Key Market Insights from December 12th, how much did you miss out?

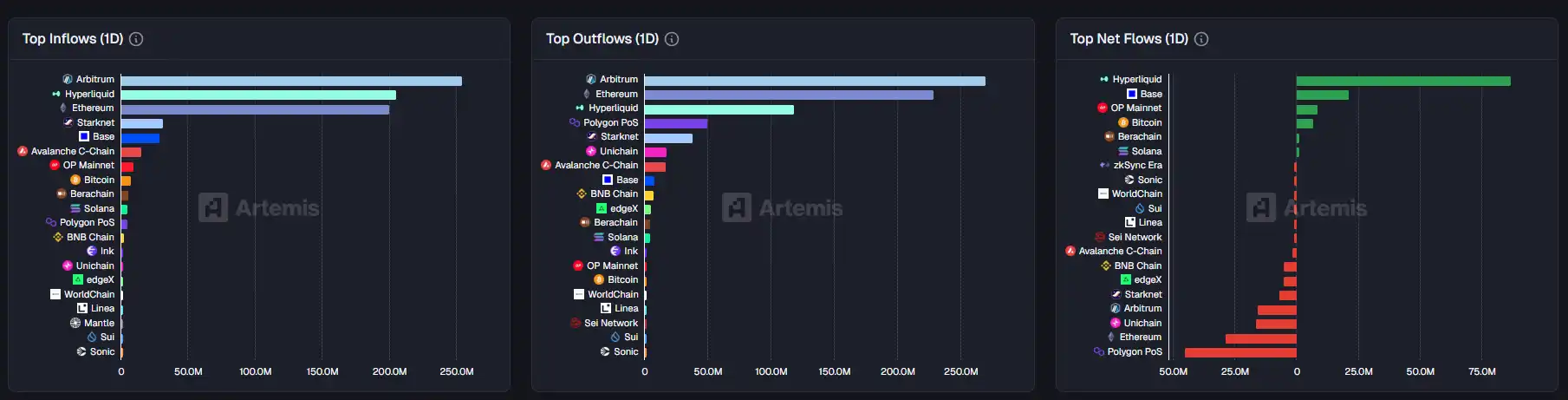

1. On-chain Flows: $86.9M USD inflow to Hyperliquid today; $45M USD outflow from Polygon PoS 2. All-time High/Low: $US, $SAD 3. Top News: Federal Reserve's Bond Buying Surpasses Expectations, Wall Street Revises Collective 2026 Forecast

Top News

1. Fed's Bond-Buying Surpasses Expectations, Wall Street Revises 2026 Forecasts Collective

2. He Yi Downplays 'Official IP Derivative' Meme Impact, BSC On-Chain Funds Shift to Community-Driven Meme

3. Perp DEX Aggregator Platform Ranger: to Launch Token Sale, Aiming to Raise $6 Million

4. Binance Alpha to List RaveDAO (RAVE), Airdrop Threshold at 230 Points

5. Trump's Son's Wealth Surged Sixfold in a Year, Cryptocurrency Business a Core Driver

Featured Articles

1. "What's Trending in the Global Crypto Community Today"

Over the past 24 hours, the crypto market has witnessed a variety of dynamics ranging from macroeconomic discussions to specific ecosystem developments. Mainstream topics focused on major announcements and project updates from the Solana Breakpoint conference, ADL controversy, Polymarket's on-chain trading volume hitting a new high, and discussions on the future of crypto debit cards. In terms of ecosystem development, both Solana and Ethereum have had significant updates, showcasing the industry's rapid innovation and expansion. This report will summarize and delve into these hot topics.

2. "They Knew the TGA Game of the Year Early and Made Thousands of Dollars"

Today, the highly anticipated TGA (The Game Awards) ceremony in the gaming industry finally came to a close. Let's rewind to 3 hours before the end of the awards. At this point, the "Best Indie Game" had just been awarded to the popular title "Light and Shadow: Expedition 33," but this actually raised concerns among many fans: no game in history has ever won both the "Best Indie Game" and the "Game of the Year (GOTY)" at TGA. As the GOTY favorite "Light and Shadow" faces the challenge of breaking the curse since the establishment of TGA, it needs to create an unprecedented moment in the gaming industry.

On-chain Data

Weekly on-chain fund flows as of December 12th

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Revival of STEM Learning as a Driving Force for Tomorrow’s Technology Investments

- Emerging STEM universities are driving tech innovation through interdisciplinary curricula and industry partnerships, focusing on AI, biotech , and advanced manufacturing. - U.S. programs like STEM Talent Challenge and NSF Future Manufacturing allocate $500K-$25.5M to bridge skills gaps and fund projects in quantum tech and biomanufacturing. - Leadership-focused STEM programs at institutions like Florida State and Purdue boost startup success rates (75-80%) and align with venture capital trends favoring

Assessing KITE’s Price Prospects After Listing as Institutional Interest Rises

- Kite Realty Group (KRG) reported Q3 2025 earnings below forecasts but raised 2025 guidance, citing 5.2% ABR growth and 1.2M sq ft lease additions. - Institutional investors showed mixed activity, with Land & Buildings liquidating a 3.6% stake while others increased holdings, reflecting valuation debates. - Technical indicators suggest bullish momentum (price above 50/200-day averages) but a 23.1% undervaluation vs. 35.1x P/E, exceeding sector averages. - KRG lags peers like Simon Property in dividend yie

Evaluating How the MMT Token TGE Influences Crypto Ecosystems in Developing Markets

- MMT's volatile TGE highlights tokenized assets' dual role as liquidity engines and speculative risks in emerging markets. - Institutional investors allocate up to 5.6% of portfolios to tokenized assets, prioritizing real-world integration and cross-chain utility. - Regulatory fragmentation and smart contract risks demand CORM frameworks to mitigate operational vulnerabilities in DeFi projects. - MMT's deflationary model and institutional backing face macroeconomic challenges, requiring hedging against gl

Trust Wallet Token's Latest Rally and Growing Institutional Interest: Driving Sustainable Value

- Trust Wallet Token (TWT) surged in 2025 due to institutional partnerships, utility upgrades, and real-world asset (RWA) integrations. - Collaborations with Ondo Finance (tokenizing $24B in U.S. Treasury bonds) and Onramper (210M+ global users) expanded TWT's institutional-grade utility. - Governance upgrades, FlexGas payments, and Binance co-founder CZ's endorsement boosted TWT's credibility and institutional appeal. - Analysts project TWT could reach $5.13 by year-end, driven by cross-chain integrations