Why ZK is Gaining Momentum in Late 2025: Growth in ZK Infrastructure and Increased Developer Engagement Driving Token Value

- Zero-Knowledge (ZK) technology's 2025 surge reflects structural adoption driven by infrastructure upgrades, developer tools, and institutional partnerships. - ZKsync and StarkNet achieved 15,000 TPS and $3.3B TVL, with Goldman Sachs , Deutsche Bank , and Sony integrating ZK for compliance and scalability. - Developer activity rose 230% via tools like solx Compiler, while ZK-rollups now handle 83% of enterprise smart contracts and $500M+ token valuations. - Institutional validation through MiCA-compliant

ZK Infrastructure Adoption: Building Blocks for Scale and Reliability

ZK infrastructure has transitioned from theoretical concept to practical implementation, with initiatives such as ZKsync and StarkNet at the forefront. By the third quarter of 2025, ZKsync’s protocol enhancements—most notably OS v0.0.5—enabled processing speeds of 15,000 transactions per second (TPS) and block times as low as one second,

The Total Value Locked (TVL) in

Developer Activity: Powering Ecosystem Expansion and Innovation

The ZK ecosystem’s momentum is further propelled by a 230% increase in developer engagement during late 2025,

The surge in developer participation is not just about numbers—it’s about quality.

Strategic Alliances and Institutional Endorsement

The embrace of ZK technology by major institutions is central to its price rally. By the end of 2025, ZK-based systems had become essential for traditional financial institutions seeking blockchain solutions that comply with regulatory standards.

These collaborations go beyond mere symbolism.

On-Chain Data: Demonstrating Network Impact

The strongest validation of ZK’s progress is found in on-chain statistics.

Additionally,

Conclusion: ZK’s Enduring Bullish Outlook

The late-2025 rise of ZK is anchored by several converging trends: infrastructure enhancements that pave the way for enterprise use, developer tools that drive rapid innovation, and institutional partnerships that confirm ZK’s practical value. As ZK networks scale to support billions in assets and millions of transactions, their tokens are set to benefit from both speculative interest and real-world demand. For investors, the message is unmistakable: ZK has moved beyond the experimental stage to become a foundational element of the blockchain landscape, with its price trajectory closely tied to its expanding influence in the real economy.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Anti-CZ Whale Loses $61M Profit in 10 Days on Hyperliquid

Quick Take Summary is AI generated, newsroom reviewed. The "Anti-CZ Whale" lost $61 million in profit in 10 days, suffering losses on aggressive long positions in ETH and XRP. The whale's overall realized and unrealized profit dropped from $100 million to $38.4 million. One of the whale's accounts is running 12.22x leverage on a $255 million long exposure, with alarmingly thin 95.40% margin usage. The reversal highlights the high risk and volatility in perpetual futures trading, even for successful contrar

Watch Out: Numerous Economic Developments and Altcoin Events in the New Week – Here is the Day-by-Day, Hour-by-Hour List

‘I Won’t Back Down,’ Michael Saylor Reinforces Strategy’s Bitcoin Mission

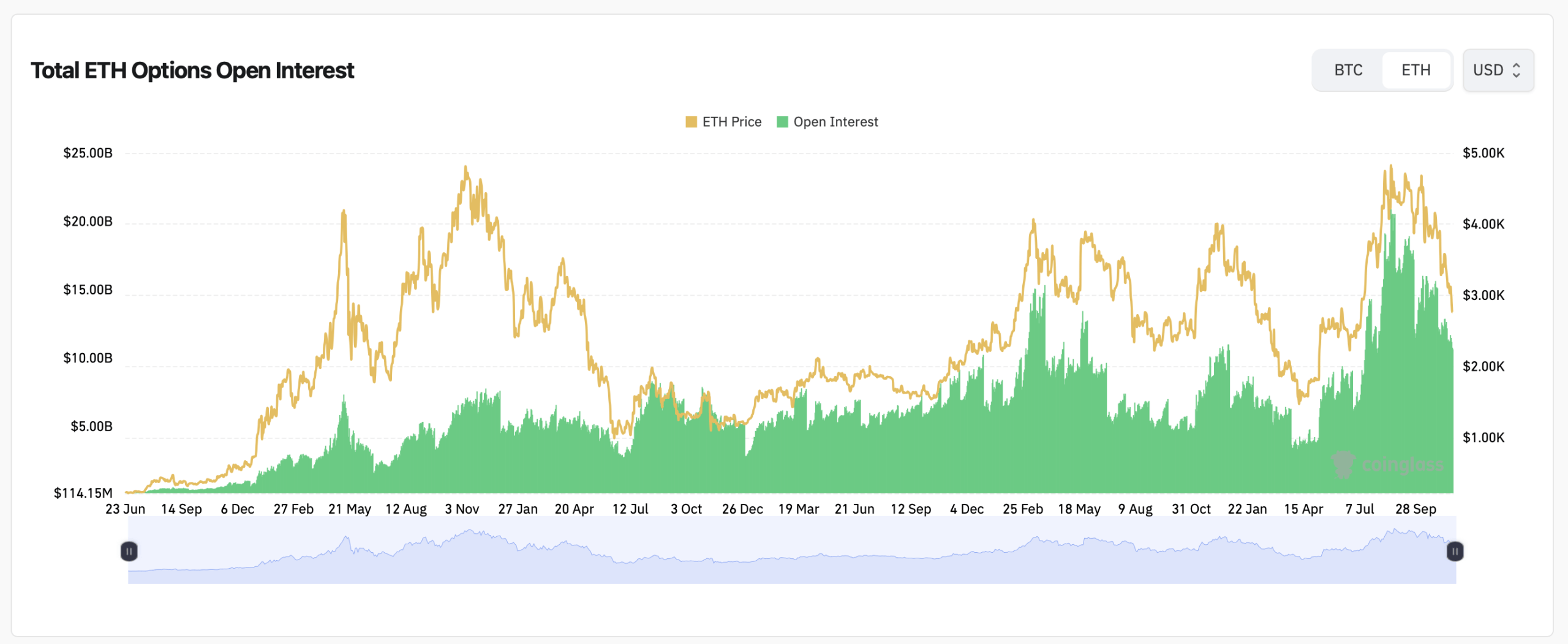

Ethereum Price Stalls as Derivatives Traders Load up for the Week Ahead