Terra Luna Classic (LUNC) Soars 100% After Viral T-Shirt Moment in Dubai

Terra Luna Classic rallied almost 100% after CoinDesk journalist Ian Allison sparked viral attention by wearing a vintage Terra logo shirt at Binance Blockchain Week Dubai. The surge coincides with a Binance-backed network upgrade, burn activity, and renewed interest in Terra’s legacy ahead of Do Kwon’s sentencing.

Terra Luna Classic (LUNC) jumped nearly 100% today, after CoinDesk journalist Ian Allison appeared at Binance Blockchain Week Dubai wearing a vintage Terra Luna logo t-shirt while moderating interviews with executives from Mastercard, Ripple, and TON.

The image circulated across X and Telegram within hours, triggering discussion that the moment felt like a nostalgic revival of one of crypto’s most notorious altcoins.

Journalist Ian Allison Wearing a Terra Luna T-shirt at the Binance Blockchain Week in Dubai

Journalist Ian Allison Wearing a Terra Luna T-shirt at the Binance Blockchain Week in Dubai

Terra Luna Is Back? Not Quite

Traders had already been rotating into LUNC ahead of a scheduled network upgrade supported by Binance.

The exchange confirmed it would pause deposits and withdrawals during the upgrade, signalling strong operational backing from the world’s biggest trading venue.

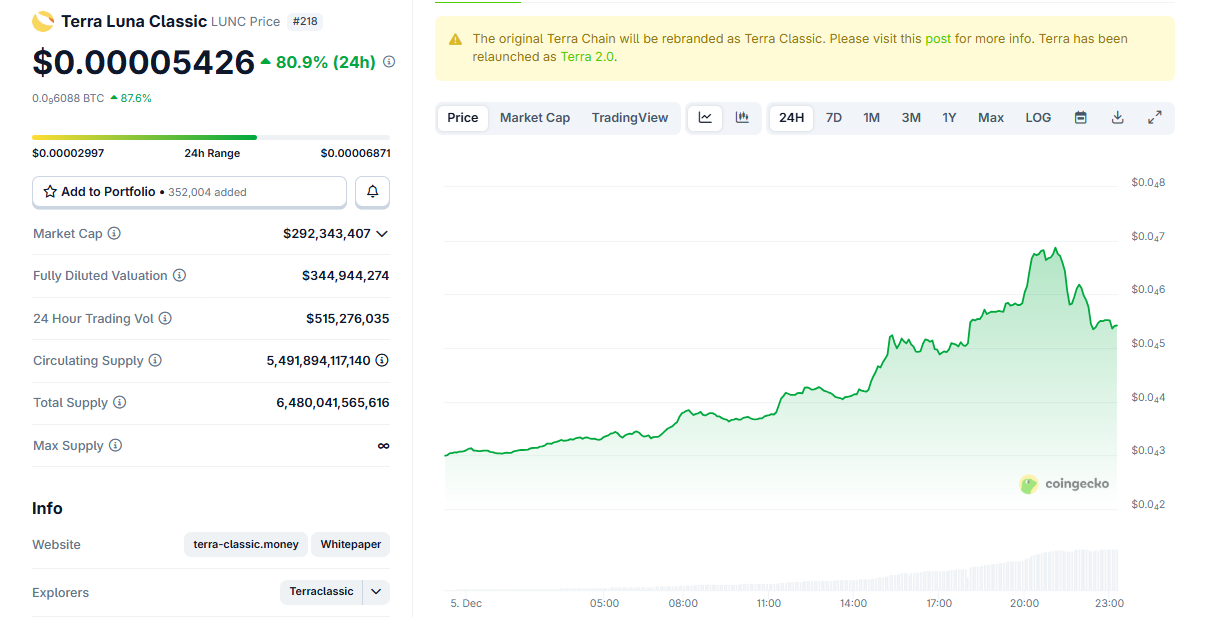

Terra Luna Classic (LUNC) Price Chart on December 5. Source:

CoinGecko

Terra Luna Classic (LUNC) Price Chart on December 5. Source:

CoinGecko

That announcement pushed volume sharply higher, setting the stage for fast speculative flows.

Token burn trackers reported aggressive supply reduction recently, including hundreds of millions of LUNC removed from circulation in the past week. Community messaging amplified the theme, reviving the idea of a shrinking float.

04 December 2025:Terra Classic $LUNC Max Supply: 6,480,742,753,204 Tokens Burned Previous Day: 83,945,886 (🔴-0.0013%)Terra Classic $LUNC Price: $0.00002834 (🟢+0.11%) pic.twitter.com/Gwppn0zHZH

— LUNC BURN UPDATE (@LuncBurnDaily) December 4, 2025

This narrative resurfaced at the same moment as Allison’s shirt went viral, reinforcing the perception of a coordinated cultural comeback.

The Do Kwon Effect

The rally also coincides with renewed attention on Do Kwon’s ongoing sentencing proceedings in the United States. Traders view developments toward legal conclusion as a potential reset point, allowing LUNC to trade like a legacy meme asset rather than a distressed one.

As volume spiked and spot markets tightened, the narrative gained traction quickly.

As expected, the DOJ wants a 12-year prison sentence for Do Kwon. Their sentencing submission suggests they don't buy Kwon's apologies, and they attack his attempts to evade blame and cast himself as a victim of Montenegrin officials. pic.twitter.com/Ub8MKk8iiP

— Alexander Osipovich (@aosipovich) December 5, 2025

Why the T-Shirt Moment Landed So Loudly

Terra’s collapse remains one of crypto’s most dramatic episodes, erasing billions in market value in 2022 and triggering regulatory crackdowns worldwide. Many in the industry still associate the logo with that moment — a symbol of excess, leverage, and systemic failure.

Seeing the design reappear on a main stage alongside established institutions added an unexpected emotional layer to the rally. It represented a strange throwback and also an emotional provocation.

$LUNC just went x2 and added 150 million to its market cap. Not because of some innovation, not because of fundamentals, but simply because a @IanAllison123 from CoinDesk wore a $LUNC t-shirt on camera. This is the reality of the market. People are not chasing technology,… pic.twitter.com/TpHeZwCWgm

— Cryptech Sam 𐤊 (@Cryptech_Sam) December 5, 2025

Terra’s Ghosts Are Still Here

Terra’s algorithmic stablecoin unraveled three years ago, triggering contagion that spread into lending platforms, hedge funds, and later exchanges. Millions of investors were left underwater, and it drove the biggest crypto winter to date.

Today’s rally simply shows that memory, speculation, and narrative still carry weight in crypto — sometimes more than fundamentals.

As LUNC surged, the sight of that shirt reminded markets how quickly sentiment can swing, even for a project once written off as irrecoverable.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Assessing How the TGE of MMT Token Influences the Cryptocurrency Ecosystem

- Momentum Finance's MMT token TGE on Sui blockchain highlights innovative DeFi tokenomics with 42.72% community allocation and ve(3,3) governance model. - Post-TGE volatility (4,000% surge followed by 70% correction) reflects market dynamics, but technical indicators and buybacks suggest long-term resilience. - MMT's $250-350M FDV target and Sui integration demonstrate strategic benchmarks, offering lessons for balancing innovation, sustainability, and institutional trust in emerging blockchain projects.

Momentum (MMT) and the Rising Popularity Among Retail Investors: Insights from Behavioral Finance

- Momentum (MMT) price surges mirror 2021 GameStop dynamics, driven by social media sentiment and behavioral biases like overconfidence and herd behavior. - Retail-driven speculation distorts market efficiency, with 21% trading volume reflecting emotional decision-making over fundamentals, as shown by Bitget and academic studies. - Institutional investors exploit these anomalies through contrarian strategies, while regulators scrutinize social media's role in destabilizing traditional market models. - The

Timeless Strategies for Investing in Today's World

- McNeel and Buffett's value investing principles remain vital in today's volatile crypto markets. - Crypto surges driven by FOMO and hype, like MMT's 2025 rise, highlight risks of ignoring these strategies. - Buffett's focus on fundamentals and emotional discipline offers a structured approach to avoid speculative traps. - Case studies show adherence to these principles can mitigate losses during market corrections. - Timeless tenets of patience and intrinsic value are essential for long-term success in u