R25's rcUSD+ Seeks to Connect DeFi and TradFi, Addressing the $55 Trillion Yield Disparity

- R25 launches rcUSD+, a yield-bearing stablecoin on Polygon, bridging DeFi and traditional finance with 1:1 USD peg and low-risk asset returns. - The token differentiates itself by generating income from institutional-grade assets like money market funds, offering DeFi users transparent yield opportunities. - Market growth sees $36B in tokenized RWAs and $300B in stablecoins, but rcUSD+ faces scrutiny over missing audit details and verification gaps. - Competing with USDY and Centrifuge, R25's Ant Financi

R25, a protocol focused on real-world assets (RWA) and stablecoins, has introduced its institutional-grade, yield-generating stablecoin rcUSD+ on Polygon. This move marks a significant collaboration aimed at connecting traditional finance with decentralized finance (DeFi).

Unlike most stablecoins that do not offer yield, rcUSD+ stands out by providing on-chain returns backed by traditional financial assets. The protocol’s design

Sandeep Nailwal, Polygon’s co-founder, highlighted the partnership’s potential to bring “institutional-grade real-world assets” onto the blockchain,

The debut of rcUSD+ comes as the RWA and stablecoin sectors experience rapid expansion.

Nevertheless, the launch has drawn questions regarding transparency.

R25’s foray into the RWA sector puts it in competition with projects like

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

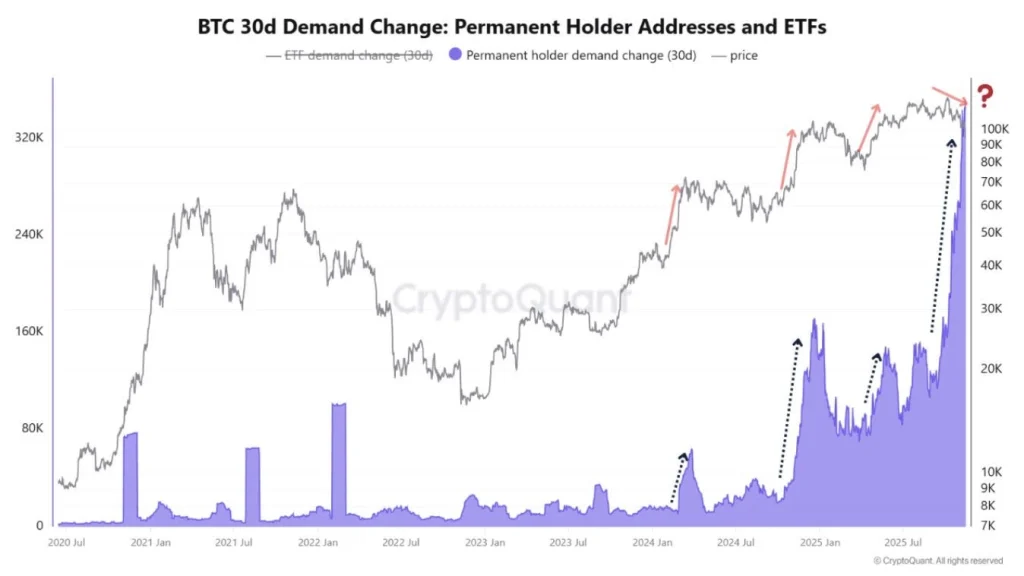

Bitcoin News Today: Bitcoin’s Plunge Below $96K Sparks Concerns Over a Bear Market Resurgence Similar to 2024

- Bitcoin fell below $96,000, erasing 2025 gains and triggering $44M in liquidations as ETF outflows hit $870M. - Market cap dropped 5.4% to $3.36T, with Ethereum and XRP hitting multi-month lows amid weak demand. - Chain metrics show 815,000 BTC sold by long-term holders, while Bull Score Index collapsed to 20 from 80. - Technical indicators warn of further declines below $93,500, testing 2024 bear market lows if support breaks. - MicroStrategy added $835M BTC despite criticism, but fear/greed index hit 1

Bitcoin News Today: Bitcoin ETFs See $870M Outflow as Long-Term Holder Selling Drives Price Near $80k

- Bitcoin’s price nears $80,000 as fear indices hit 16, signaling panic-driven capitulation. - $870M ETF outflows and 815,000 BTC sold by LTHs accelerate downward pressure since October. - Key technical levels breached: 365-day SMA broken, 50-week SMA at risk, bear market risks rising. - Ethereum faces 200-day EMA resistance; whales accumulate ETH despite $3.66B in ETF outflows. - STHs near 12.79% losses, 6-12M holder cost basis at $94,000 may offer temporary support.

Bitcoin News Update: Bitcoin ETF Sees $1.5 Billion Withdrawals While Institutional Investors Increase Their Holdings

- BlackRock's IBIT ETF saw $1.5B net outflows over 10 days as investors reassess Bitcoin exposure amid volatility. - Harvard University boosted IBIT holdings to $442.8M, surpassing its combined stake in major tech firms, while diversifying into gold . - Institutional ownership in IBIT rose to 29% QoQ, with UAE entities and sovereign wealth funds among key holders, signaling crypto's growing institutional acceptance. - KuCoin expanded institutional services as ETF outflows highlight market recalibration, wi

Bitcoin Price Retests Major Bull Market Support at $92k: $130k or $80k Next? Analysts Insights