Dogecoin (DOGE) Crisis in China! Accounts Blocked!

In China, where Bitcoin (BTC) and cryptocurrency bans continue, a “Dogecoin (DOGE)” crisis has erupted.

According to China News Weekly, a user at China Construction Bank transferred 250 yuan to her husband a few months ago, writing “Dogecoin” in the description.

The China Construction Bank then took action, determining that the statement was related to cryptocurrencies, and blocked the user's account.

China Construction Bank stated, “The bank announced that this note violated cryptocurrency governance regulations and suspended deposits and withdrawals from the account.”

The woman applied for the account to be unblocked on the condition that her husband provide transaction records and sign a written undertaking.

The bank informed the female user that in order to have the restrictions lifted, she would need to submit her husband's bank statements for several months and, after verification, sign a statement confirming that he has not been involved in cryptocurrency transactions in the past or in the future.

A bank official also stated that the block could only be lifted if documents proving no connection to cryptocurrencies were provided, adding that “bank transaction records alone cannot prove this.”

As you may recall, seven associations, including the China Internet Finance Association, issued a risk warning regarding cryptocurrency trading and published guidelines advising member companies against participating in related activities.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP Price Prediction: Why the $3 December Target Is More Hope Than Reality

“Bitcoin Rodney” Faces Decades in Prison as Feds Expand HyperFund Charges

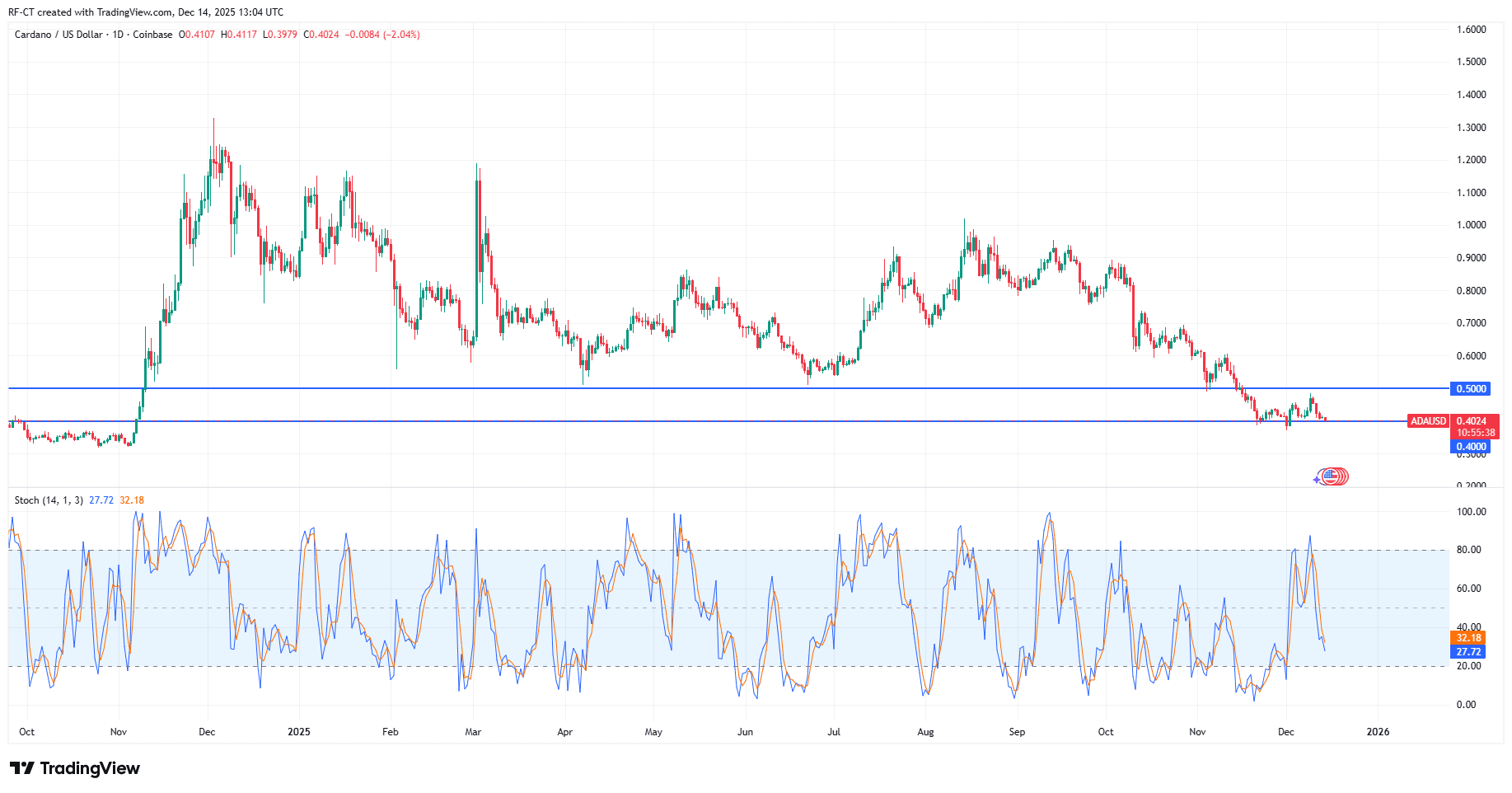

Cardano Price Prediction: Is ADA Forming a Base or Headed for Another Breakdown?

The ICP Surge: Unpacking a 30% Jump and Its Driving Factors

- ICP surged 30% in late October 2025 amid speculation and institutional adoption, driven by Microsoft/Azure partnerships and AI upgrades like Caffeine. - On-chain data shows 35% growth in active addresses but 91% fewer token transfers during downturns, highlighting fragile retail-driven momentum. - TVL hit $237B via asset tokenization, yet dApp engagement dropped 22.4%, signaling volatility despite 40+ tech upgrades including Chain Fusion. - Analysts project $11.15–$88.88 price ranges by 2030, contingent