Glassnode introduces interpolated implied volatility metrics for crypto options

Key Takeaways

- Glassnode launched interpolated implied volatility metrics covering Bitcoin, Ethereum, Solana, Binance Coin, XRP, and PAX Gold.

- The metrics provide structured market data analyzing how options price risk by delta, maturity, and option type.

Glassnode, a provider of on-chain market intelligence, today launched interpolated implied volatility metrics for crypto options, expanding coverage to Bitcoin, Ethereum, Solana, Binance Coin, XRP, and PAX Gold.

The new metrics provide structured analysis of how options markets price risk across specific deltas, maturities, and option types. The standardized data enables more precise evaluation of call and put implied volatilities for systematic trading strategies.

The interpolated volatility tools allow traders to monitor term structures and identify cross-asset opportunities by mapping volatility expectations across different time periods. The metrics support detailed comparison of risk sentiment between assets, highlighting shifts in relative demand and volatility rotations among altcoins.

Glassnode’s expansion addresses the need for granular options market analysis in crypto, where volatility expectations often signal investor sentiment around crash risk and upside exposure. The standardized approach allows for consistent cross-asset and cross-tenor comparison across the covered digital assets.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP Price Prediction: Why the $3 December Target Is More Hope Than Reality

“Bitcoin Rodney” Faces Decades in Prison as Feds Expand HyperFund Charges

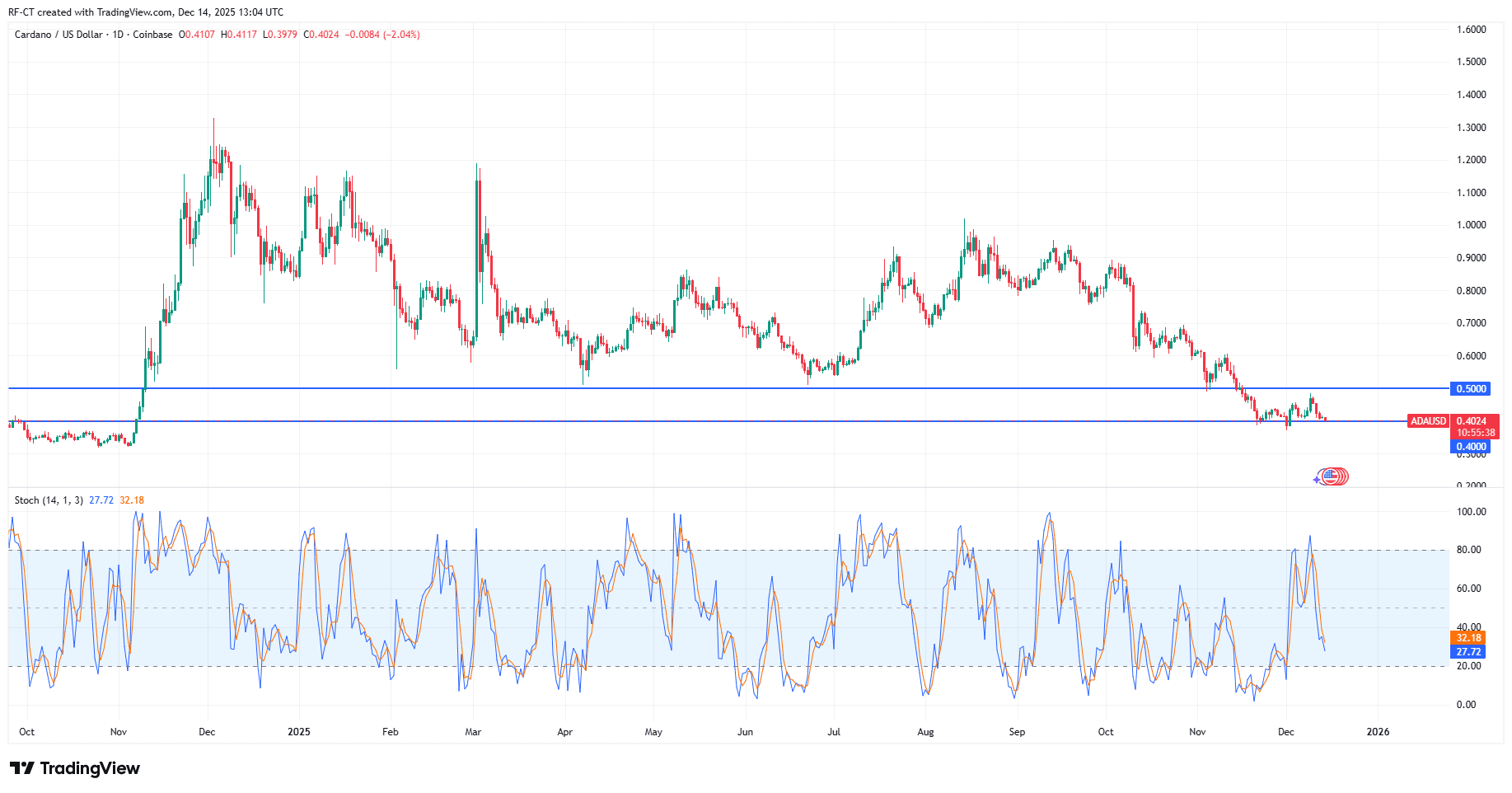

Cardano Price Prediction: Is ADA Forming a Base or Headed for Another Breakdown?

The ICP Surge: Unpacking a 30% Jump and Its Driving Factors

- ICP surged 30% in late October 2025 amid speculation and institutional adoption, driven by Microsoft/Azure partnerships and AI upgrades like Caffeine. - On-chain data shows 35% growth in active addresses but 91% fewer token transfers during downturns, highlighting fragile retail-driven momentum. - TVL hit $237B via asset tokenization, yet dApp engagement dropped 22.4%, signaling volatility despite 40+ tech upgrades including Chain Fusion. - Analysts project $11.15–$88.88 price ranges by 2030, contingent