Trump Clan Faces Setbacks as Bold Crypto Moves Falter Amid Market Downturn and Escalating Political Tensions

- Trump family's crypto/stock investments lost $1B as DJT shares fell 70% YTD amid market downturn. - Tokenized Maldives resort project aims to revive crypto-linked real estate after memecoins and Trump Media's ETFs underperformed. - Political tensions escalate with port fire criticism, GOP fractures, and Trump's 38% approval rating—the lowest of his term. - Analysts warn pro-crypto policies may fail to offset market declines as memecoins and DJT trade near 2021 lows.

The Trump family's fortune has suffered a significant blow as both their cryptocurrency and stock assets have sharply declined, wiping out close to $1 billion in value during a widespread market slump. Their main investment,

Despite these financial setbacks, the Trump Organization has increased its focus on crypto-related projects.

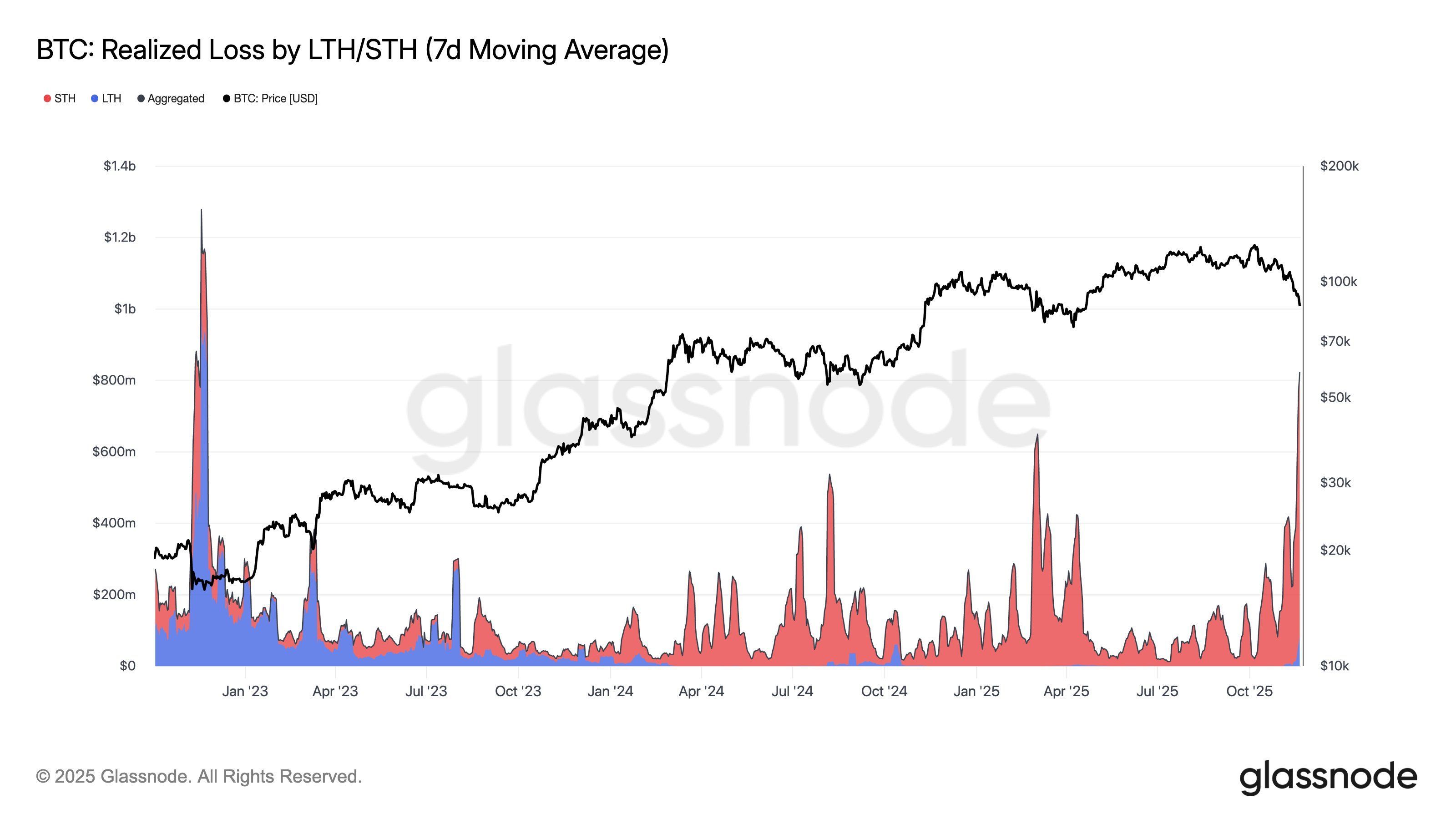

The overall crypto sector has reflected the family's difficulties. Memecoins, including Trump's official

Political issues are adding further complexity to the family's financial troubles.

The Trump family's ventures in crypto and real estate now face a highly uncertain outlook. With

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Chainlink price hits support as exchange supply dives ahead of ETF launch

Don’t fear the FDV: How real revenue creates sustainable value | Opinion

Did Bitcoin Just Bottom Out? What the Data Says About a Rebound