Bitkub Eyes Hong Kong IPO as Thai Market Downturn Stalls Local Listing Plans

Quick Breakdown

- Thailand’s largest crypto exchange is weighing a $200M IPO in Hong Kong.

- Volatile Thai markets and a five-year SET Index low stall the local debut.

- Hong Kong’s booming IPO scene and crypto-friendly stance attract Bitkub.

Bitkub considers overseas listing amid Thai market turmoil

Bitkub, Thailand’s largest cryptocurrency exchange, is exploring an initial public offering (IPO) abroad amid weak market conditions that continue to weigh on local investor sentiment. According to a Bloomberg report citing people familiar with the matter, the company is targeting about $200 million in a potential Hong Kong listing.

The move comes after Bitkub’s earlier plan to go public in Thailand in 2025 was put on hold due to heightened volatility and uncertainty in the domestic equities market.

Thai stock market hits five-year low in 2025

Thailand’s stock market has struggled to find stability throughout 2025 amid escalating political tensions with Cambodia and concerns over trade disruptions.

The Stock Exchange of Thailand (SET) has dropped roughly 10% this year, sliding to a five-year low in the first half of 2025, one of the weakest performances in Asia.

Source

:

Thailand Business News

Source

:

Thailand Business News

Even after two months of modest recovery, foreign investors remained net sellers, offloading more than 100 billion baht (about $3 billion) in equities during the first 10 months of the year.

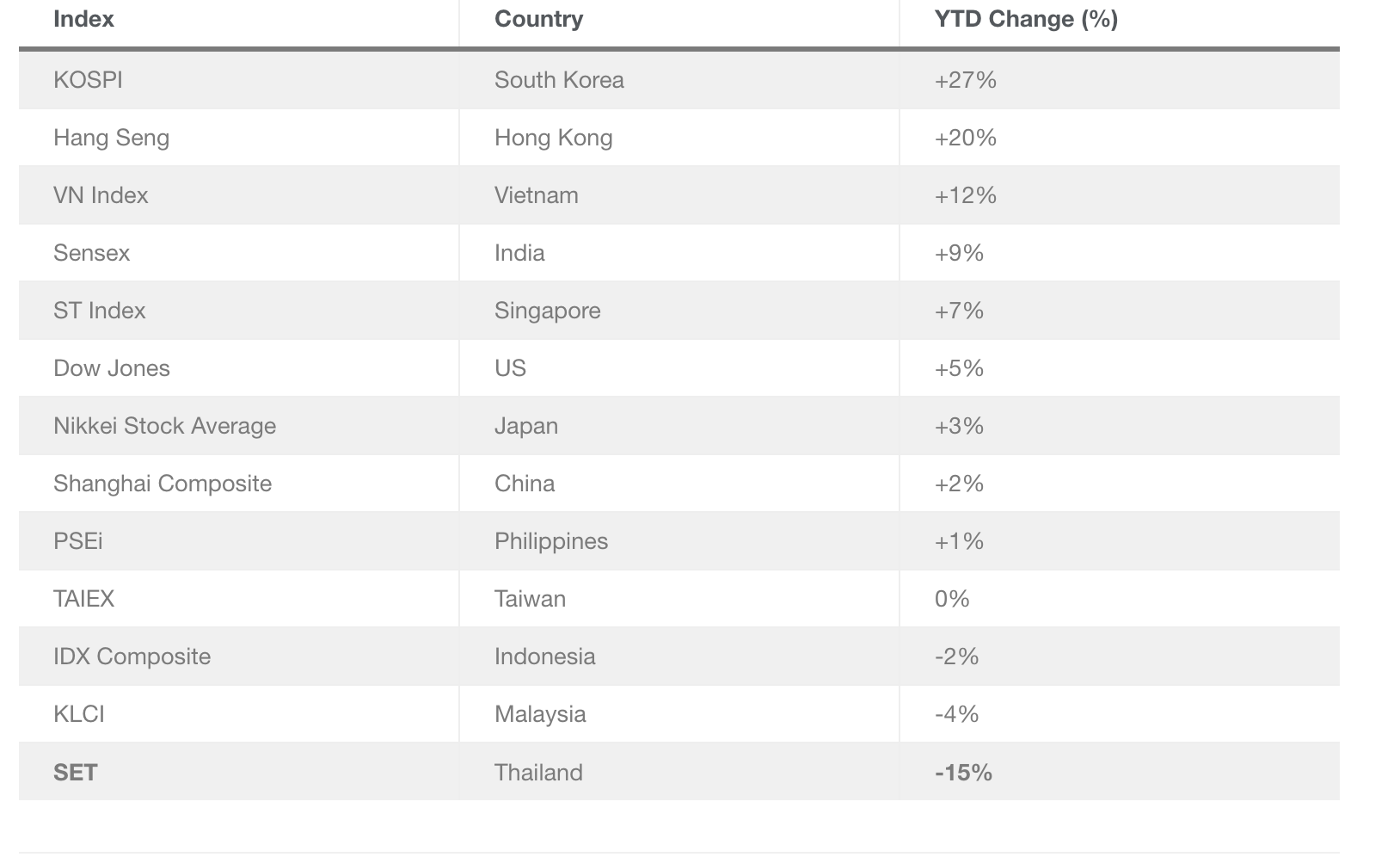

This contrasts sharply with broader regional performance: major Asian markets, including South Korea and Hong Kong, saw gains of 27% and 20%, respectively, over the same period.

Hong Kong’s IPO boom draws global crypto firms

For Bitkub, Hong Kong’s surging IPO ecosystem presents a more attractive path. The Hong Kong Stock Exchange reported raising HK$216 billion (around $27.8 billion) from IPOs between January and October 2025, a massive 209% jump from the previous year.

The city has quickly become a hotbed for digital asset companies. Bitcoin Depot, the world’s largest Bitcoin ATM operator, is among the notable crypto firms expanding into the region.

In October, local crypto heavyweight HashKey Group also filed for a public listing, aiming to raise $500 million ahead of a planned 2026 debut, potentially one of the first local crypto IPOs.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Robinhood’s 2026 platform seeks to make prediction markets more accessible to everyday investors

- Robinhood acquires 90% of MIAXdx to launch a CFTC-regulated futures/derivatives exchange by 2026, expanding into prediction markets. - The platform reported $9B in prediction market contracts traded by 1M+ users since March 2025, driven by partnerships like Kalshi. - Industry-wide growth sees Kalshi ($4.47B 30-day volume) and Polymarket ($3.58B) competing with crypto-based prediction platforms. - Robinhood aims to democratize speculative trading through fully collateralized products, leveraging MIAXdx's

Mutuum’s Robust DeFi Framework Drives 600% Token Growth and Secures $18.9M in Funding

- Mutuum Finance's MUTM token surged 250% since presale launch, with Phase 6 now 99% sold out ahead of 20% price hike in Phase 7. - The $18.9M raise attracted 18,200+ holders, positioning MUTM as 2025's most subscribed DeFi token with $0.035 current price (600% above initial $0.01). - Halborn's security audit and Sepolia testnet launch in Q4 2025 reinforce credibility, while mtToken-based lending protocol combines pooled liquidity with P2P borrowing. - Strategic features like card purchases and daily rewar

Japan Equips Crypto Exchanges with Conventional Financial Protections

- Japan's FSA mandates crypto exchanges to hold liability reserves from 2026, aligning with traditional financial safeguards after major exchange collapses. - Reserve requirements will be volume-based and incident-adjusted, allowing insurance to offset costs, ensuring immediate user compensation without bailouts. - The reform reclassifies crypto as financial instruments under strict oversight, including audit enhancements and insider-trading bans, mirroring securities firm standards. - Larger exchanges lik

Private Transactions, No Registration Required: ShopinBit's Crypto Concierge Manages International Orders with Complete Privacy

- ShopinBit launched a privacy-focused web app enabling crypto payments for global services using Bitcoin , Monero, USDT, and 2,000+ altcoins via EXOLIX. - The no-account platform offers 2% cashback for early users and handles high-end logistics with a 10% transparent service fee, emphasizing "Ultra Privacy Mode" with no data storage. - Distinguishing itself from competitors like TrustLinq, ShopinBit prioritizes discreet crypto transactions while managing complex orders through EU-based logistics partners.