Ethereum Holds Support As Smart Money Steps In – What This Means For Price

Ethereum is holding firm above key support as smart money steps in, hinting at growing confidence beneath the surface. With bullish signals and steady inflows aligning, the market now watches whether this stability can spark a meaningful upside move.

ETH Coils Below $3,200 Ahead Of A Decisive Move

AltCoin Việt Nam, in a recent post, highlighted that ETH is positioned at an extremely tense moment on its chart, signaling that the asset is preparing for a major directional move. This immediate pressure is being fueled by a significant bullish divergence that has just appeared on the chart, marking the first time the signal has materialized in over a month.

The analyst reinforced the expectation of high volatility by referencing historical data. Their research shows a consistent history of 9–16% price volatility whenever ETH falls below the $3,200 level. Given that the price is currently fluctuating tightly around the $3,100 mark, this historical context provides a clear signal that a sharp volatility explosion may be imminent.

Adding overwhelming conviction to the bullish case is the recent action of market movers. AltCoin Việt Nam reported that a single super large whale just opened a leveraged long position totaling a massive $392 million (equivalent to 120,094 ETH). This colossal bet on the upside demonstrates a firm, high-conviction among institutional players.

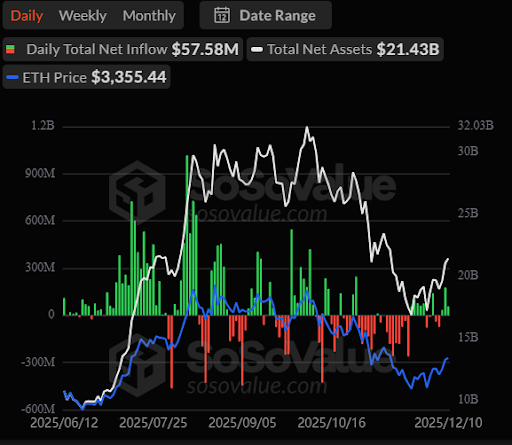

Furthermore, the institutional framework continues to provide a reliable underlying demand. The Spot Ethereum ETF market is still actively attracting substantial capital inflows, totaling over $250 million this week. BitMine Technologies also purchased an additional 33,504 ETH (valued at $112 million) today, highlighting persistent institutional accumulation.

Considering the confluence of technical divergence, historical volatility context, and massive whale and institutional purchasing, the market faces a critical juncture. AltCoin Việt Nam posed the final question: Can ETH break out strongly and immediately confirm the uptrend, or will it need to retest lower support levels before initiating the expected explosive rally?

Buyers Step In As Ethereum Defends Key Support

According to crypto analyst The Boss, ETH has shown a highly encouraging response from a key technical area. Ethereum has reacted positively with the $3,091 support zone, and is currently holding firmly above this level, which is a strong signal that short-term buying pressure remains resilient and active in the market.

As long as the price stays above the green line, the analyst confirms that the primary focus remains the upside, validating the potential for a move toward the resistance zone marked by the blue line. The Boss emphasized the importance of these structural defense moves, concluding that such strong reactions from established support levels are vital signals for confirming the validity of the current structure and providing clear direction of the prevailing trend.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Zcash Halving Scheduled for November 2025: Igniting a Bull Run for Privacy Coins

- Zcash's 2025 halving reduced block rewards by 50% to 1.5625 ZEC, implementing ZIP 1015 to lock 12% of rewards in a community-controlled wallet. - Total ZEC supply remains capped at 21 million, with 16.3 million in circulation, tightening liquidity and mirroring Bitcoin's scarcity-driven model. - Historical Bitcoin halving patterns suggest Zcash's deflationary design could trigger a bull cycle, supported by 700% price growth since September 2025. - Privacy coins like Zcash now attract institutional invest

The Rise of Financial Wellness: Exploring a New Era in Impact Investing

- Financial wellness movement integrates emotional, mental, and systemic solutions to address rising financial stress affecting 53% of Americans. - Employers adopt earned wage access (EWA) and SECURE Act 2.0-driven retirement programs to reduce workplace financial strain and boost productivity. - Fintech/edtech leverages AI for personalized financial tools, while impact investors allocate $1.164T to projects combining social good and returns. - Corporate wellness programs now include budgeting apps and AI

XRP Price Prediction: Why the $3 December Target Is More Hope Than Reality

“Bitcoin Rodney” Faces Decades in Prison as Feds Expand HyperFund Charges