Why Monad Bears Could End Up Triggering a 40% C’up’ Move?

Monad price has dropped almost 40% from its recent peak, but the last 24 hours have turned active again. The MON token is up more than 27%, and the chart now hints at a classic pattern that often leads to sharp breakouts. At the same time, derivatives data show traders leaning heavily to the short

Monad price has dropped almost 40% from its recent peak, but the last 24 hours have turned active again. The MON token is up more than 27%, and the chart now hints at a classic pattern that often leads to sharp breakouts.

At the same time, derivatives data show traders leaning heavily to the short side. This mix creates an unusual setup where bearish positions could end up driving the next big move.

Possible Cup And Handle Setup Forms On The Chart

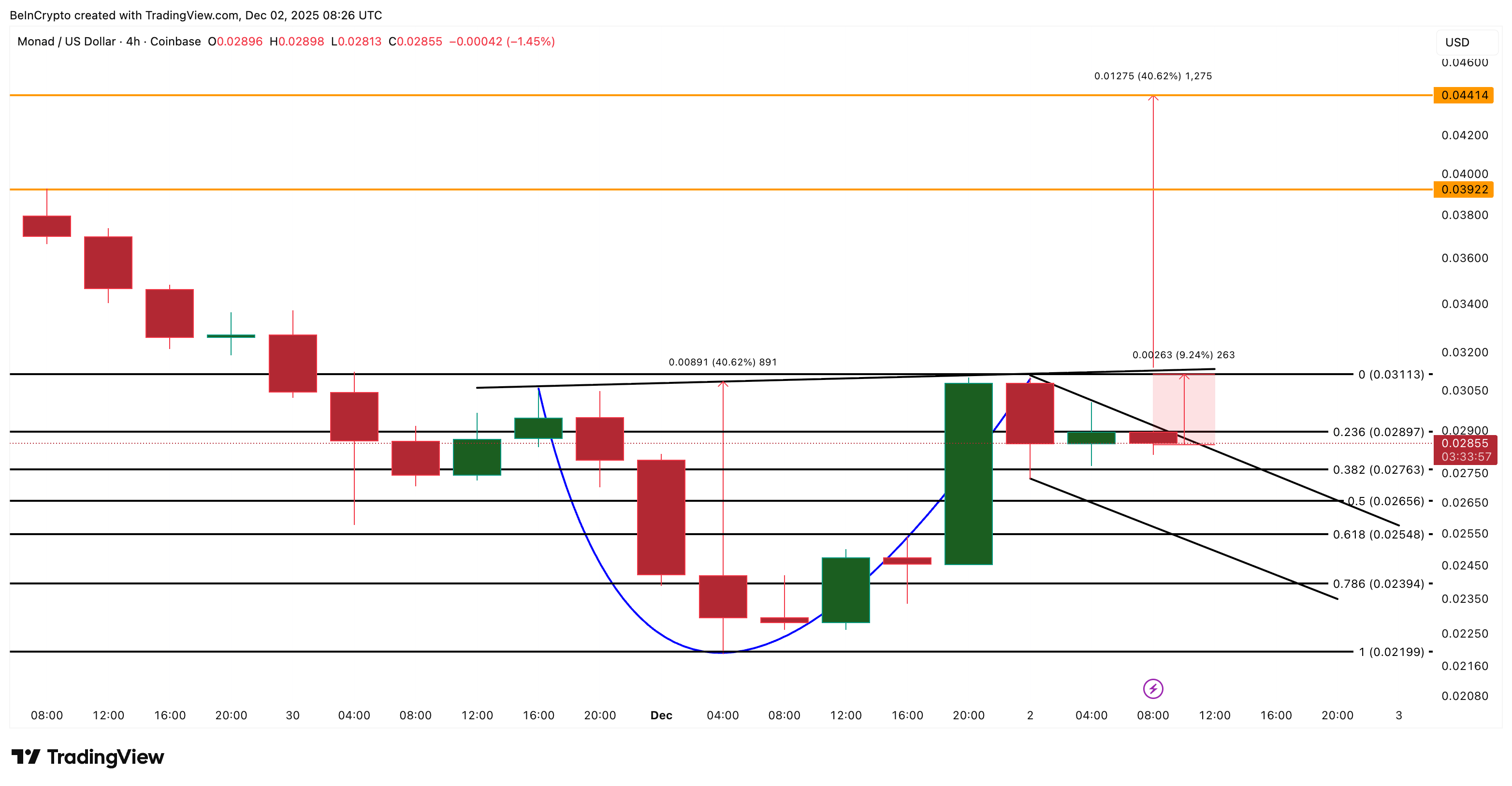

Monad trades inside a possible cup-and-handle pattern on the 4-hour chart. A cup-and-handle forms when the price rounds up, pauses, then builds a smaller pullback on the right side. This smaller pullback is called the handle. Breakouts from this pattern often lead to strong rallies.

CMF adds support to this idea. CMF (Chaikin Money Flow) tracks whether big money is entering or leaving. It has broken above its falling trend line, showing that large buyers may be returning. But CMF is still below zero. Until it moves above zero, Monad can stay inside the handle. A move above zero, while staying above the trend line, often triggers a clean breakout.

Monad Attempts Pattern Breakout:

Monad Attempts Pattern Breakout:

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

If the neckline breaks, the pattern points to a target near $0.044. This lines up with the recent high Monad set about a week ago.

Short Squeeze Setup Builds As Traders Lean Bearish

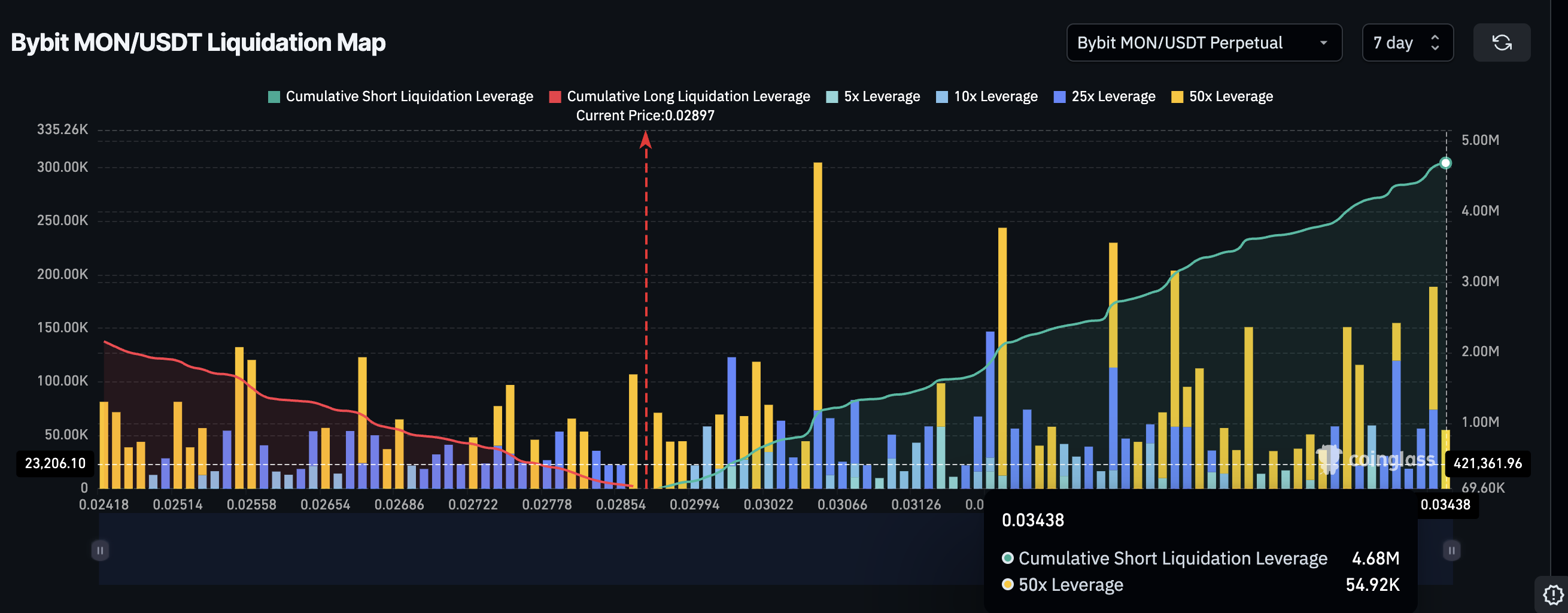

A second catalyst sits in derivatives. The Bybit liquidation chart shows short liquidation leverage stacked far above long positions. Shorts total about $4.68 million MON, while longs sit near $2.16 million. That means short leverage is almost double the longs.

Liquidation Map Favors Bears:

Liquidation Map Favors Bears:

This is why Monad bears — traders betting against the price — could end up driving a breakout. When a price move pushes against heavy shorts, those traders are forced to close. That creates a short squeeze, which sends the price higher. Derivatives-led moves have been the feature of the current crypto market cycle.

Monad Price Levels: What Confirms And What Invalidates The Setup

The Monad price breakout path starts above $0.031, a 9% upmove from the current level. Do note that a break above $0.031 would continue to liquidate the shorts, per the liquidation map shared earlier. The handle breakout, however, happens with a 4-hour close above $0.028.

Clearing this level opens the move toward $0.039. If momentum stays strong, the final leg toward $0.044 can complete the full 40% cup move.

Monad Price Analysis:

Monad Price Analysis:

But invalidation sits close. A 4-hour close below $0.025 breaks the handle and weakens the structure. If the Monad price falls below $0.021, the trend turns fully bearish.

For now, pattern strength, rising CMF, and a crowded short side put Monad in a rare position: bears could create the fuel for the next big upmove.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Inside Rivian’s ambitious investment in AI-driven autonomous driving

Bitcoin Surges in November 2025: Is This the Dawn of Widespread Institutional Investment?

- Bitcoin's 32% November 2025 drawdown occurred amid $732B in institutional inflows and record ETF adoption. - SEC-approved spot ETFs and the GENIUS Act provided regulatory clarity, boosting institutional confidence in crypto. - On-chain data showed institutional accumulation via P2WPKH addresses despite retail outflows and CDD spikes. - Macroeconomic factors like inflation and rate adjustments shaped Bitcoin's role as a hedge, with analysts viewing the correction as a mid-cycle reset. - Institutional allo

The Transformation of Education Through AI: Key Investment Prospects in EdTech and STEM Education

- AI in education market to surge from $7.05B in 2025 to $112.3B by 2034 at 36.02% CAGR, per Precedence Research. - Asia-Pacific leads growth at 46.12% CAGR; corporate e-learning to hit $44.6B by 2028 with 57% efficiency boost. - AI edtech startups raised $89.4B in Q3 2025 (34% of VC), with infrastructure investments at 51% of global deal value. - STEM institutions partner with tech giants to build AI talent pipelines, supported by $1B Google and $140M NSF investments. - Market risks include 66.4% revenue