Bitcoin Updates: Institutions Increase Bitcoin ETF Investments During Market Volatility

- U.S. Bitcoin ETFs saw $238M net inflow on Nov 21, reversing weeks of redemptions, despite BlackRock’s IBIT logging a $523M outflow earlier in the month. - Fidelity’s FBTC and Grayscale’s BTC attracted $192.9M inflows, reflecting a shift to lower-cost ETFs amid volatile markets and regulatory uncertainty. - Institutional investors like Harvard boosted IBIT holdings by 257%, signaling long-term confidence in Bitcoin as a strategic reserve asset despite short-term turbulence. - Ethereum ETFs faced $262M out

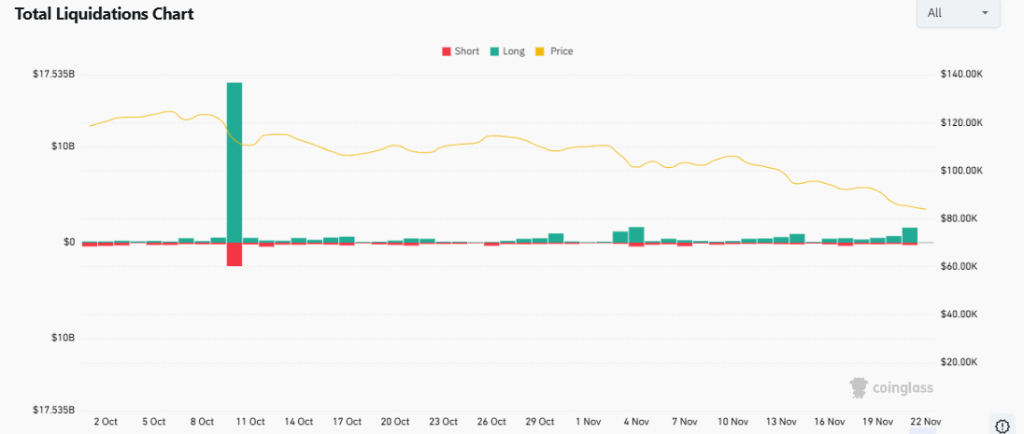

U.S. Bitcoin exchange-traded funds (ETFs) saw an unexpected net inflow of $238 million on November 21, reversing a trend of significant withdrawals in recent weeks, as reported by SoSoValue. This turnaround occurred even though BlackRock's iShares

Throughout November, Bitcoin ETFs have seen outflows totaling $2.96 billion, with

This divergence highlights the foundational influence ETFs have on Bitcoin’s price action. While ETFs have typically fueled Bitcoin rallies, this November—usually a strong month for the cryptocurrency—

Ethereum ETFs have performed even worse, with $262 million in total outflows since November 17

Market turbulence has also encouraged new product launches.

Institutional players, however, remain undeterred.

The overall ETF market presents a mixed picture. While Bitcoin ETFs

As the market processes these shifts,

The next few weeks will challenge the durability of Bitcoin ETFs. With November

---

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Why Crypto Is Crashing Today: Analysts Warn BTC Could Break Below $80K After Global Market Panic

Altcoins Hold Strong as Bitcoin Falls 24% in November

Avoid These Domains! Aerodrome Finance Warns Users After Front-End Breach

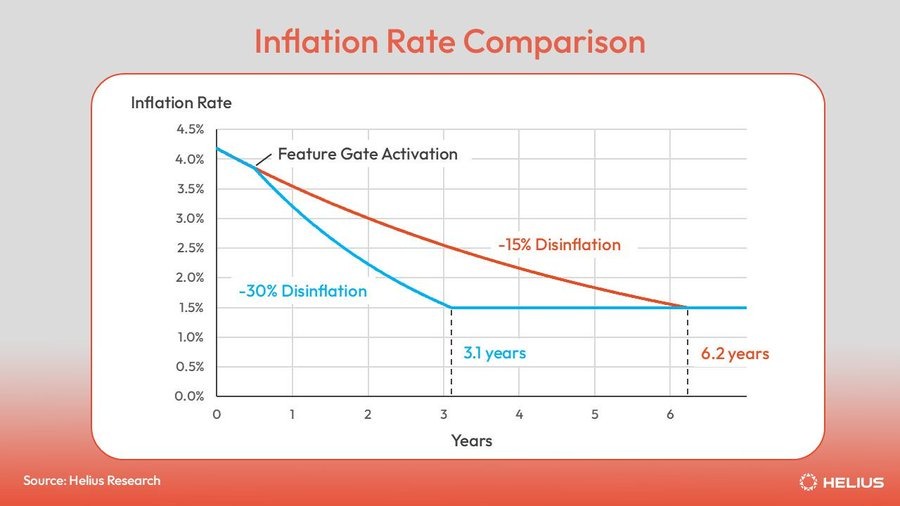

Solana Is About to Get Scarce, Biggest Update Yet!