Dogecoin Rally Hopes Rise After ETF Push — But the Real Fight Lies At $0.18

The Dogecoin price is trying to recover again. Its price trades near $0.14 after a small pullback, but the mood around the token has shifted over the past 24 hours. The new Dogecoin ETF listing has improved sentiment, the chart has flashed a clean reversal signal, and whales have begun to add again. Still, the

The Dogecoin price is trying to recover again. Its price trades near $0.14 after a small pullback, but the mood around the token has shifted over the past 24 hours.

The new Dogecoin ETF listing has improved sentiment, the chart has flashed a clean reversal signal, and whales have begun to add again. Still, the strongest resistance sits above a key price level, and breaking it remains the real test.

Reversal Setup Forms as Big Holders Add Again

Dogecoin triggered a classical reversal structure on the daily chart post the Grayscale ETF launch.

Between 4 November and 21 November, the price made a lower low while the Relative Strength Index (RSI), a momentum indicator, made a higher low. This bullish divergence pattern usually appears towards the end of a downtrend.

Right after this signal, Dogecoin climbed more than 15%.

Reversal Setup:

TradingView

Reversal Setup:

TradingView

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter .

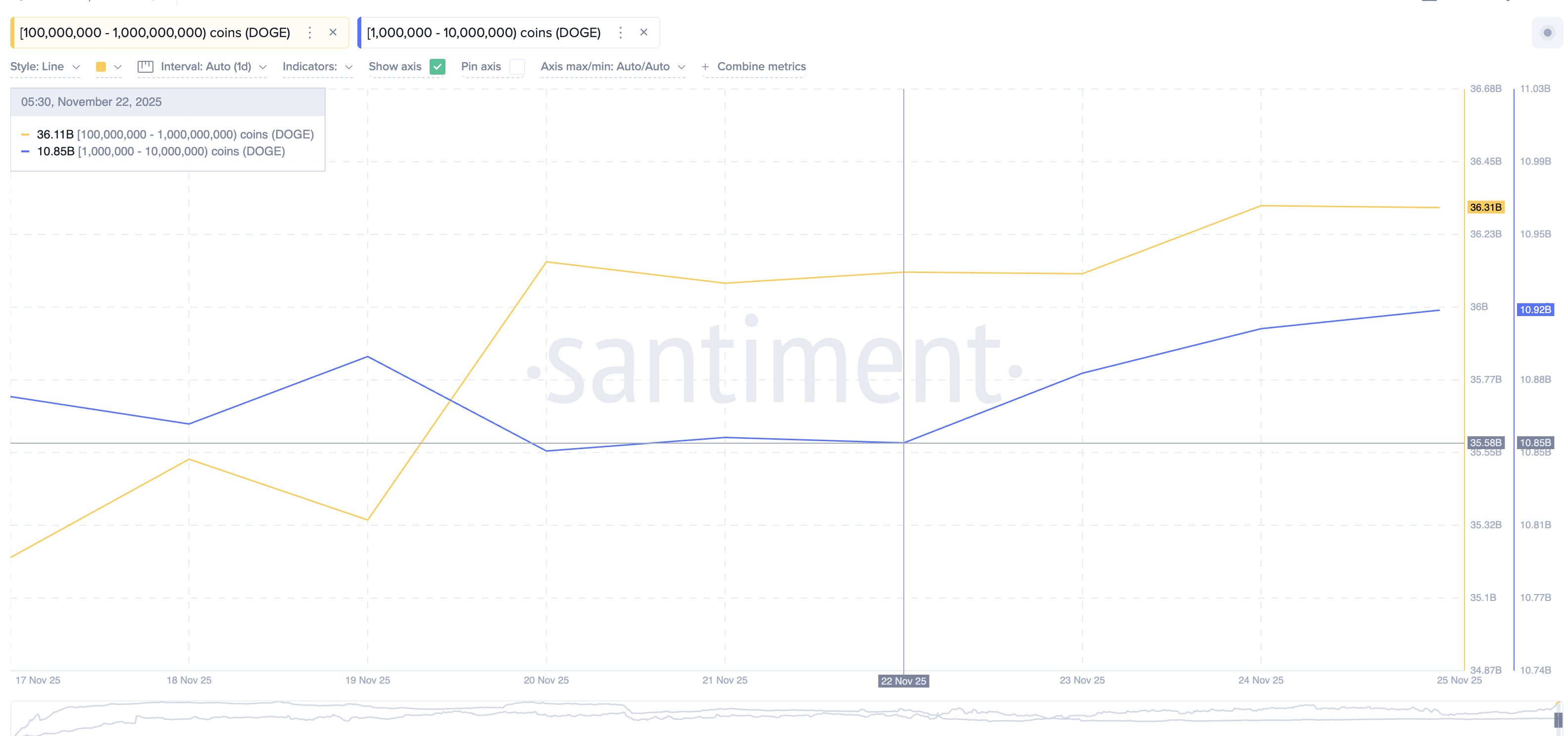

The move also aligns with fresh buying from two whale cohorts. The group holding 100 million to 1 billion DOGE increased its balance from 35.34 billion DOGE to 36.31 billion DOGE starting 19 November. A second group holding 1 million to 10 million DOGE began adding on 22 November, raising its balance from 10.85 billion DOGE to 10.92 billion DOGE.

Whales Buying Dogecoin:

Whales Buying Dogecoin:

Together, these cohorts added 1.04 billion DOGE, worth roughly $153 million, at current prices. This is the strongest accumulation in quite a while and supports the reversal structure.

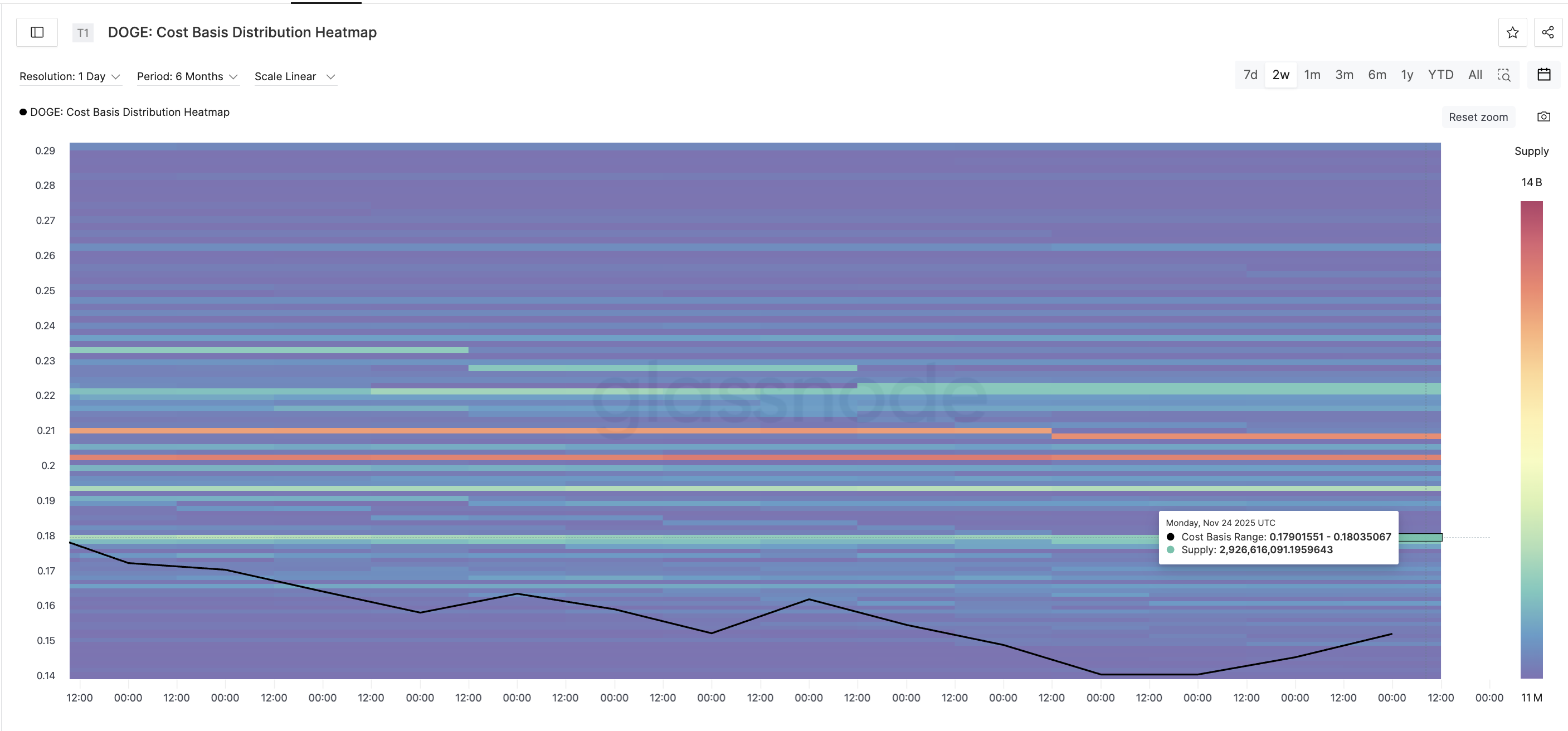

Heatmap Shows the Real Battle Ahead

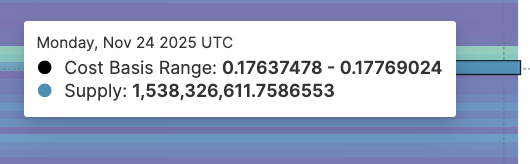

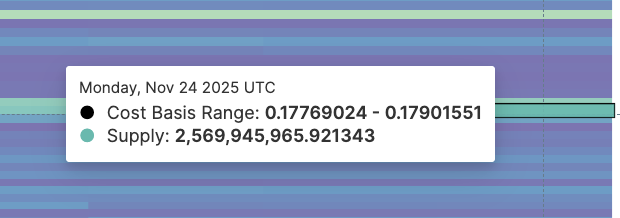

Even with the DOGE ETF boost and whale accumulation, Dogecoin now faces its largest supply block in weeks. The cost-basis heatmap shows a dense cluster of 7.03 billion DOGE between $0.17 and $0.18.

Key DOGE Cluster 1:

Key DOGE Cluster 1:

At that price, this barrier represents more than $1.20 billion worth of coins held by traders who may sell into strength.

Key DOGE Cluster 2:

Key DOGE Cluster 2:

Until Dogecoin closes above $0.18, the reversal setup and whale support cannot fully play out. And every bounce might fail if market conditions weaken.

Key DOGE Cluster 3:

Key DOGE Cluster 3:

The chart shows the real fight sits here, not in the earlier bounce.

Dogecoin Price Levels: What Confirms and What Breaks the Move

Dogecoin must reclaim $0.17 on the price chart to begin the build-up toward the $0.17–$0.18 wall. This zone is the last checkpoint before a momentum expansion.

This is the key level that has rejected every rally attempt since early November. A clean break above $0.18 opens the path toward $0.21, which aligns with the Fibonacci structure and the next major supply zone.

On the downside, the invalidation sits at $0.13. A daily close below this level breaks the reversal setup and signals that the ETP-led optimism and whale accumulation were not enough to sustain strength.

Dogecoin Price Analysis:

TradingView

Dogecoin Price Analysis:

TradingView

The Dogecoin price has a stronger setup now than it did earlier this month, but the chart is clear: the real fight, and the real confirmation of bullishness, still lies ahead.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Japan Equips Crypto Exchanges with Conventional Financial Protections

- Japan's FSA mandates crypto exchanges to hold liability reserves from 2026, aligning with traditional financial safeguards after major exchange collapses. - Reserve requirements will be volume-based and incident-adjusted, allowing insurance to offset costs, ensuring immediate user compensation without bailouts. - The reform reclassifies crypto as financial instruments under strict oversight, including audit enhancements and insider-trading bans, mirroring securities firm standards. - Larger exchanges lik

Private Transactions, No Registration Required: ShopinBit's Crypto Concierge Manages International Orders with Complete Privacy

- ShopinBit launched a privacy-focused web app enabling crypto payments for global services using Bitcoin , Monero, USDT, and 2,000+ altcoins via EXOLIX. - The no-account platform offers 2% cashback for early users and handles high-end logistics with a 10% transparent service fee, emphasizing "Ultra Privacy Mode" with no data storage. - Distinguishing itself from competitors like TrustLinq, ShopinBit prioritizes discreet crypto transactions while managing complex orders through EU-based logistics partners.

"Berachain's Unique Refund Conditions Raise MFN Issues in Cryptocurrency Agreement"

- Berachain co-founder Smokey dismissed a $25M refund clause for Nova Digital as "inaccurate," citing compliance needs for Brevan Howard's Abu Dhabi fund. - The clause allows Nova to reclaim its investment until Feb 2026 if $5M is deposited post-TGE, but activation remains unconfirmed. - Four crypto attorneys called the refund mechanism "highly unusual," raising concerns about potential violations of "Most Favored Nation" investor clauses. - Smokey denied MFN breaches, noting no other Series B investors re

Paxos Purchases Fordefi to Drive a New Era of Secure Institutional Crypto Custody

- Paxos acquires Fordefi for over $100 million to strengthen institutional crypto custody. - The deal integrates Fordefi's MPC wallet tech and DeFi tools into Paxos's regulated infrastructure. - This marks Paxos's second 2025 acquisition, reflecting growing demand for secure digital asset solutions. - Fordefi's $28M prior funding and institutional client base (300+) enhance Paxos's market position. - The move aligns with industry trends as firms prioritize secure, scalable crypto infrastructure amid regula