Date: Fri, Dec 05, 2025 | 06:55 AM GMT

The cryptocurrency market is showing slight retracement today as the prices of both Bitcoin (BTC) and Ethereum (ETH) are down by nearly 1%, applying moderate pressure across leading altcoins including Immutable (IMX).

While IMX is reflecting a modest pullback on the surface, the lower-timeframe structure is revealing something far more interesting — a harmonic formation that could be setting the stage for a potential upward expansion.

Source: Coinmarketcap

Source: Coinmarketcap

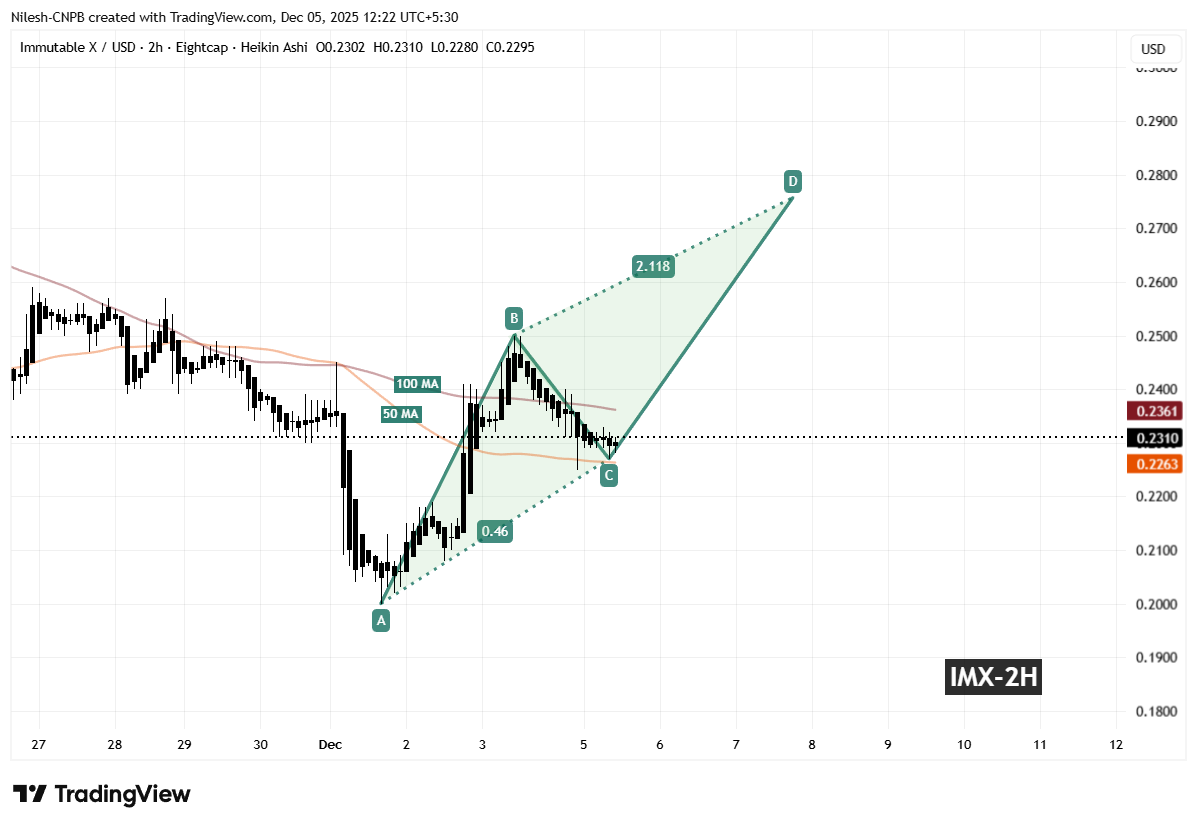

Harmonic Pattern Taking Shape

On the 2H chart, IMX is carving out a developing ABCD harmonic setup. Although this pattern is often interpreted with a bearish conclusion at its PRZ, the crucial part lies in the mid-formation: the CD-leg commonly delivers a strong upside rally before any reversal point becomes relevant.

The structure began with the impulsive lift from Point A ($0.20) to Point B, followed by a controlled pullback into Point C around $0.2270. Notably, this corrective wave stabilized right at the 50 MA, where buyers stepped back in with visible support.

Immutable (IMX) 2H Chart/Coinsprobe (Source: Tradingview)

Immutable (IMX) 2H Chart/Coinsprobe (Source: Tradingview)

Since then, IMX has rebounded toward $0.2310, indicating that the anticipated CD-extension phase may now be in motion. The next decisive technical checkpoint sits at the 100 MA near $0.2361. A clean reclaim and sustained candle closes above this dynamic resistance would validate bullish continuation potential within the pattern.

What’s Next for IMX?

If IMX maintains traction and breaks beyond the 100 MA barrier, momentum could extend toward the harmonic projection at the 2.118 level, aligning near $0.2757. Such a move reflects an estimated 19% upside zone from current price conditions — a notable target for short-term swing traders gauging breakout potential.

In contrast, if the structure fails to hold the C-marker support at $0.2270, momentum could soften and push price back into consolidation, delaying the CD-leg’s expansion rather than invalidating the broader setup altogether.

For now, IMX holds a constructive stance — volume compression is easing, price is stabilizing above dynamic averages, and the emerging harmonic geometry points toward a likely upside trajectory if resistance levels permit.