3 Altcoins Facing Major Liquidation Risk in the Final Week of November

Billion-dollar liquidation events have become a new normal in recent months. These events show that traders continue to get caught off guard by market volatility. Several altcoins in the final week of November could create similar surprises. These are the altcoins and the reasons they may trigger major liquidations. 1. XRP XRP’s 7-day liquidation map

Billion-dollar liquidation events have become a new normal in recent months. These events show that traders continue to get caught off guard by market volatility. Several altcoins in the final week of November could create similar surprises.

These are the altcoins and the reasons they may trigger major liquidations.

1. XRP

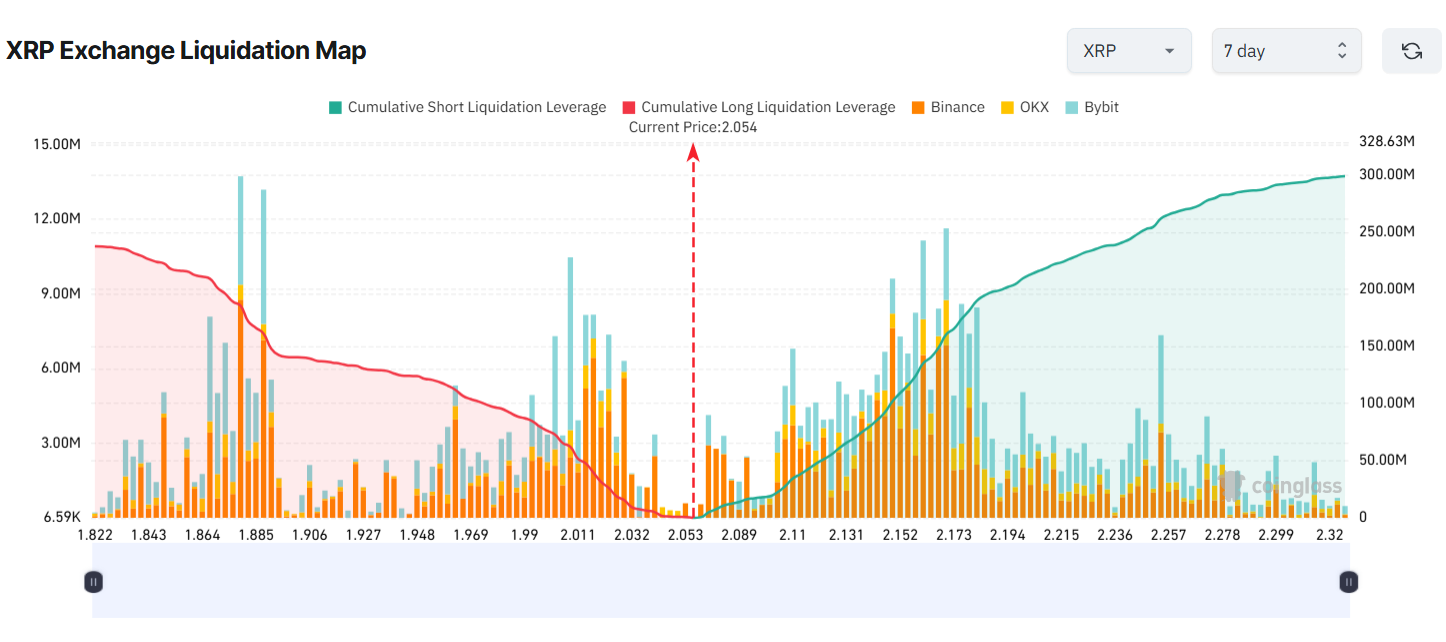

XRP’s 7-day liquidation map shows notable risk levels. If XRP rises to $2.32 this week, approximately $300 million in short positions will be liquidated. If XRP falls to $1.82, around $237 million in long positions will be liquidated.

XRP Exchange Liquidation Map. Source:

Coinglass

XRP Exchange Liquidation Map. Source:

Coinglass

Short traders in the final week of November may face liquidation for several reasons. For example, Grayscale’s XRP ETF will debut on the NYSE on November 24. US-listed XRP ETFs have also posted a cumulative total net inflow of more than $422 million, despite the broader market decline.

However, other reports show that XRP whales have shifted from accumulation to heavy selling in recent days. This selling pressure could push XRP lower and trigger liquidation for long positions.

These conflicting forces may cause losses for both long and short traders, especially as the derivatives market shows signs of heating up again.

2. Dogecoin (DOGE)

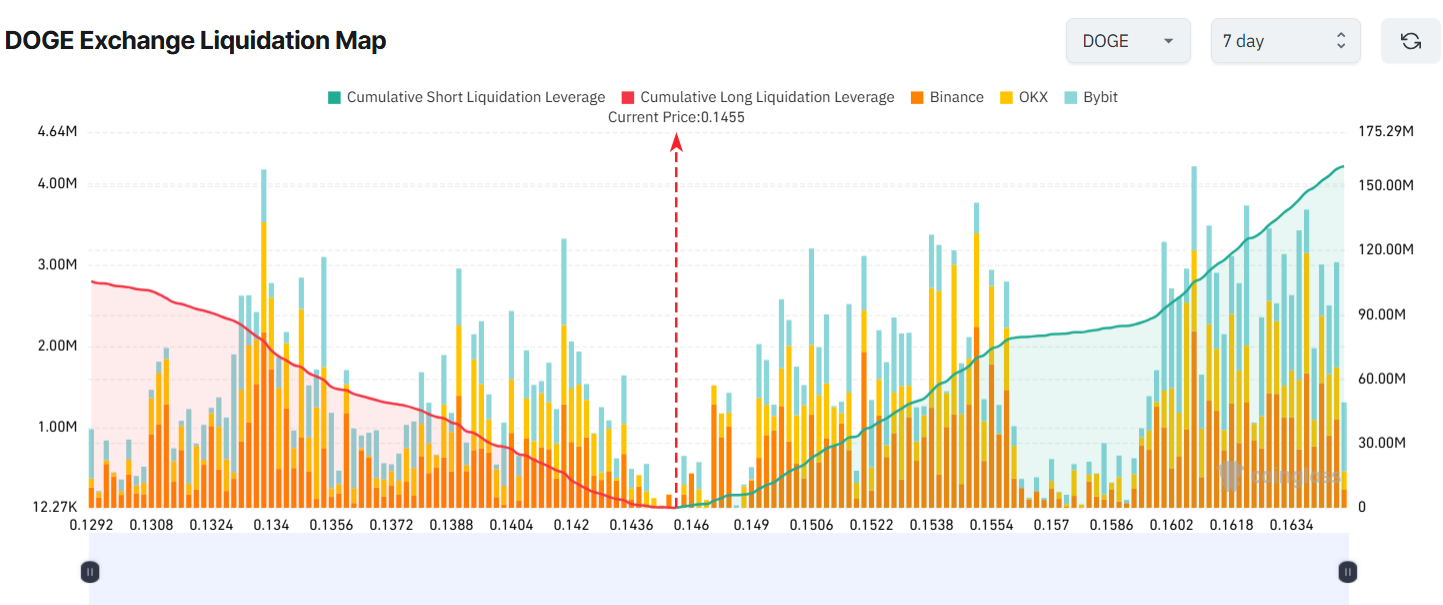

Similar to XRP, Grayscale’s DOGE ETF is also set to launch on November 24. The launch is expected to boost sentiment around the leading meme coin.

ETF expert Nate Geraci believes the Grayscale Dogecoin ETF (GDOG) marks an important milestone. He views it as clear evidence of major regulatory changes over the past year.

“Grayscale Dogecoin ETF. First ‘33 Act doge ETF. Some (many) might laugh. But this is a highly symbolic launch. IMO, the best example of a monumental crypto regulatory shift over the past year. By the way, GDOG might already be a top-10 ticker symbol for me,” Geraci said.

DOGE Exchange Liquidation Map. Source:

Coinglass

DOGE Exchange Liquidation Map. Source:

Coinglass

If these positive factors push DOGE above $0.16 this week, total short liquidations could reach $159 million.

However, another report shows that whales sold 7 billion DOGE over the past month. If this selling pressure continues, it may cap the recovery or even trigger a decline.

If DOGE falls below $0.13, long liquidations could exceed $100 million.

3. Tensor (TNSR)

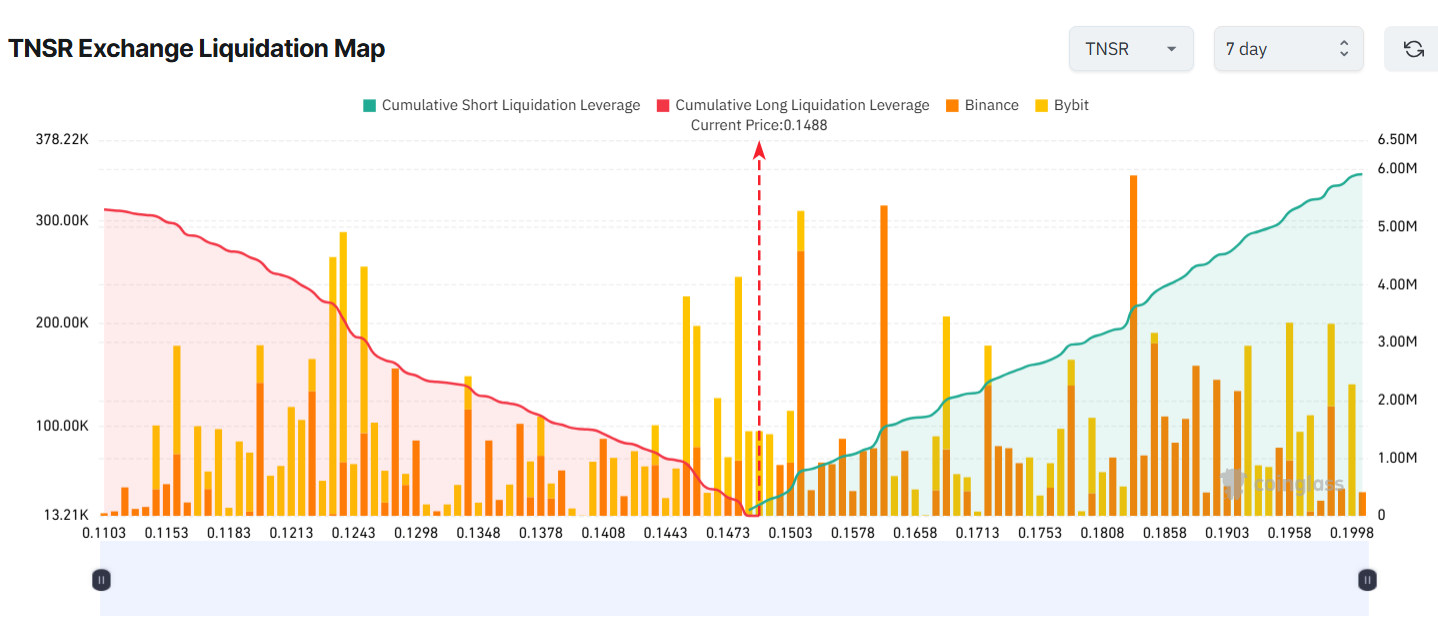

Tensor (TNSR) rallied by more than 340% last week, drawing strong attention from traders. However, the price quickly corrected by nearly 60% from its recent peak at $0.36.

Simon Dedic, founder of Moonrock Capital, argued that the rally looked suspicious. He suggested that the price action showed signs of an “insider pump.”

Tensor and Coinbase have not responded to these accusations. Yet other analysts note that the top 10 wallets hold roughly 68% of the total supply. This concentration creates significant risk and increases volatility.

TNSR Exchange Liquidation Map. Source:

Coinglass

TNSR Exchange Liquidation Map. Source:

Coinglass

These factors could influence TNSR’s price in the coming days. If the price rises to $0.19, short liquidations may reach nearly $6 million. If the price drops to $0.11, long liquidations may exceed $5 million.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bears Make Progress While Whales Continue to Gather PEPE During Market Decline

- PEPE faces potential 18% decline as technical indicators and whale activity signal bearish momentum, with price below all major moving averages. - Whale accumulation (65% long-term supply) contrasts with $21M short-seller profits, deepening market uncertainty amid fragile price dynamics. - Broader memecoin sector weakens (-19.35% weekly PEPE drop), though UK/Japan regulatory easing offers faint hope for 15-20% ETH-based token liquidity by Q1 2026. - Price projections remain polarized (bulls: $0.0000147 b

Bitcoin Updates Today: The Mystery of Bitcoin Persists: Dorsey's Approach Sparks New Theories About Satoshi

- Jack Dorsey's Bitcoin integration at Block and strategic announcements fuel speculation he may be Satoshi Nakamoto, though no proof exists. - Bitcoin's 30% price drop reduced Nakamoto's estimated paper wealth to $95B, now ranking 18th globally amid market volatility. - Ark Invest boosted crypto stock exposure including Block and Circle, signaling sector resilience despite short-term downturns. - Experts caution Dorsey-Nakamoto links remain circumstantial, emphasizing lack of cryptographic evidence or dir

Bitcoin Latest Update: Fed's Mixed Signals Drive Bitcoin Past $84,000

- Bitcoin surged above $84,000 on Nov. 21, 2025, driven by New York Fed President John Williams' hints at a potential December rate cut, pushing market odds of easing above 70%. - The rebound followed weeks of 30% declines from record highs amid hawkish policies, contrasting with Cleveland Fed President Beth Hammack's downplayed labor risks. - Analysts highlight critical support at $74,500–$83,800 for Bitcoin's recovery, with a successful defense potentially triggering a rebound toward $94,000–$100,000. -

Bitcoin News Today: JPMorgan's Bitcoin Report: Using Leverage Increases Both Profits and Risks

- JPMorgan launches a leveraged Bitcoin structured note tied to the iShares Bitcoin Trust ETF , offering amplified gains or losses over a two-year horizon. - The product guarantees $160 per $1,000 investment if BTC/ETF hits a price target by 2026, or 1.5x returns if extended to 2028, amid Bitcoin's 30% two-month decline. - The $3.5B November ETF outflows and XRP's $587M inflows highlight shifting crypto dynamics, with low-cost institutional ETFs driving adoption. - JPMorgan's offering mirrors traditional l