Scaramucci: Solana will ‘flip’ Ethereum

Anthony Scaramucci is once again singing Solana’s praises, telling attendees at the Breakpoint conference that he expects the public blockchain platform to eventually overtake Ethereum in market value.

- Scaramucci joked that he’s “not chain monogamous” and still supports multiple networks.

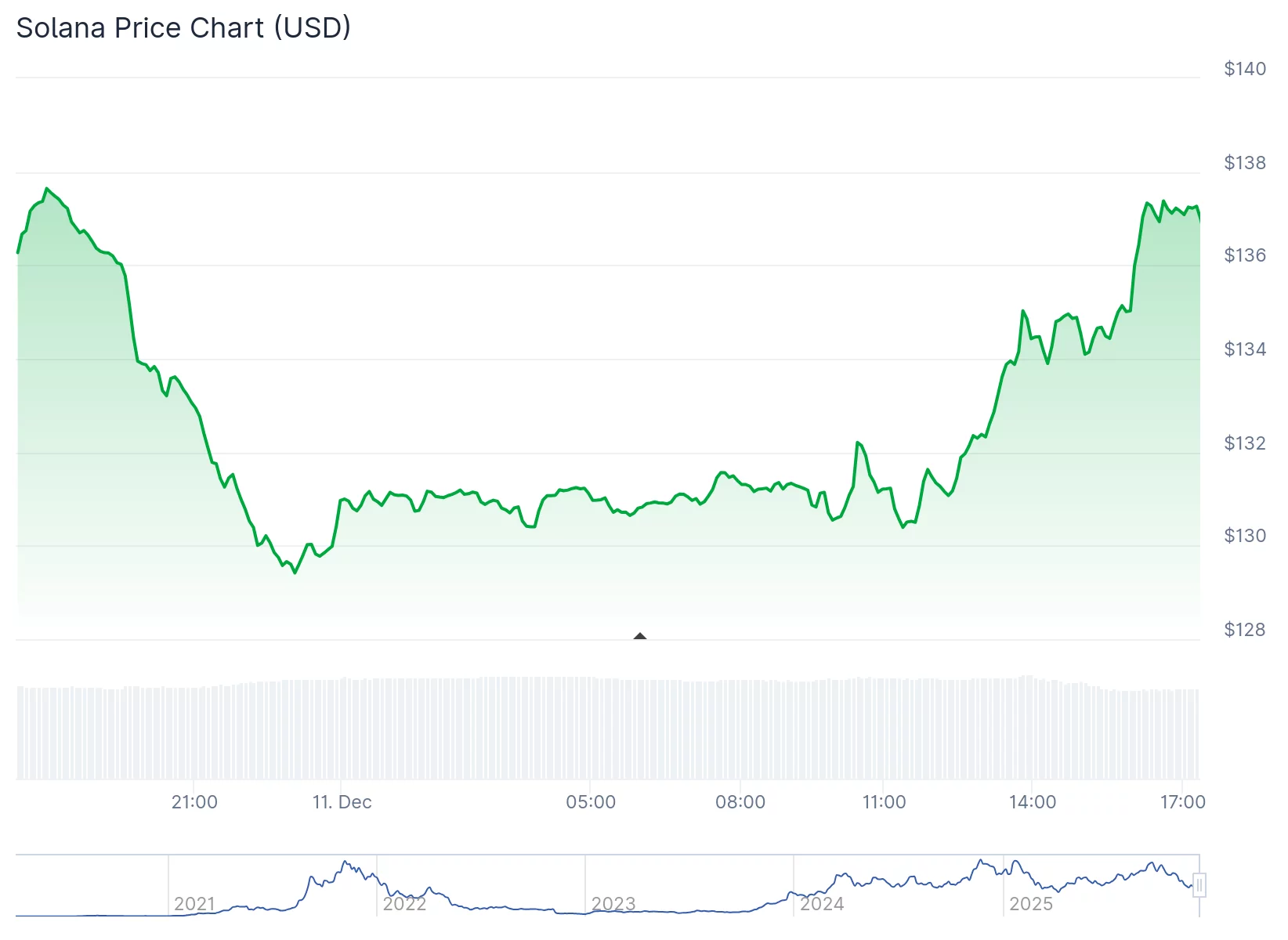

- His remarks came as ETH held key support near $3,121 despite heavy outflows, while Solana struggled near $137 amid bearish technical signals pointing toward a possible drop to $100.

- Despite the price pressure, Solana’s ecosystem has surged with new bridges, tokenized funds and major corporate integrations.

“I think it will flip Ethereum,” the SkyBridge Capital founder said, before quickly clarifying that he still loves ETH and Avalanche too, insisting he is “not chain monogamous.” See below.

In other words, it’s not you, Ethereum — it’s Solana’s blazing throughput, expanding developer base, and, presumably, its ability to make very loud entrances at conferences.

Why it matters

Scaramucci’s comments revived the long-running Layer-1 rivalry, which has intensified as Solana’s ecosystem continues expanding with new infrastructure, developer tooling, and institutional pipelines. But price charts painted a less romantic picture for both networks.

Ethereum traded around $3,200, hovering just above its 20-day EMA at $3,121 — a support zone that could launch bullish targets at $3,309, $3,382, and $3,453 if buyers show up. Despite $116 million in net outflows reported today by Coinglass, ETH has refused to set new lows, building a pattern of higher lows that suggests sellers are running out of steam. The Supertrend indicator remains red, however, warning the love story isn’t fully bullish just yet.

Solana, meanwhile, was last seen near $137 — down nearly 50% from its September highs and sulking near the bottom of its chart. Technical indicators point to possible further downside toward $100, with a bearish flag pattern and a death cross both flashing red. A break below $122 could cement the slide, while reclaiming $147 would invalidate the bearish setup.

Source: CoinGecko

Source: CoinGecko

Fundamentally, Solana has had plenty to brag about:

- A new bridge connecting Solana and Base via Chainlink

- Ondo Finance and State Street launching SWEEP, a tokenized liquidity fund

- Animoca Brands preparing to list its equity on Solana

- Bhutan rolling out the first sovereign-backed gold token on the network

- Coinbase unveiling trading access to the full suite of Solana tokens

Even ETFs appear smitten — Solana exchange-traded products have taken in more than $22 million this week alone, pushing cumulative inflows to $661 million and total assets to $950 million.

Despite the price slump, Scaramucci’s bullishness underscores a broader view shared by some crypto investors: both Solana and Ethereum can grow, coexist, and maybe even thrive together — even if one day, Solana ends up with “flip” bragging rights.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Rise of Liquid Clean Energy Markets and Their Impact on Investment Opportunities

- Global energy transition accelerates liquid clean energy markets, reshaping institutional investment strategies with ESG-aligned assets. - U.S. DOE and private firms advance infrastructure, including fusion and hydrogen projects, addressing scalability and reliability. - RESurety’s CFTC-approved CleanTrade platform boosts transparency and liquidity in clean energy derivatives, enabling $16B in trading. - Institutional investors diversify portfolios with clean energy derivatives, leveraging ESG compliance

Anthropology-Inspired Advancements in Higher Education: The Impact of Cross-Disciplinary Research on Student Success and Institutional Worth

- Farmingdale State College integrates anthropology with STEM/edtech to cultivate critical thinking and cross-disciplinary skills, aligning with evolving workforce demands. - Its Anthropology Minor (15 credits) and STS program emphasize cultural context, societal implications of technology, and data-driven problem-solving for STEM-aligned careers. - Partnerships like the $1.75M Estée Lauder collaboration and $75M Computer Sciences Center demonstrate how interdisciplinary approaches attract investment and a

Clean Energy Market Fluidity and Investment Prospects: How REsurety's CleanTrade Platform is Transforming Corporate Strategies for Energy Transition

- REsurety's CleanTrade platform, CFTC-approved as the first SEF for clean energy , standardizes VPPAs, PPAs, and RECs to address market inefficiencies like fragmented pricing and low liquidity. - The platform attracted $16B in notional value within two months by offering real-time transparency, reducing counterparty risk, and enabling precise decarbonization tracking for corporations. - ESG funds leverage CleanTrade's swaps and liquidity tools to hedge price volatility, aligning with 77% of sustainable in

Hyperliquid (HYPE) Price Rally: Key Factors Behind Institutional Embrace in 2025

- Hyperliquid's HIP-3 upgrade enabled permissionless perpetual markets, driving $400B+ trading volume and 32% blockchain revenue share in 2025. - Institutional adoption accelerated via 90% fee reductions, TVL of $2.15B, and partnerships with Anchorage Digital and Circle's CCTP V2. - HYPE's deflationary model (97% fees fund buybacks) and $1.3B buyback fund fueled price surges, mirroring MicroStrategy's Bitcoin strategy. - Regulatory alignment with GENIUS Act/MiCAR and USDH stablecoin compliance strengthened