Fidelity's Bitcoin ETF sees $199M net inflow, leading Bitcoin spot ETFs

Key Takeaways

- Fidelity's Bitcoin ETF (FBTC) recorded a $199 million net inflow in one day, leading the spot Bitcoin ETF market.

- Total inflows into FBTC have reached $12.3 billion since its launch.

Spot Bitcoin exchange-traded funds recorded around $152 million in net inflows yesterday, with Fidelity’s FBTC leading the group at $199 million.

Other funds managed by Grayscale, Bitwise, ARK Invest, Invesco, Franklin Templeton, and WisdomTree also saw positive flows on Tuesday, whereas BlackRock’s IBIT faced $135 million in net outflows.

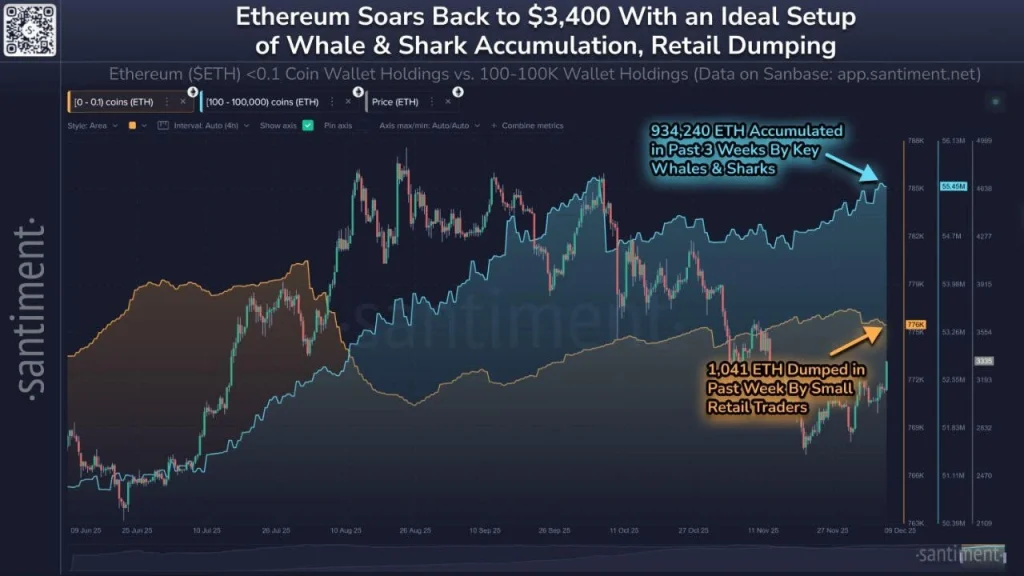

Elsewhere, spot Ethereum ETFs pulled in almost $178 million in fresh investment, their strongest single-day haul since late October. Fidelity’s fund topped the list, with Grayscale and BlackRock close behind.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

TMGM Raises the Bar With Its Largest-Ever Global Competition Prize Pool of $671,500

TRUMP Price Rises Amid Doubled DeFi Activity: Can It Finally Recover?

ETH Strengthens Against BTC Amid Its Renewed Whales Demand: Is Altseason Next?

Federal Reserve Strategies and the Rising Worth of Solana: How Changes in Monetary Policy Propel Institutions Toward High-Performance Blockchain Adoption

- Fed's 2025 rate cuts and QT halt injected $72.35B liquidity, coinciding with a 3.01% Solana price surge. - Institutional capital shifted toward Solana due to infrastructure upgrades and accommodative monetary policy. - Regulatory frameworks like MiCA and GENIUS Act boosted Solana's institutional appeal despite macroeconomic volatility. - Fed's policy normalization accelerated blockchain adoption, positioning Solana as a long-term investment amid uncertainty.