k Bitcoin consolidation, balancing Fed policy risks against 68% adoption rates and regulatory clarity from EU MiCA and U.S. GENIUS Act. - Strategic entry strategies include core positions at $85k-$87k support, hedging with stablecoins/altcoins, and timing Fed rate cut expectations t

Moonbirds to launch BIRB token in early Q1 2026