Bitcoin News Update: MicroStrategy's Optimism on Bitcoin Faces Skepticism as Shares Fall by 35%

- MicroStrategy's Saylor dismissed Bitcoin sell rumors, reaffirming aggressive accumulation amid crypto volatility. - Company's latest $835M purchase added 8,178 BTC, boosting total holdings to 649,870 coins valued at $61.3B. - Saylor defended financial strategy, claiming 80% BTC price drop would still leave balance sheet "overcollateralized." - Stock fell 35% YTD despite bullish stance, as critics question equity dilution and dividend sustainability. - Long-term vision includes $1T Bitcoin balance sheet f

Michael Saylor, who serves as executive chairman at MicroStrategy (MSTR), has refuted speculation that the company is offloading its

MicroStrategy’s most recent acquisition—8,178 BTC for $835.6 million—stands as its largest since July, according to a filing dated Nov. 17. This purchase increases the company’s total Bitcoin holdings to 649,870 BTC, now worth about $61.3 billion at present market rates

The company’s market value has now dipped below the worth of its Bitcoin reserves, causing its market-to-net-asset value (mNAV) to fall under 1—a figure often cited as a sign of undervaluation. As of Nov. 14, MicroStrategy’s market capitalization was $59.92 billion, compared to the $61.3 billion value of its BTC holdings

MicroStrategy funds its strategy through convertible bonds and preferred shares, with recent Euro-denominated preferred stock sales bringing in $715 million. Since 2020, the company has raised $8.2 billion via convertible debt, using the capital to grow its Bitcoin reserves. Saylor contended that even if Bitcoin’s price were to drop by 80%, the company’s assets would still be "overcollateralized" compared to its debt

Saylor’s ambitions go beyond treasury management. In a wider discussion with Bitcoin Magazine, he described plans to build a $1 trillion Bitcoin balance sheet, aiming to use long-term appreciation to launch Bitcoin-backed lending products with yields higher than those in traditional finance. This would involve developing over-collateralized offerings, such as savings and insurance products, all denominated in Bitcoin

Despite Saylor’s optimistic outlook, MicroStrategy’s shares have dropped nearly 35% since the start of the year, trading at about $195 as of Nov. 17. Critics claim that the company’s dependence on issuing new shares to finance purchases has eroded shareholder value, while regulatory uncertainty and market downturns have dampened investor sentiment

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Today: Bitcoin’s Plunge Below $96K Sparks Concerns Over a Bear Market Resurgence Similar to 2024

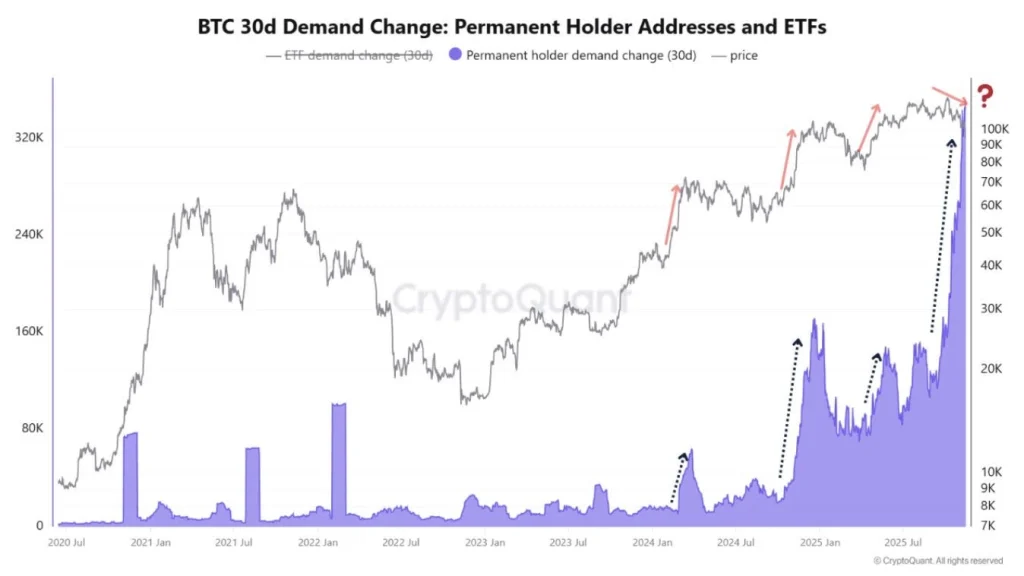

- Bitcoin fell below $96,000, erasing 2025 gains and triggering $44M in liquidations as ETF outflows hit $870M. - Market cap dropped 5.4% to $3.36T, with Ethereum and XRP hitting multi-month lows amid weak demand. - Chain metrics show 815,000 BTC sold by long-term holders, while Bull Score Index collapsed to 20 from 80. - Technical indicators warn of further declines below $93,500, testing 2024 bear market lows if support breaks. - MicroStrategy added $835M BTC despite criticism, but fear/greed index hit 1

Bitcoin News Today: Bitcoin ETFs See $870M Outflow as Long-Term Holder Selling Drives Price Near $80k

- Bitcoin’s price nears $80,000 as fear indices hit 16, signaling panic-driven capitulation. - $870M ETF outflows and 815,000 BTC sold by LTHs accelerate downward pressure since October. - Key technical levels breached: 365-day SMA broken, 50-week SMA at risk, bear market risks rising. - Ethereum faces 200-day EMA resistance; whales accumulate ETH despite $3.66B in ETF outflows. - STHs near 12.79% losses, 6-12M holder cost basis at $94,000 may offer temporary support.

Bitcoin News Update: Bitcoin ETF Sees $1.5 Billion Withdrawals While Institutional Investors Increase Their Holdings

- BlackRock's IBIT ETF saw $1.5B net outflows over 10 days as investors reassess Bitcoin exposure amid volatility. - Harvard University boosted IBIT holdings to $442.8M, surpassing its combined stake in major tech firms, while diversifying into gold . - Institutional ownership in IBIT rose to 29% QoQ, with UAE entities and sovereign wealth funds among key holders, signaling crypto's growing institutional acceptance. - KuCoin expanded institutional services as ETF outflows highlight market recalibration, wi

Bitcoin Price Retests Major Bull Market Support at $92k: $130k or $80k Next? Analysts Insights