Tech Issues Compel MegaETH to Return $500M After $1B Fundraising Mishap

- MegaETH refunds $500M after technical errors in KYC system and multisig transaction caused its $1B fundraising to exceed limits. - Project admits "sloppy execution" led to premature cap increase and user exploitation during pre-deposit phase. - Crypto community reacts with criticism over preventable mistakes, while praising transparency in disclosing failures. - Parallel Berachain case highlights industry risks through unusual $25M refund clause with unverified compliance requirements. - Incidents unders

MegaETH to Refund Pre-Deposit Funds After Technical Setbacks

MegaETH, a layer-2 protocol built on Ethereum, has announced plans to reimburse all funds collected during its pre-deposit bridge phase. This decision follows a series of technical mishaps that disrupted its ambitious $1 billion fundraising initiative.

The project attributed the problems to "sloppy execution," citing issues such as misconfigurations in its Know Your Customer (KYC) system and the unintended activation of a multisignature transaction that was supposed to raise the fundraising cap. These errors caused the pre-deposit process—designed to let verified users reserve MEGA tokens—to unravel. The KYC system malfunctioned, and the fundraising cap was lifted too early, enabling participants to exploit timing gaps and push the total raised to $500 million, double the intended $250 million limit, before the team intervened to stop the sale.

The crypto community has responded with a mix of support and criticism. Some have commended MegaETH for openly addressing the failures, while others have pointed out that the mistakes could have been prevented. AzFlin, a developer and DAO founder, argued that more thorough testing might have averted these issues. MegaETH has stated it will offer a retroactive withdrawal option for those affected, but questions remain about the project's reputation going forward.

Industry Scrutiny Over Refund Clauses and Technical Errors

This incident is not isolated within the crypto space. Berachain, another blockchain project, recently disclosed a $25 million refund agreement with Brevan Howard's Nova Digital hedge fund. The deal, which hinges on a $5 million deposit that has yet to be confirmed, allows Nova to reclaim its investment within a year of Berachain's token launch. Legal professionals have described this type of post-launch refund clause as highly unusual, with several crypto lawyers noting its rarity and one calling it unprecedented in the industry.

Lessons for the Crypto Sector

The challenges faced by both MegaETH and Berachain underscore the increasing risks associated with technical flaws and unclear contractual terms in the crypto industry. MegaETH's inability to achieve its fundraising goals highlights the complexities of managing large-scale token offerings in a rapidly evolving market. Meanwhile, Berachain's unique refund provision raises concerns about the enforceability of such agreements without proper verification.

As the digital asset sector continues to evolve, there is a growing expectation for enhanced transparency and accountability from both developers and investors. While MegaETH's move to return pre-deposit funds may help restore some confidence, the overarching takeaway is clear: meticulous technical execution and robust governance are essential for the success of major crypto projects.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Switzerland Postpones Crypto Tax Data Exchange to Meet Technological and International Requirements

- Switzerland delays crypto tax data sharing until 2027, aligning with global regulatory reevaluations amid evolving tech and market dynamics. - SGS acquires Australia's Information Quality to boost digital revenue, reflecting Swiss firms' expansion into tech-driven compliance solutions. - Canada's Alberta oil sands policy shift highlights governments prioritizing economic growth over strict climate regulations, mirroring Switzerland's approach. - BridgeBio's precision medicine and Aires' EMF solutions dem

Switzerland's Focus on Privacy Conflicts with International Efforts for Crypto Taxation

- Switzerland delays crypto tax data sharing with international partners until 2027, contrasting with global regulatory efforts to close offshore loopholes. - The U.S. advances implementation of the OECD's CARF framework, aiming to automate reporting on foreign crypto accounts by 2029. - CARF requires foreign exchanges to report U.S. account details, mirroring traditional tax standards and targeting crypto tax evasion. - Switzerland's privacy-focused stance highlights tensions between financial confidentia

Zcash News Update: Reliance Shifts Entirely to Zcash, Citing Privacy and Regulatory Alignment

- Reliance Global Group, a Nasdaq-listed fintech firm, shifted its entire crypto portfolio to Zcash (ZEC), divesting Bitcoin , Ethereum , and other major coins. - The strategic pivot, announced November 25, prioritizes Zcash's privacy-focused zk-SNARKs technology for institutional compliance and selective data disclosure. - Zcash's 1,200% 90-day price surge and Grayscale's ETF filing highlight growing institutional interest in privacy-centric assets. - The move reflects broader crypto industry trends towar

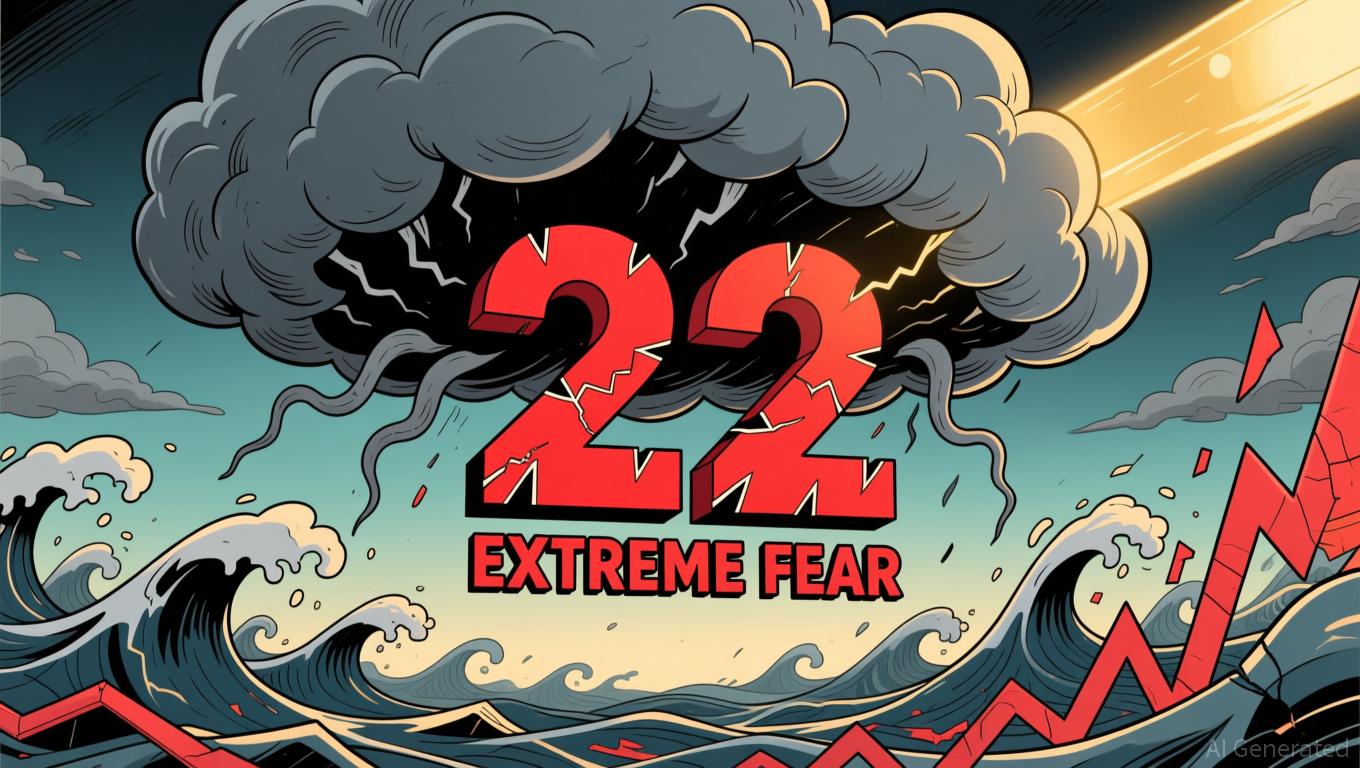

Bitcoin News Update: Bitcoin Fear Index Drops to 22 While Investors Look for Signs of Market Rebound

- Bitcoin Fear & Greed Index rose to 22 from 20, indicating slight easing of extreme fear but persistent bearish sentiment. - Bitcoin stabilized near $87,000 after hitting $80,553, yet remains below key resistance levels amid $3.5B ETF outflows. - Structural factors like leverage and liquidations drive selloffs, with ETF redemptions correlating to 3.4% price drops per $1B outflow. - Analysts note oversold technical indicators and waning retail capitulation as potential inflection points for near-term rebou