Short-Term Bitcoin Holders Are Dominating Profits, But Will It Lead To Recovery?

Bitcoin is making another attempt to break the downtrend that has kept the crypto king capped since late October. Price is hovering near $91,000 as investors watch a rare shift in market structure unfold.

For the first time in more than two and a half years, short-term holders have surpassed long-term holders in realized profits, creating both opportunities and risks for BTC.

Bitcoin Sees Some Shift

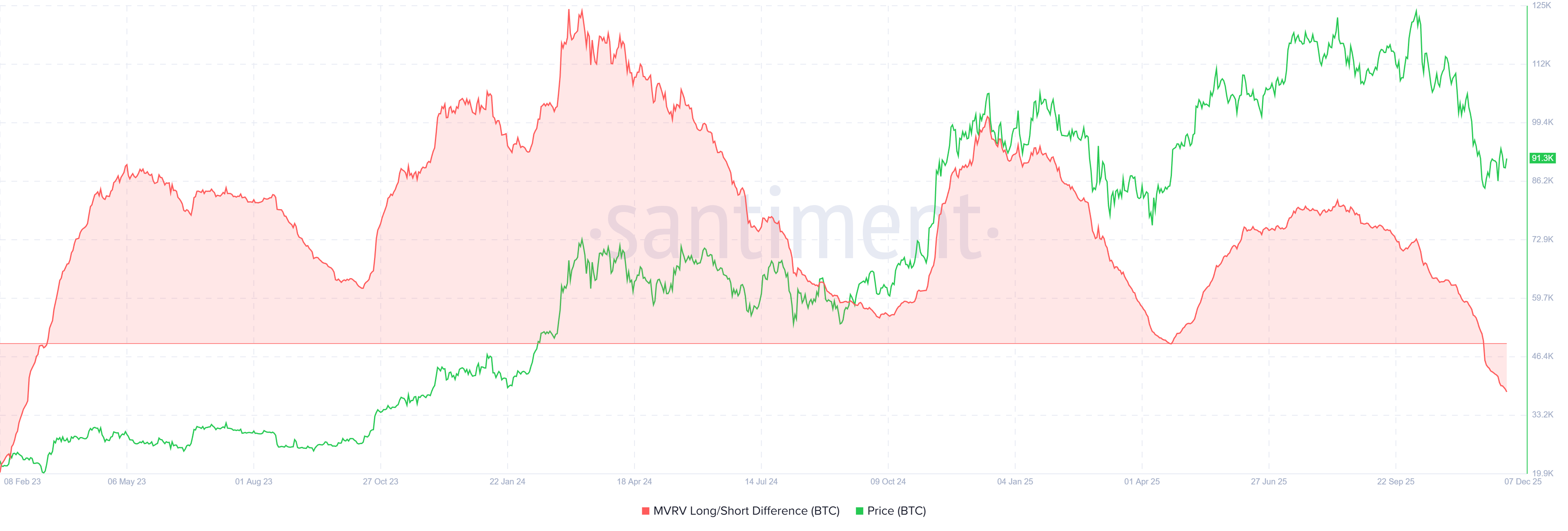

The MVRV Long/Short Difference highlights a notable change in Bitcoin’s profit distribution. A positive reading usually signals long-term holders hold more unrealized gains, while a negative value indicates short-term holders are ahead.

In Bitcoin’s case, the difference has dipped into negative territory for the first time since March 2023. This marks 30 months since short-term holders last led in profits.

Such dominance raises concerns because short-term holders tend to sell aggressively when volatility increases. Their profit-taking behavior could add pressure on BTC’s price if the broader market weakens, especially during attempts to break the downtrend.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

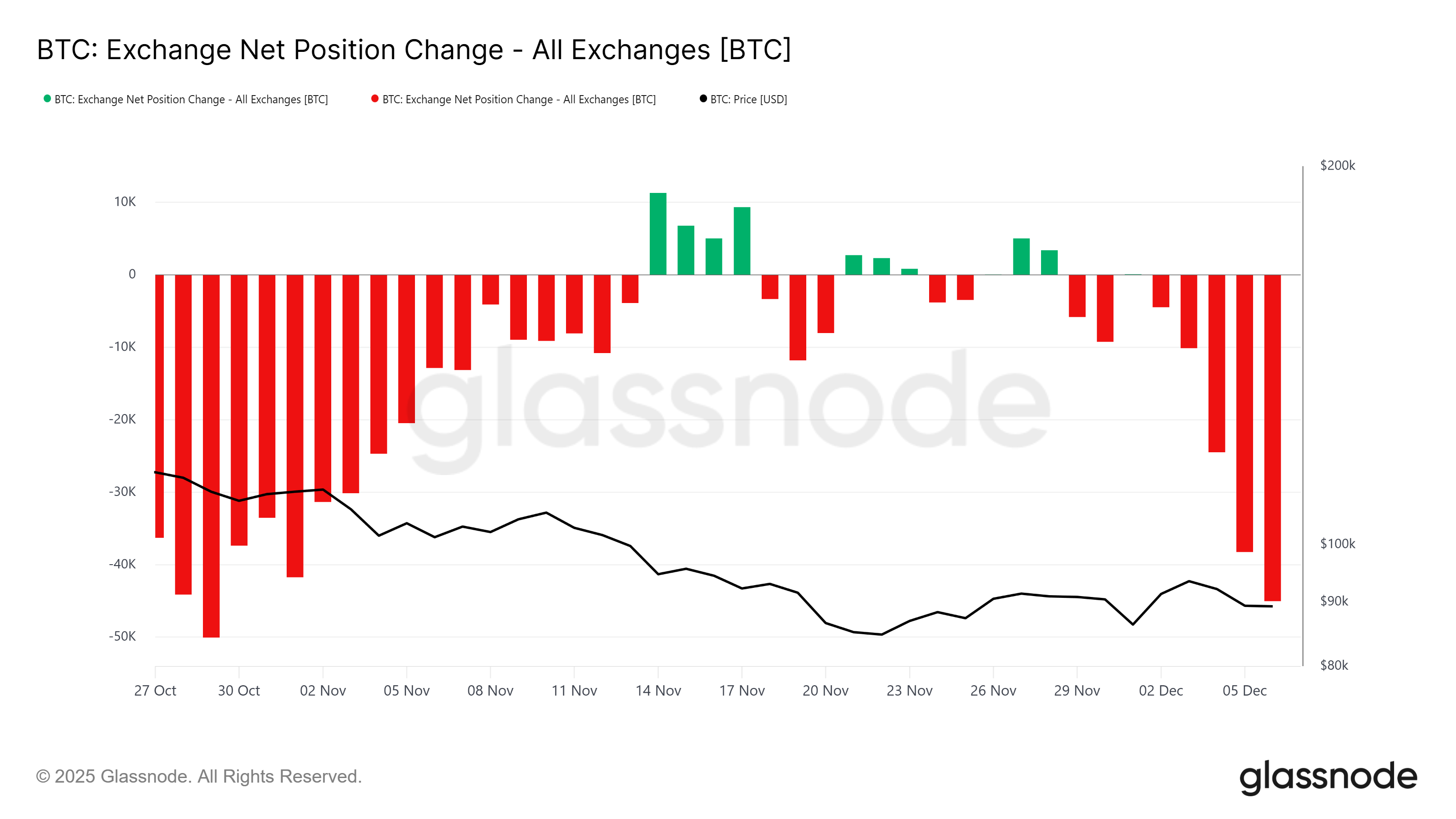

Despite this shift, Bitcoin’s broader momentum shows encouraging signs. Exchange net position change data confirms rising outflows across major platforms, signaling a shift in investor accumulation. BTC leaving exchanges is often treated as a bullish indicator, reflecting confidence in long-term appreciation.

This trend suggests that many traders view the $90,000 range as a reasonable bottom zone and are preparing for a potential recovery. Sustained outflows support price stability and strengthen the probability of BTC breaking above immediate resistance levels.

BTC Price Is Trying Its Best

Bitcoin is trading at $91,330 at the time of writing, positioned just below the $91,521 resistance. Reclaiming this level and flipping it into support is essential for BTC to challenge the month-and-a-half-long downtrend. Without this breakout, upside momentum remains limited.

If short-term holders refrain from selling and accumulation continues, Bitcoin could climb toward $95,000. A successful break above that level may send BTC toward $98,000, signaling renewed bullish strength.

However, if short-term holders start taking profits, the pressure could push BTC back toward $86,822. A drop to this level would prevent any meaningful breakout and invalidate the bullish setup, keeping Bitcoin confined within its multiweek downtrend.

The post Short-Term Bitcoin Holders Are Dominating Profits, But Will It Lead To Recovery? appeared first on BeInCrypto.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

India’s Spinny set to secure $160 million in funding for GoMechanic acquisition, sources report

PENGU Price Forecast: Managing Immediate Market Fluctuations and Exploring Future AI Opportunities

- PENGU token's price fell to $0.01114 in Nov 2025, far below its 2024 peak of $0.068, amid regulatory and macroeconomic risks. - Short-term volatility is amplified by SEC ETF delays, $7.68M short positions, and susceptibility to broader crypto market downturns. - Long-term potential emerges through AI-driven features like dynamic staking and cross-chain interoperability, plus Schleich's physical collectible partnerships. - Pudgy Penguins' hybrid digital-physical model, including Walmart retail presence, d

The Rise of Dynamic Clean Energy Markets

- CleanTrade, CFTC-approved as a Swap Execution Facility (SEF), transformed clean energy markets into institutional-grade assets by standardizing VPPAs, PPAs, and RECs. - The platform addressed fragmented pricing and opaque risks, enabling $16B in transactions within two months and bridging renewable assets with institutional capital. - Institutional investors now use CleanTrade’s tools to hedge fossil fuel volatility and lock in renewable energy prices, mirroring traditional energy strategies. - Global cl

COAI Token Fraud: Insights for Cryptocurrency Investors During Times of Regulatory Ambiguity

- COAI token's 88% collapse in late 2025 exposed systemic risks in AI-driven DeFi ecosystems, with $116.8M investor losses. - Governance flaws included 87.9% token concentration in ten wallets, untested AI stablecoins, and lack of open-source audits. - Panic selling accelerated by AI-generated misinformation and CEO resignation, amid conflicting global crypto regulations. - Lessons emphasize scrutinizing token distribution, demanding transparent audits, and avoiding jurisdictions with regulatory ambiguity.