Altcoin advancements surge while security concerns pose risks to the next major breakthrough in cryptocurrency

- Altcoin investors target AI-driven projects like Ozak AI (Phase 7 presale) and Digitap ($TAP) for utility-focused growth amid market uncertainty. - Ozak AI's DePIN architecture and Phala Network partnership highlight AI's role in optimizing crypto yields and financial predictions. - Security risks escalate as South Korea's Upbit suffers $36M Solana breach, echoing Trezor CEO's warnings about exchange vulnerabilities. - Institutional adoption grows with projects like BlockchainFX ($BFX) redistributing tra

Altcoin Market Sees Renewed Interest Amid Recovery Hopes

The cryptocurrency sector is experiencing a crucial period as investors look for promising altcoins that may be undervalued ahead of an anticipated market rebound. Ozak AI has emerged as a notable contender by leveraging artificial intelligence for yield optimization, automating smart contracts, and utilizing a Decentralized Physical Infrastructure Network (DePIN). Ozak AI has distinguished itself among AI-centric crypto initiatives. The project’s recent collaboration with Phala Network to create secure AI-powered financial prediction models further enhances its strategic value, according to industry analyses.

Utility-Focused Projects Gain Momentum

Across the altcoin landscape, projects that prioritize real-world applications and innovation are gaining traction. BlockchainFX ($BFX) is drawing attention with its multi-asset trading platform, enabling users to access over 500 assets and distributing 70% of daily trading fees to participants, as reported by industry sources. These developments highlight a shift toward tokens that deliver tangible utility, as market participants move away from purely speculative assets.

Security and Regulation Remain Key Challenges

Despite the sector’s growth, security concerns and regulatory oversight continue to pose significant hurdles. A recent incident at South Korea’s Upbit exchange resulted in a $36 million Solana hot wallet breach, prompting a comprehensive audit of the platform and underscoring persistent risks for crypto exchanges. Trezor CEO Matej Zak has described exchanges as attractive targets for cybercriminals, referencing $2.47 billion in crypto losses from security breaches during the first half of 2025. These challenges highlight the importance of robust security measures and regulatory compliance, especially as platforms like Avalanche and Securitize work to expand institutional-grade tokenized trading systems.

AI Infrastructure Drives Market Evolution

Artificial intelligence-powered infrastructure is increasingly shaping the digital asset landscape. In mainland China, the cloud infrastructure market expanded by 21% in the second quarter of 2025, fueled by the integration of AI into enterprise solutions. Alibaba Cloud, Huawei Cloud, and Tencent Cloud together accounted for 61% of the market share, with Alibaba’s Qwen3-Max and Agent Bay platforms leading the transition to AI-native operations, according to recent reports. This trend mirrors global developments, as major institutions such as BlackRock and Nasdaq ramp up their involvement in Bitcoin ETF derivatives and tokenized assets.

Investor Focus: Real-World Use Cases

Investors are increasingly drawn to projects with clear practical applications. RLUSD’s growing adoption among institutions and its foundation on Ethereum position it as a potential top-five stablecoin, according to expert analysis. While challenges persist, ongoing innovation and rising institutional engagement suggest that select altcoins may outperform as the market enters its next growth phase.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana News Update: Meme Coin Craze and Its Hidden Dangers—Will Apeing Tactics Pay Off?

- Meme coin Apeing ($APEING) offers $0.001 whitelist tokens before public trading, emphasizing structured growth and utility to differentiate from speculative projects. - The 2025 crypto market sees rising meme coin interest amid Bitcoin's rebound, but faces risks like the $116M Balancer hack and Solana's price volatility. - Apeing's community-driven strategy mirrors Dogecoin's success, yet analysts caution against market manipulation and security vulnerabilities in high-risk altcoin investments. - Project

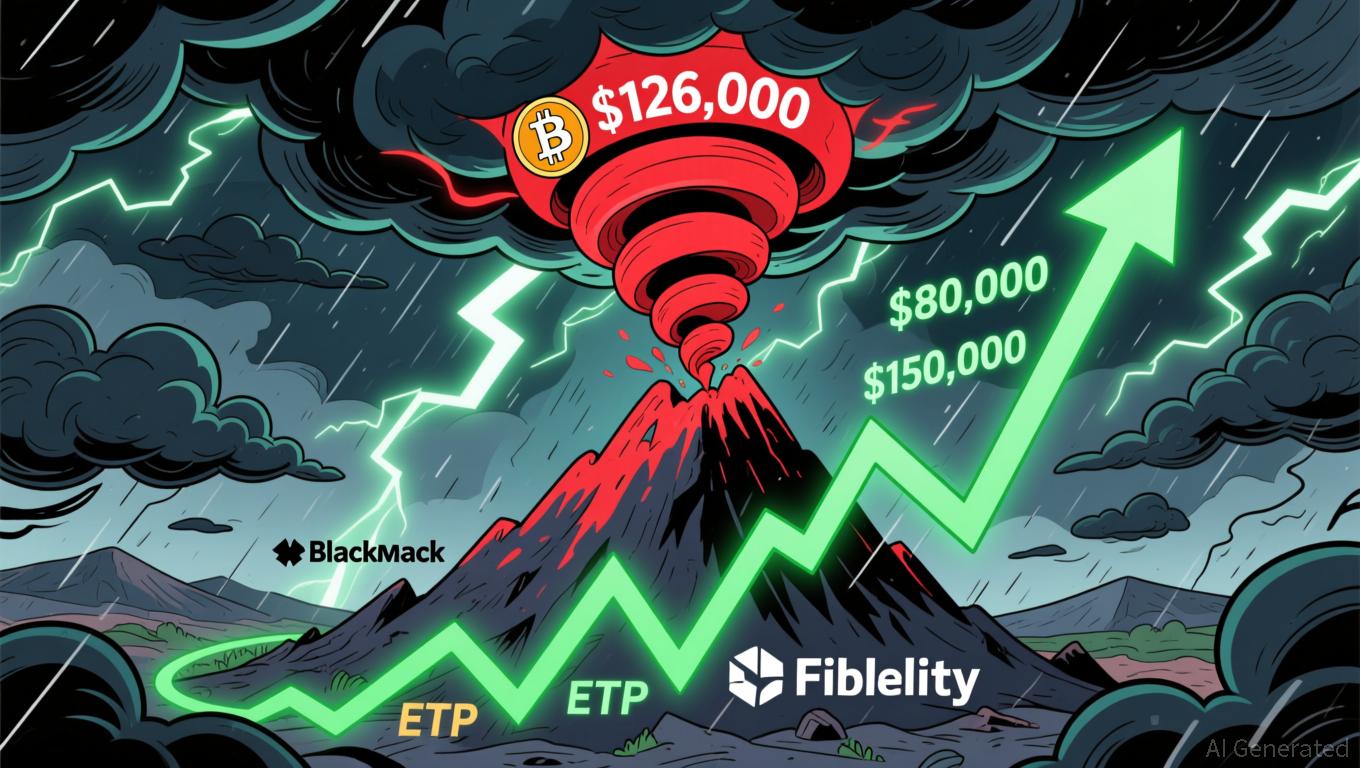

Bitcoin Updates Today: Conflicting Indicators for Bitcoin: Temporary Pullback or Extended Decline?

- Bitcoin trades near $80,000 after 30% correction from $126,000 high, amid $1T+ market value loss from geopolitical tensions and leveraged liquidations. - Binance delists GMT/BTC and ME/BTC pairs to comply with regulations, potentially tightening liquidity for niche crypto pairs. - Analysts split between bullish consolidation (ETF inflows) and bearish warnings (triple divergence, 50-week MA break) for short-term BTC trajectory. - Long-term forecasts range from $150,000–$225,000 (institutional adoption) to

The Growing Prevalence of Shovel-Ready Infrastructure Grants and Their Influence on Real Estate and Industrial Growth

- Shovel-ready grants in NY and PA are accelerating industrial development through infrastructure upgrades and land value appreciation. - Municipal partnerships reduce development risks, transforming underused sites like coal mines into competitive industrial hubs. - Programs like FAST NY and PA SITES have generated billions in private investment, creating 16,700+ jobs and boosting regional competitiveness. - Strategic infrastructure investments in transportation , utilities , and site readiness drive prem

ZEC's Latest Rally and the Infrastructure-Fueled Momentum in Webster, NY

- Zcash (ZEC) surged 66% in a month as Webster , NY's $9.8M infrastructure upgrades boost regional economic confidence. - Webster's "bluefield" model combines advanced manufacturing with residential/commercial development, attracting $650M in private investment. - Institutional adoption of ZEC grew with Reliance Global Group and Cypherpunk Technologies allocating $120M+ to its zero-knowledge privacy technology. - The $283M state initiative linking physical infrastructure and digital innovation highlights s