Zcash (ZEC) Price Loses A Chunk of Its 1,442% Rise, Was It A Bubble?

Zcash is facing one of its harshest corrections of the year as the altcoin’s price continues to slide, erasing a major portion of its October surge. The sharp drop has raised an important question among investors: was the recent “privacy tokens” hype an unsustainable bubble, or is there still long-term value behind ZEC’s fundamentals? Zcash

Zcash is facing one of its harshest corrections of the year as the altcoin’s price continues to slide, erasing a major portion of its October surge.

The sharp drop has raised an important question among investors: was the recent “privacy tokens” hype an unsustainable bubble, or is there still long-term value behind ZEC’s fundamentals?

Zcash Suffers Losses

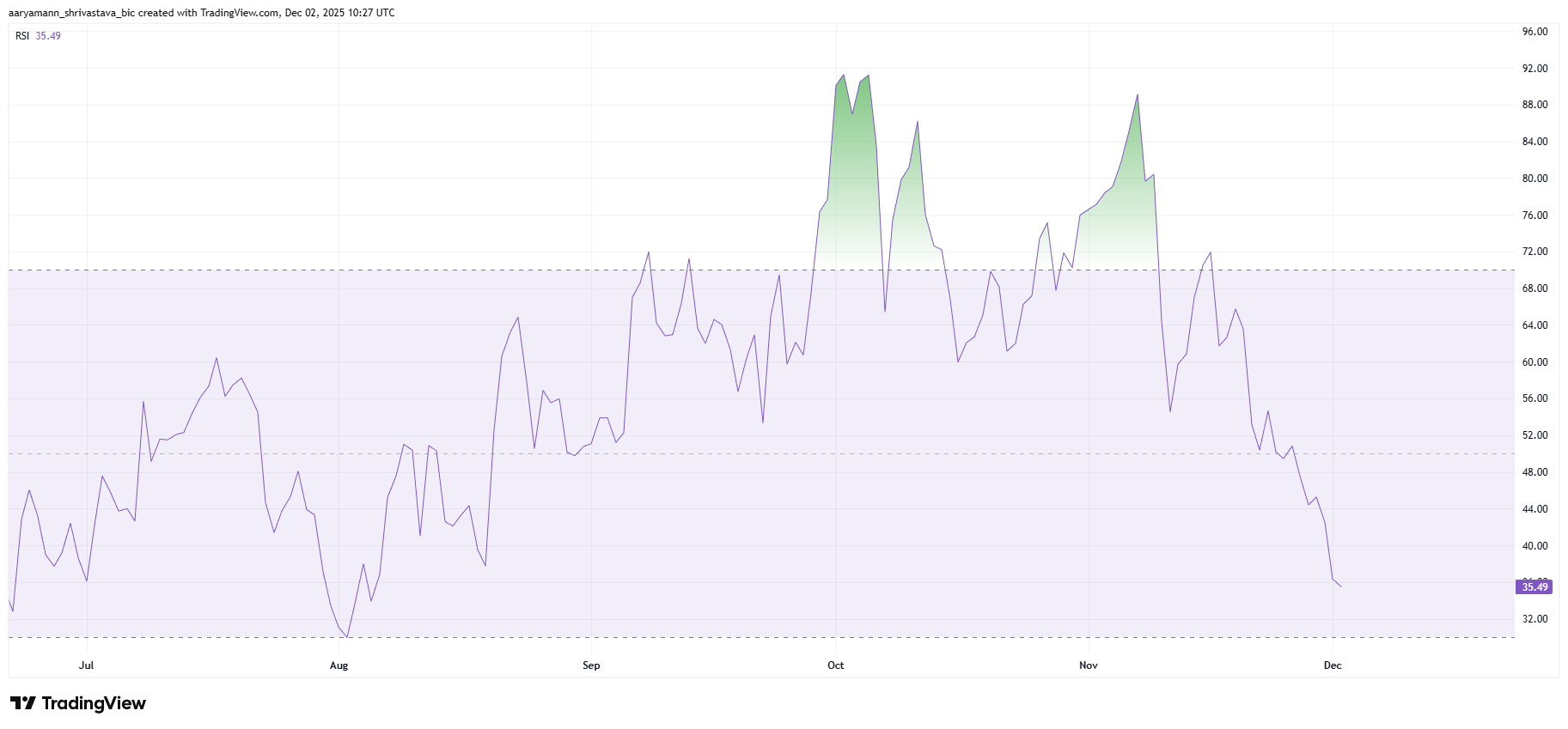

The Relative Strength Index (RSI) reflects the heavy bearish pressure surrounding Zcash. The indicator has slipped below the neutral 50.0 mark into negative territory, a sign that sellers are firmly in control.

This downward shift is often associated with weakening recovery potential, especially when momentum continues to build on the bearish side. For ZEC to show any meaningful reversal signal, the RSI would need to hit oversold conditions, where a bounce becomes statistically more likely.

However, ZEC has not yet reached that stage, leaving its trajectory vulnerable to further downside. The lack of clear reversal signals highlights the current uncertainty, suggesting that buyers remain hesitant to re-enter despite the steep discount from recent highs.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

ZEC RSI. Source:

ZEC RSI. Source:

ZEC RSI. Source:

ZEC RSI. Source:

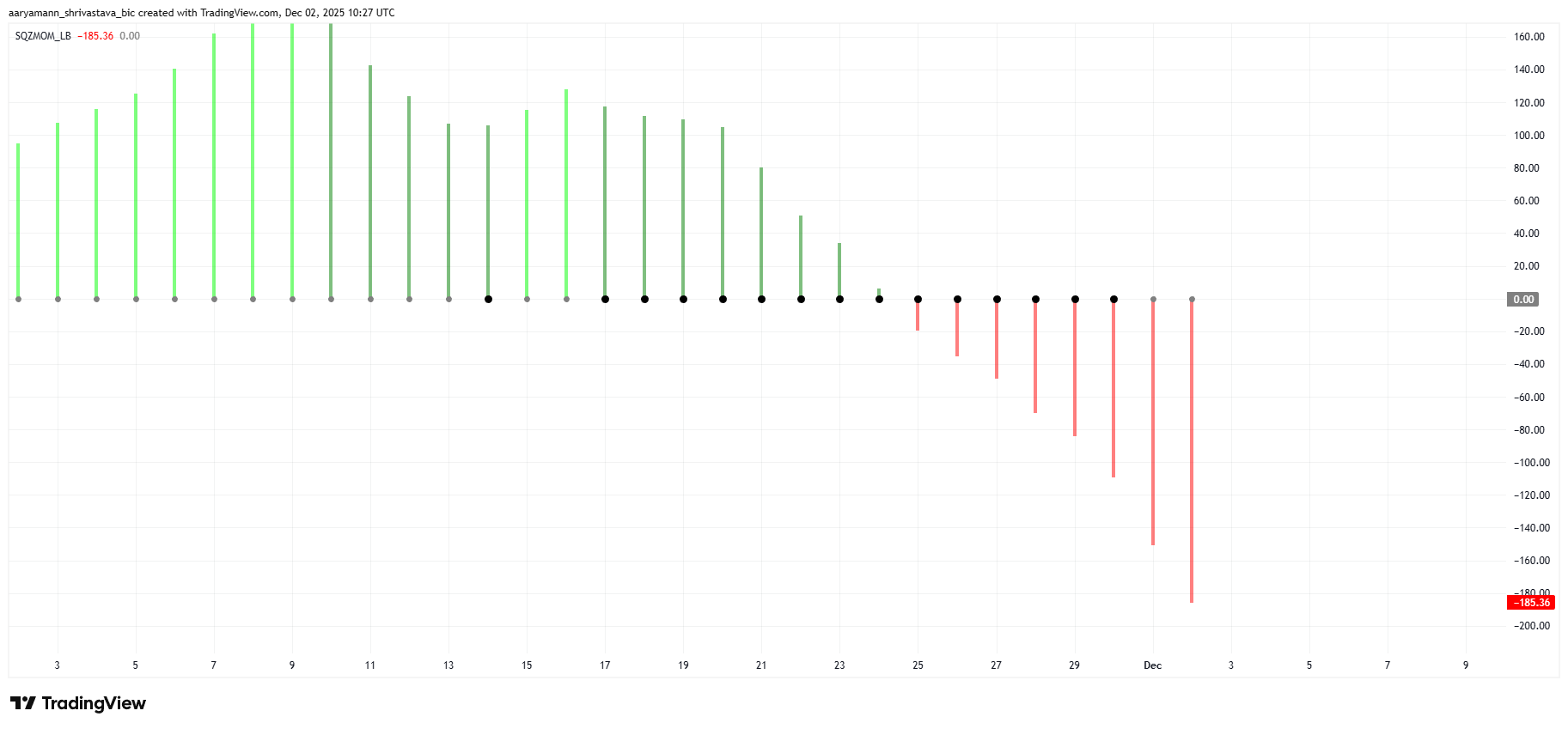

The Squeeze Momentum Indicator adds another layer of concern. Earlier this month, the indicator showed a buildup of compression, typically a prelude to major volatility. That squeeze has now released to the downside, aligning with a strong wave of bearish momentum. When a squeeze release happens during a downtrend, it often accelerates losses rather than stabilizing price action.

This shift confirms that bearish forces are present and also intensifying. Combined with the market-wide cooling of the privacy-coin narrative, the indicator suggests more volatility and downward pressure may lie ahead for Zcash.

ZEC Squeeze Momentum Indicator. Source:

ZEC Squeeze Momentum Indicator. Source:

ZEC Squeeze Momentum Indicator. Source:

ZEC Squeeze Momentum Indicator. Source:

ZEC Price May See Further Declines

ZEC previously posted a massive 1,442% rally during the peak of the privacy-token narrative. That momentum faded at the start of November, and the altcoin has since crashed 56% from its highs.

A staggering 43% of that loss occurred in just the last week, pushing ZEC down to $323. If this trend continues, Zcash is likely to break below the $300 support level and fall toward $260, or even $204, erasing more of its earlier gains.

ZEC Price Analysis. Source:

ZEC Price Analysis. Source:

ZEC Price Analysis. Source:

ZEC Price Analysis. Source:

However, Arthur Hayes believes crypto markets follow distinct yearly narratives. According to him, 2025 revolved around AI-linked tokens and the rapid expansion of stablecoins, but 2026 will center on privacy. He says this pivot could spark renewed interest in privacy-driven cryptocurrencies and the underlying tech that supports them.

Thus, if buyers return at these discounted levels, ZEC could attempt a bounce from the $344 area. A recovery toward $442 and eventually $520 would be needed to invalidate the current bearish outlook.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

U.S. November ADP employment change at -32K, vs. 10K expected and 42K prior.

Hyperliquid (HYPE) Price Fluctuations: Unraveling Blockchain Hazards and Institutional Confidence for 2025

- Hyperliquid (HYPE) dominates 73% of Perp DEX market share in 2025 through $5B TVL, BlackRock/Stripe partnerships, and 11% HLP returns despite security breaches. - Repeated 2025 security incidents ($4.9M POPCAT attack, $21M private key breach) triggered 20%+ price drops and $4B TVL decline amid liquidity flight. - Institutional trust persists as TVL/open interest grew post-March 2025, but circulating supply unlocks and Lighter/Aster competition threaten HYPE's $34 price stability. - Platform's success hin

Strategic Property Investment in the Revitalization of the Former Xerox Campus: Infrastructure-Led Renewal in Webster, NY

- Webster , NY, is transforming its post-Xerox campus via $14.3M in state infrastructure grants for industrial upgrades and public-private partnerships. - Road, sewer, and electrical improvements reduced industrial vacancy to 2%, attracting $650M fairlife® dairy plant and 250 jobs. - Residential values rose 10.1% annually as NEAT corridor targets $1B in development by 2026 with $283M public-private investment. - Strategic infrastructure funding de-risks development, creating a scalable model for post-indus

3 Key Signals That Hint at a Near-Term Shiba Inu Upswing