Bitcoin ETFs Hit Record $11.5 Billion Volume as Most Investors Slip Into Losses

Despite market volatility, the 12 Bitcoin ETFs posted net inflows of more than $238 million as some investors bought the dip.

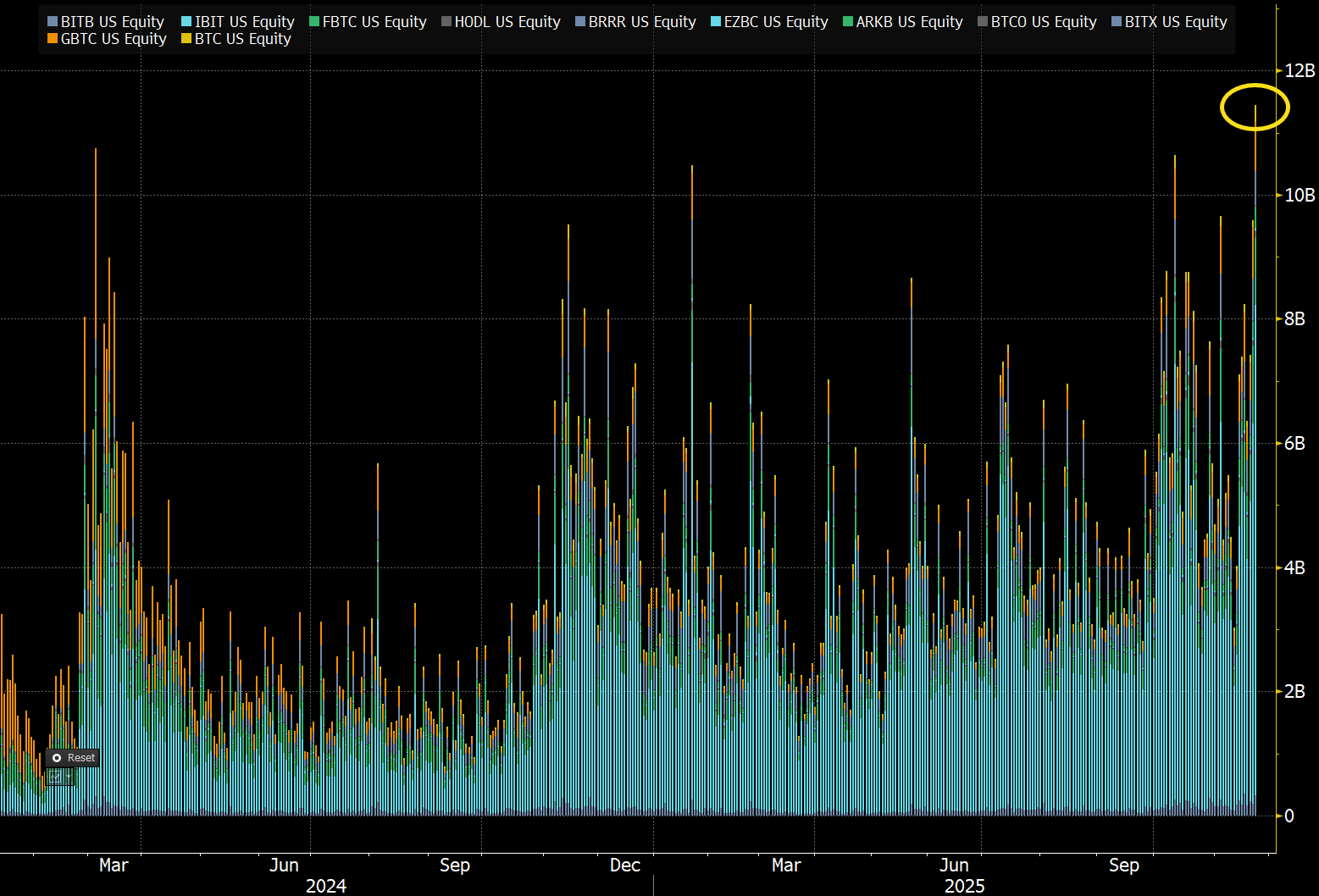

US spot Bitcoin exchange-traded funds just posted their busiest trading session ever, even as the recent slide in the cryptocurrency’s price has left the average ETF investor holding losses.

The surge in activity marks a new phase in the market’s adjustment to this month’s selloff in the sector.

BlackRock’s IBIT on Top as $238 Million Inflows Return Amid Market Stress

On November 21, Bloomberg Senior ETF Analyst Eric Balchunas reported that the 12 spot Bitcoin ETFs recorded $11.5 billion in combined trading volume.

US Bitcoin ETFs Record Trading Volume. Source:

Eric Balchunas

US Bitcoin ETFs Record Trading Volume. Source:

Eric Balchunas

Balchunas described the spike in volume as “wild but normal,” noting that ETFs and other asset classes tend to record elevated turnover during periods of market stress.

He said such bursts of activity often signal the release of liquidity as investors reshuffle positions.

The elevated turnover reflected brisk two-way participation, with some investors cutting exposure while others took advantage of lower prices to add to positions.

BlackRock’s IBIT led the surge, generating $8 billion in turnover and accounting for more than 69% of all spot Bitcoin ETF trading that day. This was IBIT’s highest-volume session since launch, though the fund still ended the day with $122 million in outflows.

“Also, no surprise record week for Put volume in IBIT.. this is one thing that may help people stay the course, they can always buy some puts as a hedge while they stay long,” Balchunas added.

Meanwhile, other Bitcoin ETFs, led by Fidelity’s FBTC, posted net inflows of more than $238 million.

Despite this inflow, the 12 Bitcoin investment vehicles are on course for their worst trading month, with net outflows of more than $3.5 billion.

US Bitcoin ETFs Monthly Flows. Source:

SoSoValue

US Bitcoin ETFs Monthly Flows. Source:

SoSoValue

This substantial outflow and record session come as the average spot Bitcoin ETF holder has slipped into the red.

Data from Bianco Research shows the weighted average purchase price for spot Bitcoin ETF inflows stood at $91,725 as of November 20.

The average Spot BTC ETF holder is now in the red.

— Jim Bianco (@biancoresearch) November 20, 2025

Bitcoin’s drop below that level this week pushed most holders, including those who entered the market in January 2024, into unrealized losses.

Bitcoin fell roughly 12% this week to as low as $80,000 before recovering to $84,431 as of press time. This price performance extends a month-long slide and reinforces the risk-off sentiment across digital assets.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

India’s Spinny set to secure $160 million in funding for GoMechanic acquisition, sources report

PENGU Price Forecast: Managing Immediate Market Fluctuations and Exploring Future AI Opportunities

- PENGU token's price fell to $0.01114 in Nov 2025, far below its 2024 peak of $0.068, amid regulatory and macroeconomic risks. - Short-term volatility is amplified by SEC ETF delays, $7.68M short positions, and susceptibility to broader crypto market downturns. - Long-term potential emerges through AI-driven features like dynamic staking and cross-chain interoperability, plus Schleich's physical collectible partnerships. - Pudgy Penguins' hybrid digital-physical model, including Walmart retail presence, d

The Rise of Dynamic Clean Energy Markets

- CleanTrade, CFTC-approved as a Swap Execution Facility (SEF), transformed clean energy markets into institutional-grade assets by standardizing VPPAs, PPAs, and RECs. - The platform addressed fragmented pricing and opaque risks, enabling $16B in transactions within two months and bridging renewable assets with institutional capital. - Institutional investors now use CleanTrade’s tools to hedge fossil fuel volatility and lock in renewable energy prices, mirroring traditional energy strategies. - Global cl

COAI Token Fraud: Insights for Cryptocurrency Investors During Times of Regulatory Ambiguity

- COAI token's 88% collapse in late 2025 exposed systemic risks in AI-driven DeFi ecosystems, with $116.8M investor losses. - Governance flaws included 87.9% token concentration in ten wallets, untested AI stablecoins, and lack of open-source audits. - Panic selling accelerated by AI-generated misinformation and CEO resignation, amid conflicting global crypto regulations. - Lessons emphasize scrutinizing token distribution, demanding transparent audits, and avoiding jurisdictions with regulatory ambiguity.