Did McDonald’s Really See a Job Applicant Surge After the Crypto Crash?

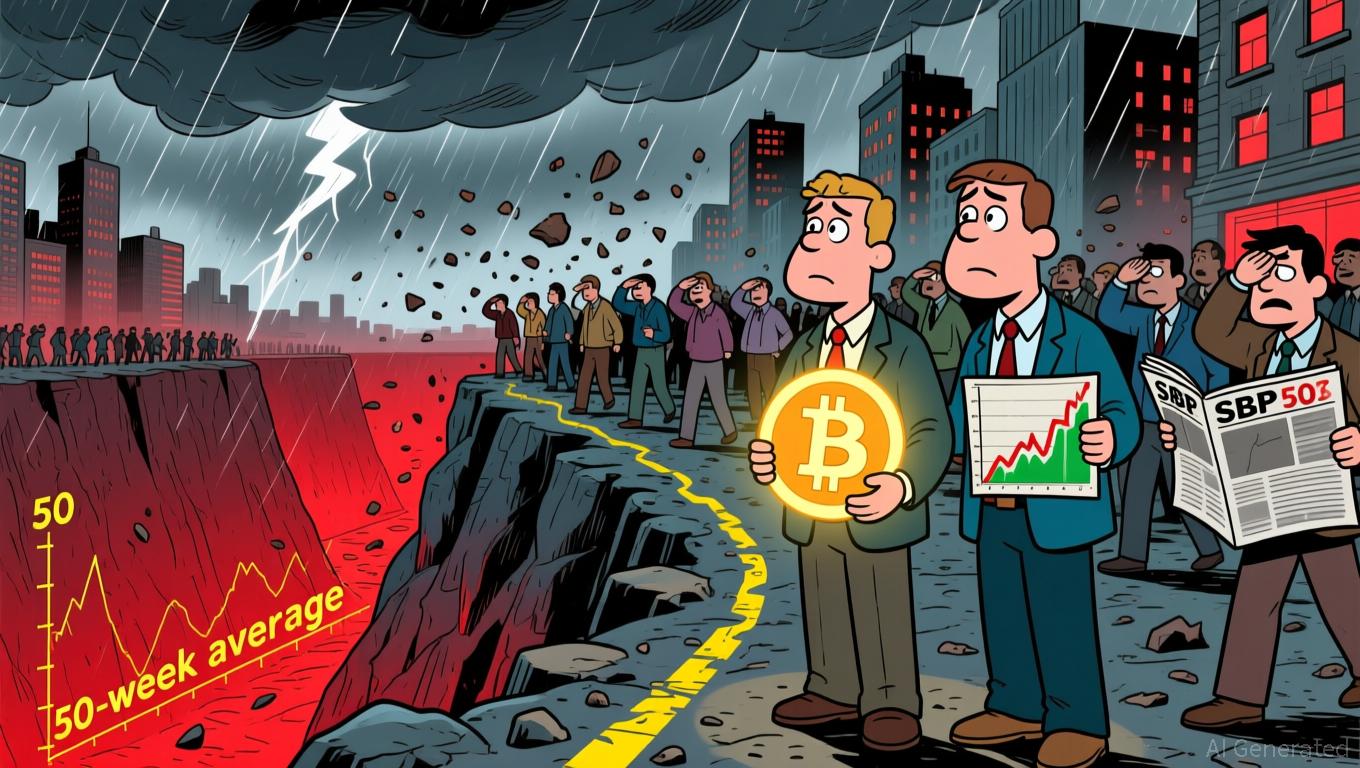

As crypto entered extreme fear this week, a new claim began circulating online:

“McDonald’s sees a record surge in job applicants amid the crypto crash.”

It’s catchy, it’s meme-friendly, and it taps into the long-running joke that traders turn to fast-food jobs whenever Bitcoin drops.

But is it true?

The Claim: McDonald’s Hiring Surges Because Bitcoin Fell

The narrative popped up on social media shortly after $Bitcoin slipped below $100K and sentiment hit extreme fear levels .

The implication:

Crypto traders lost money and rushed to apply for jobs at McDonald’s .

It’s a meme the community has used for years, often resurfacing whenever prices drop sharply. But memes are not facts — and this specific claim is unsupported.

The Reality: Zero Data, Zero Reports, Zero Evidence

Here’s what we can confirm:

- McDonald’s has not released any official hiring report tied to crypto markets.

- There are no announcements from the company about increased applications.

- There is no labor data showing unusual spikes in fast-food job interest this week.

- No credible media outlet, HR firm, or labor research group has published anything linking crypto’s decline to McDonald’s hiring trends.

Simply put:

The claim is internet satire, not breaking news.

Bitcoin Did Drop — But That Doesn’t Prove the Claim

Bitcoin indeed dipped below $100K, briefly touching levels that pushed fear and liquidity risk higher.

But financial volatility does not automatically translate into employment trends — especially not in a specific company like McDonald’s.

Labor shifts take time, are tracked through national data, and are reported quarterly — not instantly after a market dip.

Why the Meme Keeps Coming Back

The “McDonald’s job” joke is a long-standing part of crypto culture. Every major crash — from 2018 to 2020 to 2022 and now — triggers the same meme cycle:

- Bitcoin dips

- Traders panic

- Memes about working at McDonald’s flood the timeline

While entertaining, they’re exaggerated and not grounded in real-world labor analytics.

Conclusion – It’s Satire, Not a Statistic

There is no factual basis for claims that McDonald’s is experiencing a record surge in job applications linked to the crypto crash.

It’s simply a viral meme that has been mistaken for real news.

Crypto markets may be shaky this week, but employment reports — especially from major corporations — are based on verified data, not social media jokes.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates Today: Is Bitcoin’s Drop Indicating a Bear Market or Revealing Foundational Strength?

- Bitcoin's drop below $95,000 triggered a 2.8% S&P 500 decline, raising fears of synchronized market downturns. - American Bitcoin (ABTC) reported $3.47M profit but shares fell 13% as BTC price erosion offset mining gains. - 43-day U.S. government shutdown created information vacuum, while $869M Bitcoin ETF outflows highlighted investor panic. - Fed rate cut odds dropped to 45% amid inflation concerns, with analysts warning of cascading price drops below $90,000. - Institutional ETF adoption and $835M Mic

Hyperliquid News Today: Goldman: AI's $19 Trillion Buzz Surpasses Actual Progress, Bubble Concerns Rise

- Goldman Sachs warns U.S. stock markets have overvalued AI's economic potential, pricing $19T gains ahead of actual productivity impacts. - The bank identifies "aggregation" and "extrapolation" fallacies as key risks, mirroring historical tech bubbles from 1920s/1990s over-optimism. - AI expansion extends beyond tech sectors, with blockchain compliance tools and energy management markets projected to grow via AI integration. - Regulatory challenges persist as DeFi collapses expose gaps in AI token definit

SGX Connects Conventional Finance and Digital Assets through Launch of Professional-Grade Futures

- SGX launches institutional-grade Bitcoin/Ethereum perpetual futures on Nov 24, 2025, benchmarked to CoinDesk indices. - Contracts offer no-expiry leveraged positions, targeting accredited/expert investors amid $187B+ global crypto derivatives volumes. - Aims to redirect Asian crypto flows to regulated on-exchange trading, aligning with Singapore's fintech innovation and investor protection balance. - SGX President Michael Syn emphasizes institutional adoption, restricting retail access to mitigate risks

XRP News Today: Federal Uncertainty and Worldwide Regulations Trigger $1 Trillion Crypto Market Crash

- Bitcoin fell below $92,000, erasing $1 trillion in crypto value as major altcoins faced double-digit weekly losses. - Fed rate cut uncertainty and Japan's regulatory scrutiny intensified selling, with analysts warning of further declines to $80,000–$86,000. - XRP's 14% drop and whale-driven selling pressured prices, though new ETFs sparked speculation about potential rebounds to $2.75.