- ZEC: Oversold conditions and strong support hint at a potential December rebound.

- LINK: ETF approval signals new institutional access as price consolidates near support.

- TRX: Key support holds while recent upgrades improve network efficiency and performance.

The final month of the year brings strong interest in selected altcoins as traders search for assets with real potential. December offers a unique mix of momentum, value zones, and major updates across several networks. This list highlights three promising altcoins with notable activity on both charts and fundamentals. Each project holds clear drivers that may influence performance in the coming weeks. Investors tracking near-term setups may find solid opportunities across these three assets.

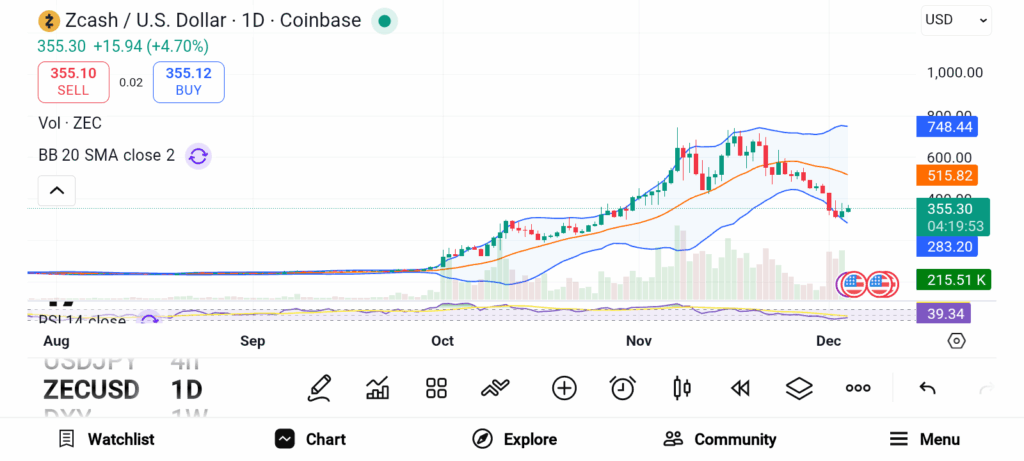

Zcash (ZEC)

Source: TradingView

Source: TradingView

Zcash — ZEC , starts December with heavy bearish pressure after a drop below the $434 and $371 zones. RSI readings now sit in oversold territory, raising the chance of a short-term reversal. Traders watch the psychological $300 support closely. A strong reversal candle above that level could send ZEC toward $500 soon. Recent ETF discussions also keep the project relevant among analysts.

Shielded-transaction activity remains steady across the network and adds confidence to long-term holders. The price now moves within a tight range, so volume shifts may guide direction into early 2026. ZEC earns a spot on this list due to strong gains this year and renewed attention on privacy-focused ecosystems.

Chainlink (LINK)

Source: TradingView

Source: TradingView

Chainlink’s LINK trades within a narrow zone between $13.70 and $11.90 after a sharp monthly drop. The chart confirms a bearish structure after a clean break below the $16.50 support. The price also sits under the 50-day SMA while RSI stays under 50. These signals point to a market with downward pressure. A shift in sentiment appeared after new reports regarding a Chainlink ETF.

Grayscale shared plans to convert a private trust into a spot ETF following SEC approval. This new development brings fresh institutional access at a time when LINK trades near the lower end of the consolidation range. Market attention now shifts toward how traders react to renewed interest from larger players.

TRON (TRX)

Source: TradingView

Source: TradingView

TRON’S TRX shows a mild 6 percent decline over the past month. The chart still moves inside a channel near strong resistance around $0.28. MACD readings remain below zero on the four hour chart, keeping momentum bearish for now. Support sits near $0.27 and has held firm for several weeks. A break below that level could invite a slide toward $0.25. The 200-day SMA also trends downward, which signals ongoing control from sellers. Recent updates offer a bright spot for supporters. The GreatVoyage v4.8.1 mainnet upgrade boosts EVM compatibility and increases node efficiency.

Zcash shows promise as oversold conditions meet steady long-term demand. Chainlink attracts attention after new ETF developments. TRON holds key support while the network pushes upgrades that strengthen performance. These three altcoins appear ready for strong focus during December.