Date: Wed, Dec 03, 2025 | 02:04 PM GMT

The broader cryptocurrency market is showing a notable rebound from the Dec 01 selloff as the prices of both Bitcoin (BTC) and Ethereum (ETH) trade in green with impressive 7% gains in the last 24 hours respectively. This recovery has allowed several altcoins to bounce back, including Solana (SOL).

SOL is up 6% today, and more importantly, the chart is now highlighting a classic bullish formation that could fuel a strong upside continuation — if the breakout level is reclaimed.

Source: Coinmarketcap

Source: Coinmarketcap

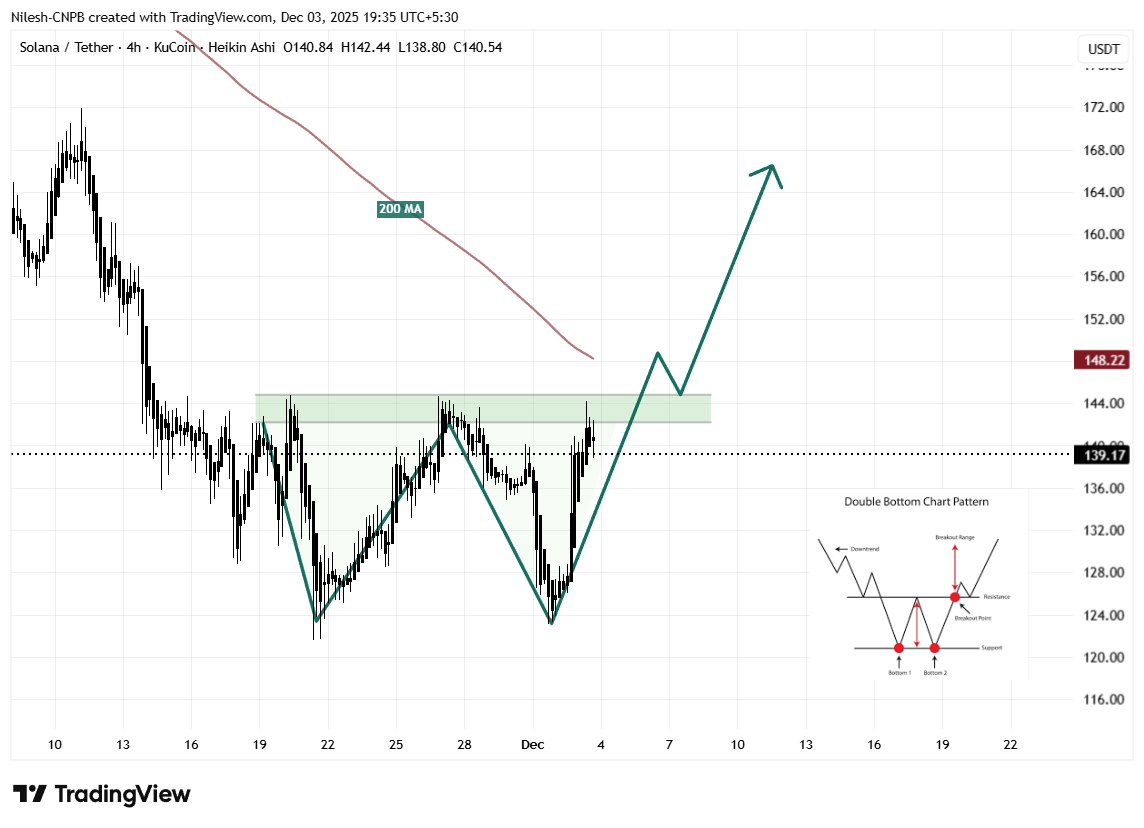

Double Bottom Formation in Play

On the 4H chart, SOL is forming a clean double bottom pattern — one of the most reliable bullish reversal structures in technical analysis. The formation becomes valid when the price prints two distinct lows near the same level, followed by a strong rebound from the second bottom.

The first bottom developed when SOL dipped into the $121 zone, which led to a sharp bounce toward the neckline resistance between $142.25 and $144.75. However, the price failed to break through and corrected back down, retesting the same support around $123 — marking the second bottom of the pattern.

Solana (SOL) 4H Chart/Coinsprobe (Source: Tradingview)

Solana (SOL) 4H Chart/Coinsprobe (Source: Tradingview)

From this level, SOL surged aggressively and now trades near $139.17, placing it directly below the neckline resistance. This region is crucial, as it determines whether buyers can trigger the next major leg higher.

What’s Next for SOL?

If the double bottom structure continues to unfold as expected, the key step ahead is a clean breakout above $144.75. A strong 4H candle close above the neckline — ideally with rising volume — would confirm the pattern’s activation.

Once confirmed, this setup projects an upside target near $166.30, representing an additional 19% move from current levels. This target aligns well with the broader bullish sentiment returning across the market.

For now, SOL’s market structure remains constructive. Reclaiming the 200-MA at $148.22 after the breakout, along with a successful retest of the neckline, would further strengthen the bullish case and give traders more confidence in a sustained upward move.