Date: Thu, Dec 11, 2025 | 08:40 AM GMT

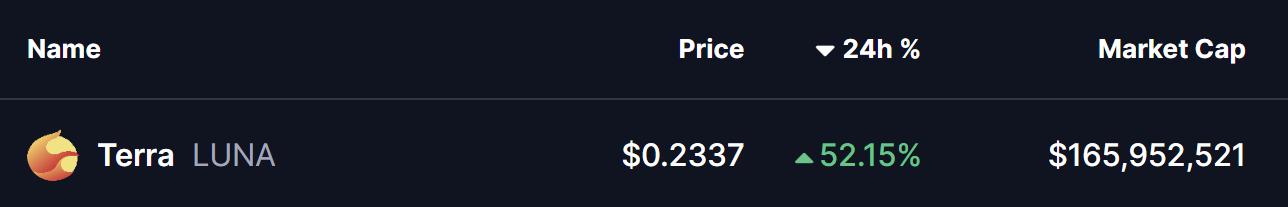

The broader cryptocurrency market is witnessing notable retracement today, with both Bitcoin (BTC) and Ethereum (ETH) slipping by more than 2% and 4% respectively. Amid this weakness, Terra (LUNA) has managed to steal the spotlight after a sharp and decisive surge.

LUNA exploded with an impressive 52% single-day jump, but what makes this move even more interesting is the emerging fractal structure on its daily chart — a structure that strongly resembles a recent breakout model seen in another altcoin.

Source: Coinmarketcap

Source: Coinmarketcap

LUNA Mirrors ICP’s Breakout Pattern

A side-by-side comparison of LUNA and ICP on the daily timeframe reveals an almost identical structural development, hinting that a stronger trend reversal may already be underway.

In its previous cycle, ICP spent several weeks inside a right-angled ascending broadening wedge, gradually grinding lower and eventually tapping the wedge’s base. The rebound from that level sparked a recovery back toward the 100-day moving average. Once ICP reclaimed this moving average and approached its upper wedge boundary, momentum flipped sharply. The result was a clean breakout and a 54% explosive rally from the breakout trigger.

ICP and LUNA Fractal Chart/Coinsprobe (Source: Tradingview)

ICP and LUNA Fractal Chart/Coinsprobe (Source: Tradingview)

LUNA now appears to be mirroring the same multi-stage behavior.

After revisiting the lower boundary of its own broadening wedge, LUNA generated a strong reaction and pushed aggressively upward. The reclaim of the 100-day moving average is a critical technical milestone and has now brought price directly into the upper resistance band at $0.2278–$0.2520 — the same structural zone that acted as the ignition point for ICP’s breakout.

What’s Next for LUNA?

If LUNA continues to respect the fractal and the wedge dynamics, a breakout above the upper boundary could serve as the trigger for the next major extension. The projected move marked on the chart points toward $0.4312, representing an approximate 81% upside from current levels.

Fractal setups do not guarantee identical outcomes, but they often provide early directional clues based on recurring market behavior. And right now, LUNA’s chart is delivering a very clear message — structure is improving, buyers are stepping in with conviction, and the breakout zone is now firmly in sight.