New Toku–PDAX partnership lets Filipino workers receive pay in stablecoins

PDAX, a regulated cryptocurrency exchange in the Philippines, has partnered with Web3 payroll provider Toku to enable remote workers in the country to receive wages in stablecoins.

According to Tuesday’s press release, the new integration connects Toku’s token-based payroll system with PDAX’s regulated cash-out rails, enabling companies to send stablecoin wages through their usual payroll flows and allowing workers to convert earnings to pesos without incurring wire fees or delays.

Toku routes payments directly to PDAX wallets or external addresses for real-time, onchain settlement. Workers can then cash out to nearly any Philippine bank or e-wallet, including GCash and GrabPay, while employers have the option to fund payroll in either PHP or stablecoins such as (USDC), (USDG) or (RLUSD).

Toku is a global payroll platform that lets businesses pay employees and contractors in tokens or stablecoins using their existing payroll systems. According to the company’s website, it is used in over 100 countries.

PDAX is a Philippine crypto exchange that provides trading, cash-out services and tokenized asset products for local users and businesses.

Related: Grab deepens stablecoin push with StraitsX Web3 wallet and settlements

The Philippines is bullish on crypto

The Philippines has become one of Asia’s more active crypto adopters, with government agencies and major banks launching blockchain pilots and stablecoin initiatives over the past two years.

In 2024, Tether partnered with Web3 platform Uquid to let people in the Philippines pay their Social Security System contributions using USDt on The Open Network. The SSS is the country’s state-run social security program, covering workers across both formal and informal sectors.

In January 2025, several Philippine banks began collaborating on the PHPX stablecoin, a Hedera-based project designed to facilitate real-time remittances using distributed ledger technology.

In July 2025, the Philippine government said it would begin notarizing official documents on the Polygon blockchain. Paul Soliman, CEO of Bayanichain, the company behind the effort, said the system will be used to track government budget records.

In August, the country’s Congress considered a bill that would direct the central bank to build a 10,000 Bitcoin strategic reserve. The “Strategic Bitcoin Reserve Act” would require the Bangko Sentral ng Pilipinas (BSP) to purchase 10,000 Bitcoin and hold it in a trust for a minimum of 20 years.

Magazine: 2026 is the year of pragmatic privacy in crypto: Canton, Zcash and more

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: VanEck Issues Bitcoin an Ultimatum—Adopt Quantum-Resistant Privacy or Face Withdrawal

- VanEck CEO warns firm may exit Bitcoin if quantum computing threatens its encryption and privacy model. - Privacy coins like Zcash gain traction as alternatives, using zero-knowledge proofs to address Bitcoin's transparency risks. - Quantum-resistant crypto market grows rapidly, with IBM-Cisco quantum internet project and PQC sector projected to reach $2.84B by 2030. - Regulatory shifts and institutional investments in altcoins signal evolving crypto landscape amid security and privacy challenges.

Bitcoin Updates: Stimulus Fails to Curb Crypto Fluctuations; Uncertainty Over Hedging Function

- Japan's $135B stimulus package failed to curb Bitcoin's decline below $85,500 amid heightened market volatility. - Analysts debate crypto's role as an inflation hedge, with Fundstrat's Tom Lee framing it as a leading indicator for U.S. stocks. - Brazilian firm Rental Coins' $370M BTC collapse highlights sector fragility, filing Chapter 15 bankruptcy to recover assets. - Security threats persist in DeFi, with Aerodrome Finance's front-end attack and Coinbase's routine wallet migrations underscoring risks.

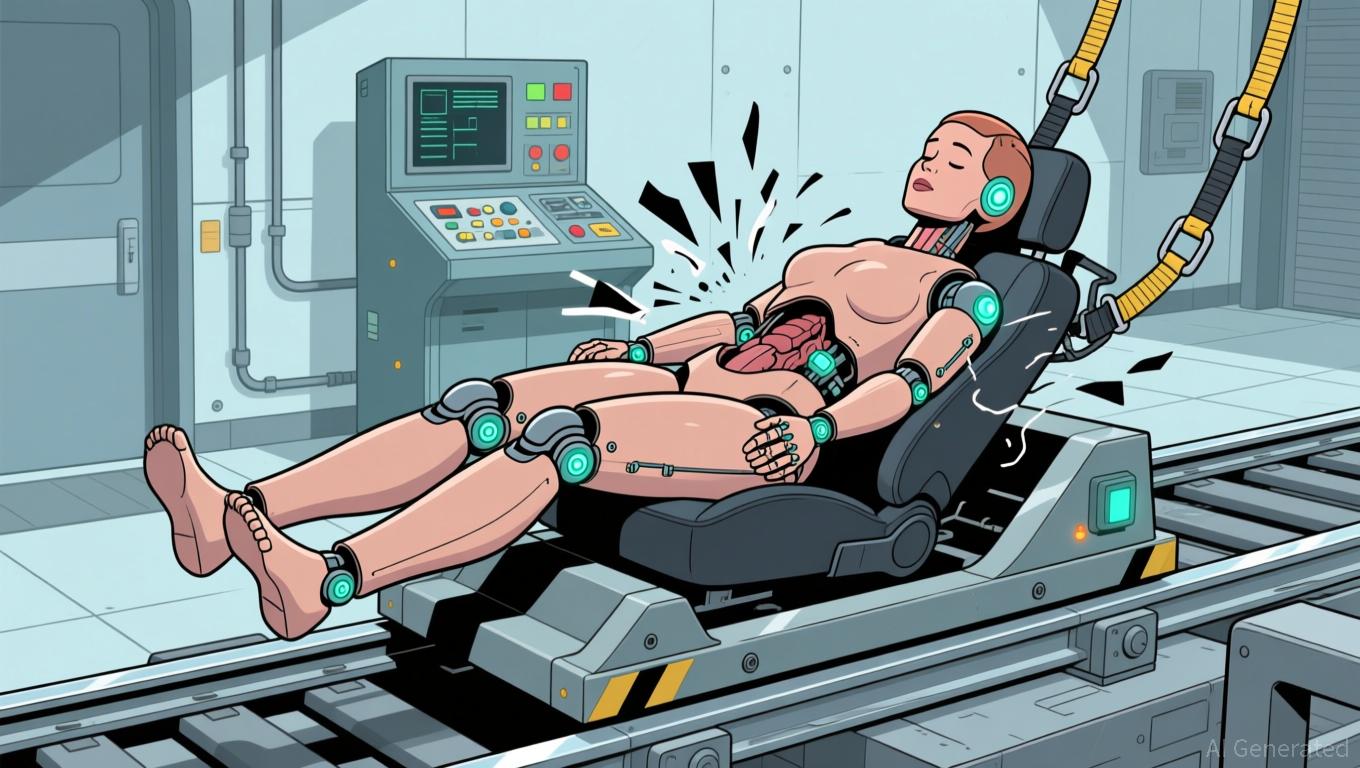

Polkadot News Today: "U.S. Requires Female Crash-Test Dummies to Tackle Longstanding Gender Inequality in Safety Engineering"

- U.S. DOT mandates female crash-test dummies in federal safety testing by 2027-2028 to address gender bias in vehicle design. - THOR-05F, representing average adult women, replaces outdated 1970s models that left women 73% more likely to suffer serious injuries in crashes. - NHTSA emphasizes scientific validation for the 150-sensor dummy, while automakers and IIHS express skepticism about current safety standards. - Advocacy groups praise the move as critical for closing safety gaps, but activists warn de

Assessing the Factors Behind COAI's Significant Price Drop in Late November 2025 and Its Long-Term Impact on Investment

- COAI's 88% year-to-date plunge in late 2025 exposed systemic risks in AI/crypto markets, driven by governance failures, regulatory ambiguity, and overvaluation. - C3.ai's $116.8M loss, leadership turmoil, and lawsuits triggered panic, while the CLARITY Act's vague oversight deepened institutional investor caution. - The selloff highlighted a stark divide between foundational AI tech and speculative crypto assets, with analysts warning against conflating sector-wide risks with isolated failures. - Long-te