Litecoin Is Being Ignored by Retail — While Institutions Quietly Accumulate 3.7 Million LTC

Litecoin (LTC) has not escaped the shadow of its long downtrend since 2021. Its weak price performance has caused many retail investors to overlook this “legacy” altcoin. However, new reports reveal quietly growing positive signals. These signals form the basis for analysts to predict that the price may soon break above $100. Institutions Accumulate 3.7

Litecoin (LTC) has not escaped the shadow of its long downtrend since 2021. Its weak price performance has caused many retail investors to overlook this “legacy” altcoin.

However, new reports reveal quietly growing positive signals. These signals form the basis for analysts to predict that the price may soon break above $100.

Institutions Accumulate 3.7 Million LTC Despite Falling Prices

This year, as companies and institutions expand their digital-asset reserves and launch crypto ETFs, Litecoin has also joined this trend.

According to data from Litecoin Register, by the end of 2025, Treasuries and ETFs held nearly 3.7 million LTC. The total value exceeded $296 million.

Total Treasury & ETF Holdings (LTC). Source:

Litecoin Register

Total Treasury & ETF Holdings (LTC). Source:

Litecoin Register

“There are now over 3.7 million Litecoin being held in 10 public companies and investment funds. An increase of one million LTC since August 2025,” the Litecoin Foundation commented.

The chart illustrates a persistent accumulation over the past year. This trend continued even though LTC has not set a new high in 2025.

Notable holders include Grayscale, Lite Strategy, and Luxxfolio Holdings. Luxxfolio Holdings aims to accumulate 1 million LTC by 2026.

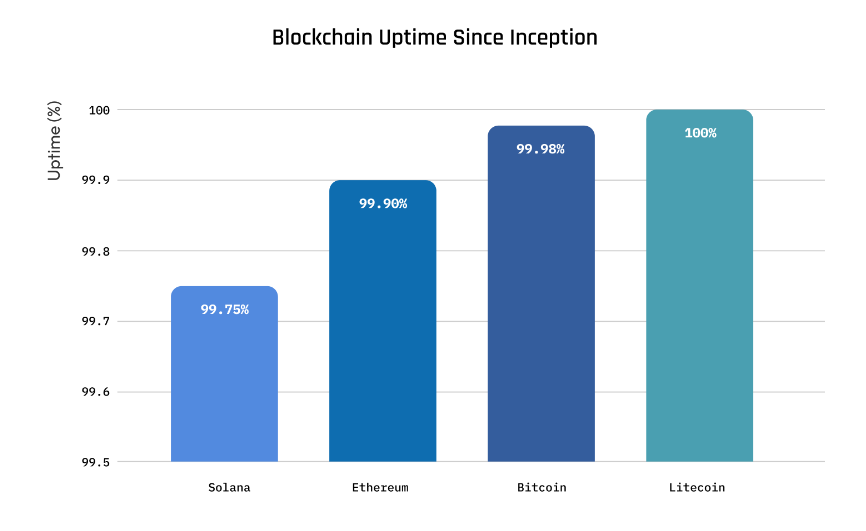

In addition, the “Silver Standard” report from LitVM highlights Litecoin as the blockchain with the highest uptime among legacy networks. It has maintained 100% uptime for the past 12 years.

Blockchain Uptime Since Inception. Source:

LitVM

Blockchain Uptime Since Inception. Source:

LitVM

Uptime measures the duration of a network’s continuous operation without interruption. A blockchain with high uptime demonstrates system stability, security, and reliability in processing transactions without technical failures.

“Institutions want sound money. They want LTC’s 12-year reliability,” investor Creed stated.

Fundamental data does not always create an immediate short-term impact. However, the short-term outlook from derivatives markets appears highly positive.

Binance top traders are rapidly increasing their $LTC long positions.

— CW (@CW8900) December 12, 2025

Top traders on Binance rapidly increased long LTC positions in the second week of December. Their behavior signals strong bullish expectations.

These factors may explain why several long-time investors continue to trust LTC. A crypto investor active since 2015, Lucky, believes that LTC will recover soon.

“I don’t see $LTC staying below $100 for much longer,” Lucky predicted.

Litecoin price recovery scenario. Source:

Lucky

Litecoin price recovery scenario. Source:

Lucky

LTC’s situation resembles that of several altcoins with strong fundamentals but slow price action, such as XRP, XLM, LINK, and INJ.

Experts also argue that only altcoins supported by liquidity from DATs and ETFs can survive and grow sustainably in the new phase of the market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Zcash Halving Scheduled for November 2025: Igniting a Bull Run for Privacy Coins

- Zcash's 2025 halving reduced block rewards by 50% to 1.5625 ZEC, implementing ZIP 1015 to lock 12% of rewards in a community-controlled wallet. - Total ZEC supply remains capped at 21 million, with 16.3 million in circulation, tightening liquidity and mirroring Bitcoin's scarcity-driven model. - Historical Bitcoin halving patterns suggest Zcash's deflationary design could trigger a bull cycle, supported by 700% price growth since September 2025. - Privacy coins like Zcash now attract institutional invest

The Rise of Financial Wellness: Exploring a New Era in Impact Investing

- Financial wellness movement integrates emotional, mental, and systemic solutions to address rising financial stress affecting 53% of Americans. - Employers adopt earned wage access (EWA) and SECURE Act 2.0-driven retirement programs to reduce workplace financial strain and boost productivity. - Fintech/edtech leverages AI for personalized financial tools, while impact investors allocate $1.164T to projects combining social good and returns. - Corporate wellness programs now include budgeting apps and AI

XRP Price Prediction: Why the $3 December Target Is More Hope Than Reality

“Bitcoin Rodney” Faces Decades in Prison as Feds Expand HyperFund Charges