Bitcoin Updates: MSCI's Uncertainty in Classifying Bitcoin Puts MSTR's $59 Billion Worth at Risk

- MSCI's proposed exclusion of MSTR from major indices could trigger $2.8B in outflows, destabilizing its leveraged Bitcoin model. - JPMorgan warns the move reflects a debate over classifying Bitcoin-holding firms as investment vehicles, not operating businesses. - MSTR's stock has fallen 60% since November 2024, with its NAV multiple collapsing to 1.1 as Bitcoin prices drop 30%. - Saylor continues aggressive Bitcoin buying ($1.5B in November) via equity/dilutive debt, straining investor confidence and pus

Michael Saylor's

The move to exclude Strategy is rooted in an ongoing debate about whether companies like it, which primarily hold

Even amid market volatility, Saylor has continued to rapidly increase the company’s Bitcoin reserves. In November alone, Strategy purchased $1.5 billion worth of Bitcoin, raising its total holdings to 640,808 BTC as of November 17,

Saylor, nevertheless, remains optimistic. In a recent interview, he shared an ambitious plan to amass a $1 trillion Bitcoin balance sheet,

As the January deadline nears, Strategy’s situation highlights the fragile nature of index inclusion in today’s markets. What once amplified Saylor’s story now threatens to unravel it,

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Anti-CZ Whale Loses $61M Profit in 10 Days on Hyperliquid

Quick Take Summary is AI generated, newsroom reviewed. The "Anti-CZ Whale" lost $61 million in profit in 10 days, suffering losses on aggressive long positions in ETH and XRP. The whale's overall realized and unrealized profit dropped from $100 million to $38.4 million. One of the whale's accounts is running 12.22x leverage on a $255 million long exposure, with alarmingly thin 95.40% margin usage. The reversal highlights the high risk and volatility in perpetual futures trading, even for successful contrar

Watch Out: Numerous Economic Developments and Altcoin Events in the New Week – Here is the Day-by-Day, Hour-by-Hour List

‘I Won’t Back Down,’ Michael Saylor Reinforces Strategy’s Bitcoin Mission

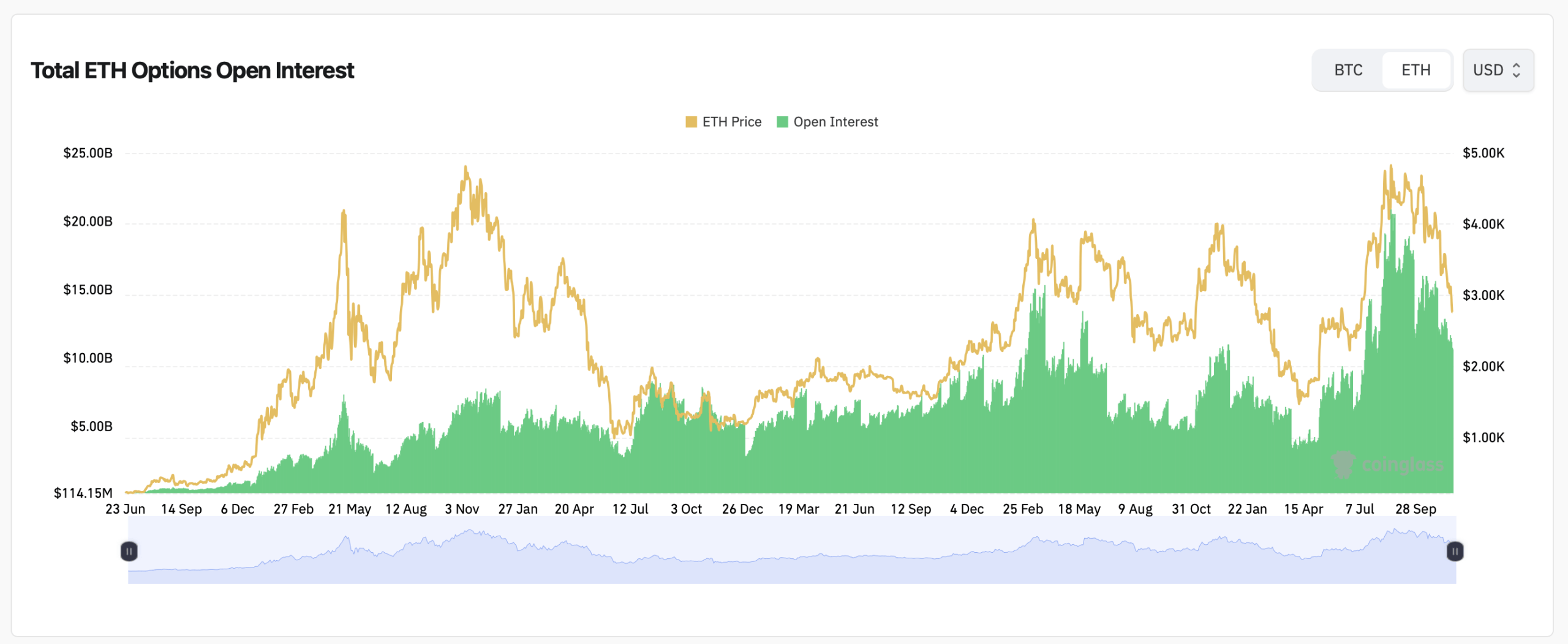

Ethereum Price Stalls as Derivatives Traders Load up for the Week Ahead