ETH Gas Limit Jumps to 60M and the Timing Is Wild

Ethereum just took a major step forward, and the timing couldn’t be more deliberate. The network has quietly bumped its block gas limit from 45 million to 60 million, giving the base layer far more breathing room right as ecosystem throughput hits new highs and the Fusaka upgrade sits days away. This isn’t a random tweak. It’s a coordinated shift in how Ethereum wants to scale, and the ripple effects are already visible across L2s, developers, and the wider rollup economy.

Why the Ethereum Gas Limit Jump Matters

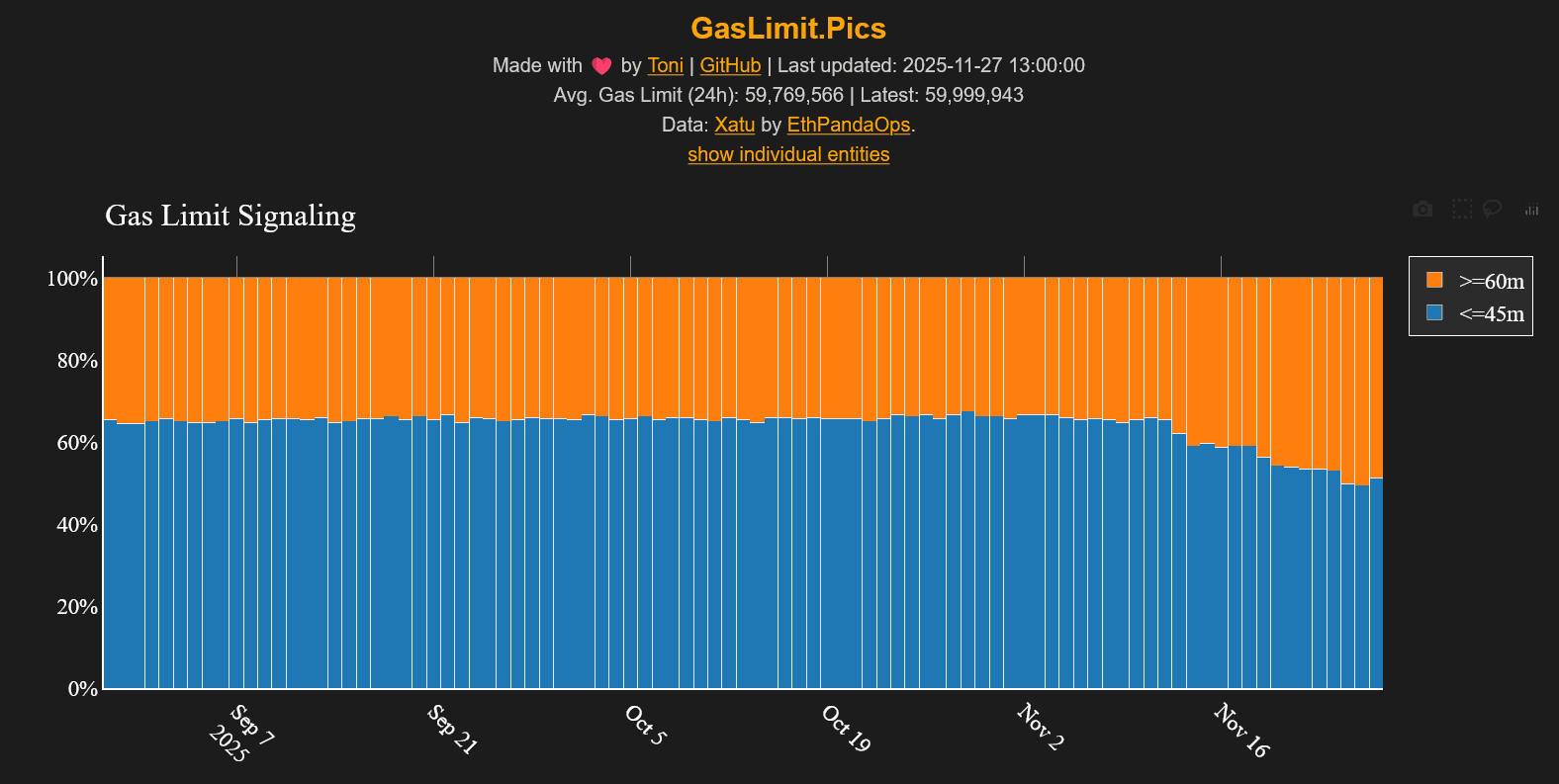

Ethereum has always treated the Ethereum gas limit like a pressure valve. Push it too far and you risk clogging the network or stressing clients. Keep it too low and you throttle innovation. The move from 45M to 60M is the biggest increase in years, and it happened only after more than half of validators signaled approval, triggering an automatic network-wide switch on November 25.

This change didn’t appear overnight. Toni Wahrstätter from the Ethereum Foundation called it the result of a long, steady community push that started a year ago. In his words, Ethereum is now running at double the gas limit it had last year, and this is only the beginning.

For developers and DeFi users, the impact is simple: blocks can now fit more transactions. That means higher base-layer throughput, fewer peak-hour bottlenecks, and more breathing room as L2s continue to scale.

What Made the Increase Possible?

If you zoom out, the increase is the result of three major forces converging at the right moment.

First, EIP-7623 added new block-size safeguards at the protocol level, reducing risks tied to runaway block growth. Second, major clients have been optimized across the board. That means Geth, Nethermind, Besu, and others can now handle heavier gas loads without slowing block propagation. Finally, long stretches of testnet trials have shown something everyone wanted to see: stable behavior even under heavier load.

Independent researcher Zhixiong Pan highlighted this combination as the reason Ethereum can now pursue more “aggressive L1 scaling” without gambling on network stability. And he’s right. Ethereum has rarely been this aligned on both engineering readiness and real-world conditions.

Vitalik’s Take: Not Just Bigger Blocks, Smarter Scaling

Vitalik Buterin added an interesting layer to the conversation. Yes, the gas limit is higher. But he argued the future isn’t simply about making blocks as big as possible. Instead, he sees the next wave of scaling as more targeted.

What this really means is that future upgrades could raise the gas limit again but pair it with higher gas costs for specific heavy operations. Complex precompiles, expensive arithmetic, specialized contract calls — all of these could be priced higher to keep the network efficient as effective block sizes grow.

This is Ethereum stepping away from blunt scaling and moving toward fine-tuned optimization. Bigger blocks where it helps. Higher costs where it’s safer.

Rollups Are Pushing Throughput Records

The gas-limit increase lands during a record-beating moment for Ethereum’s scaling networks. Over the past 24 hours, Ethereum’s combined rollup ecosystem has processed around 31,000 transactions per second. That’s not a typo — 31,000 TPS.

Lighter, a perpetuals-focused zero-knowledge rollup with about 1.2 billion dollars locked, led the pack at nearly 5,455 TPS. Coinbase’s Base contributed 137 TPS, while a long tail of ZK and optimistic rollups filled in the rest.

This kind of throughput shows where Ethereum’s real growth is coming from. L2s are exploding, and the base layer is now being tuned to support that expansion.

Fusaka Is Around the Corner

All of this leads to the upcoming Fusaka hard fork, targeted for December 3 . The update has already gone live on major testnets and even launched a two-million-dollar audit contest. Fusaka isn’t a small upgrade. It’s a foundational shift.

At the center sits PeerDAS, a redesign of how data availability sampling works. Vitalik has called PeerDAS essential for Ethereum’s long-term scaling goals, especially for rollups that depend on fast, reliable data throughput. It’s meant to make L2 block publication smoother, more predictable, and far more efficient.

Fusaka will also deliver client updates, consensus tweaks, security improvements, and a raft of low-level refinements that tighten the engine under Ethereum’s hood.

What This All Signals for Ethereum’s Future

Put it together and a clear picture emerges. The gas-limit increase is not a one-off move. It’s a signal of confidence — that clients are ready, testnets are stable, and L2s are hungry for more room. With PeerDAS arriving in days, $Ethereum is effectively widening the base layer at the exact moment its rollup ecosystem is hitting new speed records.

The story here isn’t just about bigger blocks. It’s about a network preparing for its next era of scaling with a mix of engineering discipline, community alignment, and real-world demand.

If this is the pre-Fusaka phase, the post-Fusaka landscape is going to be even more interesting.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Bitcoin Drops 30%, Revealing 'Panda Phase'—A Mild Bear Market Lacking a Definite Bottom

- Bitcoin fell 30% to $87,080, its steepest two-month drop since 2022, driven by ETF outflows, leverage liquidations, and stablecoin declines. - Institutional confidence waned as asset managers paused accumulation, while retail investors exited en masse, worsening liquidity and market sentiment. - The Crypto Fear & Greed Index hit record lows at 15, reflecting panic amid Fed policy uncertainty and Bitcoin's 0.72 correlation with the Nasdaq 100. - Deribit's $1.76B call condor bet hints at cautious optimism,

Lowe's CEO's Approach to DEI: Embedding Diversity into Operations Rather Than Symbolic Actions

- Marvin Ellison, former Target part-timer and one of eight Black Fortune 500 CEOs, led Lowe's to $20.81B Q3 revenue through operational discipline and AI-driven innovation. - His Total Home strategy integrating services and store productivity, plus 50+ AI models for inventory/price optimization, drives growth amid retail challenges. - Ellison prioritizes action-based DEI reforms like leadership-focused hiring over credentials, rejecting performative gestures post-2020 George Floyd protests. - Despite rais

Bitcoin News Update: Unveiling Layered Risks as Connections Between Crypto and Traditional Finance Deepen

- Bybit temporarily halted CME-linked crypto futures trading after CME Globex disruptions, exposing vulnerabilities in centralized infrastructure linking traditional and digital markets. - CME Group faced scrutiny for technical glitches suspending Bitcoin futures, despite record 9% monthly growth in crypto derivatives volume and 132% YoY expansion in notional value. - Analysts highlight cascading risks from centralized system failures, urging diversified risk strategies as institutional adoption of 24/7 cr

BREAKING: Why Tether’s USDT Is One Bitcoin Crash From Breaking