Will XRP Price Crash to 0.65?

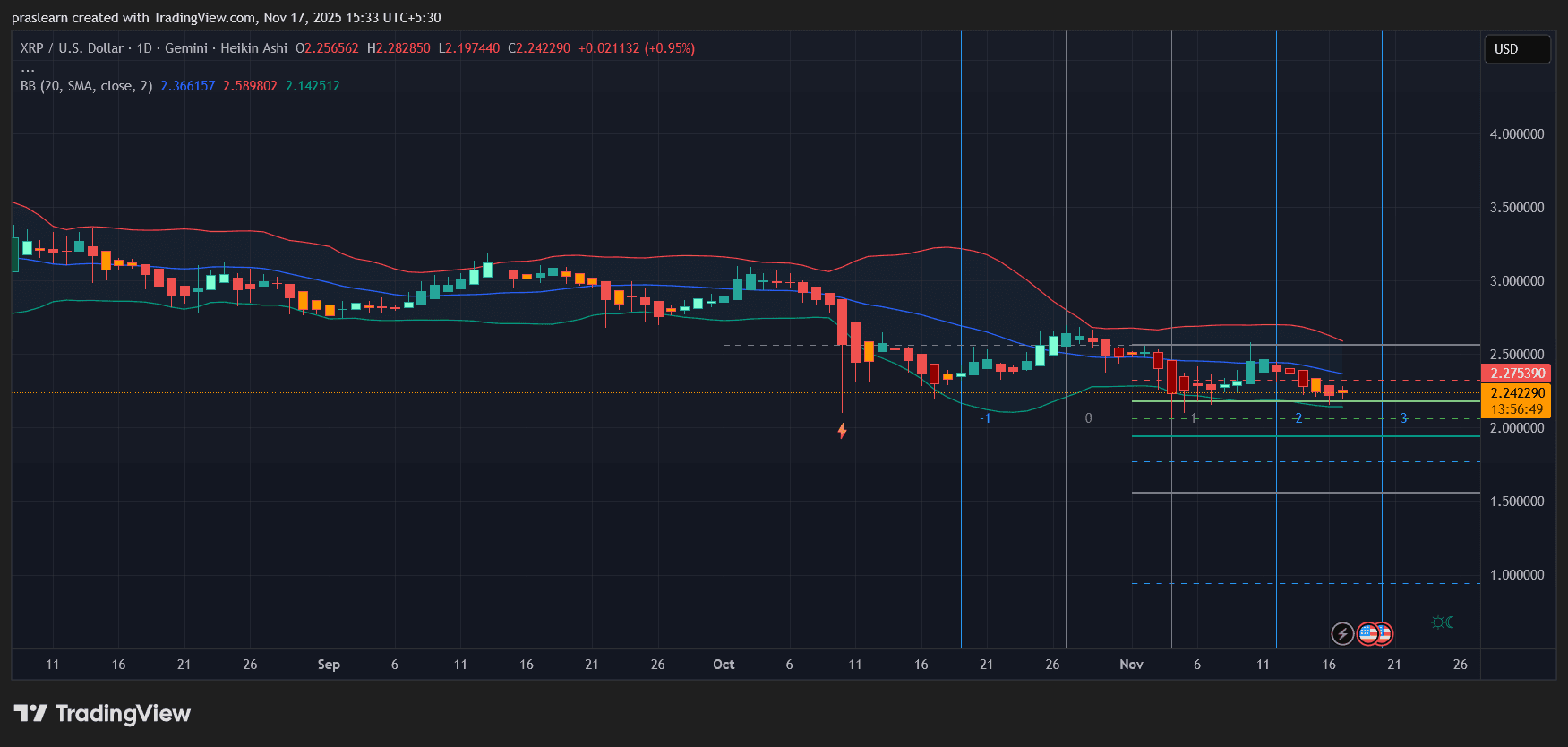

XRP price is slipping again, and the mood across the market isn’t helping. With Nvidia, Walmart, Target, and Home Depot all reporting earnings this week—plus the return of US economic data after the historic 43-day government shutdown—risk sentiment is shaky. Traders are watching every candle with suspicion. In the middle of all this, XRP price has moved into a fragile zone, raising a tough question: is a drop to 0.65 even on the table?

XRP Price Prediction: Why the Market Mood Matters Right Now

Before jumping into the technicals, it’s worth understanding the backdrop. The shutdown halted key economic reports for more than a month, leaving investors moving blind. As the data pipeline reopens, volatility tends to spike.

Add to that:

- Nvidia’s earnings, which heavily influence risk appetite

- Major retailers reporting results that reflect real consumer strength

- FOMC minutes that may hint at the next interest-rate shift

- Ongoing weakness in housing and sentiment data

This kind of week can easily pressure altcoins. XRP feels that pressure more than most when momentum is already leaning down.

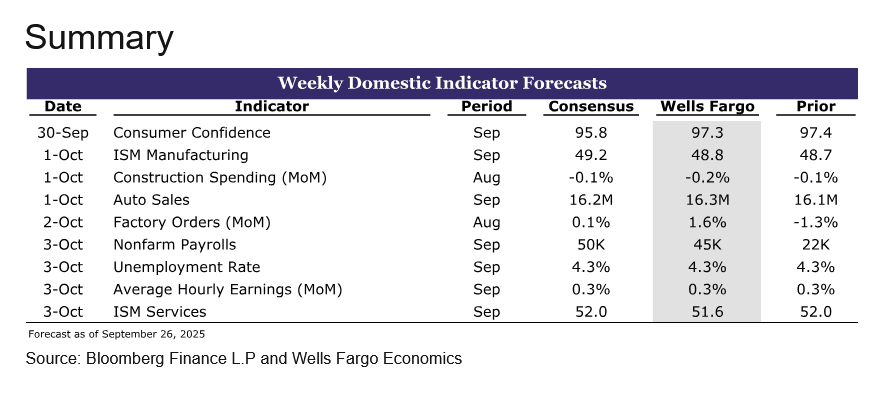

What the XRP Price Daily Chart Is Actually Showing

The daily candles tell a clear story: XRP is in a controlled downtrend, but not a freefall.

XRP/USD Daily Chart- TradingView

XRP/USD Daily Chart- TradingView

1. Price Is Stuck Under the Mid-Bollinger Band

The mid-band has acted like a ceiling for nearly the entire month. Every attempt to reclaim it has failed, which shows sellers remain in control.

2. The Lower Bollinger Band Has Started to Slope Down

A downward-angled lower band often precedes another leg lower. It signals room for volatility to expand on the downside.

3. Repeated Taps of the 2.20–2.00 Support Zone

This region is being tested over and over without a convincing rebound. When support becomes a lounge chair instead of a trampoline, breakdowns happen.

4. Heikin Ashi Candles Are Softening

The candles are losing body size, with more flat-bottomed reds showing up. That’s a classic continuation signal in Heikin Ashi analysis. The chart is weak. But weak does not automatically mean catastrophic.

Is 0.65 a Realistic Scenario?

0.65 is nowhere near the current structure. To reach that level, XRP price would need to slice through several major supports that haven’t even been threatened on this timeframe.

For a move toward 0.65, you would need:

- A macro shock hitting all risk assets

- Bitcoin breaking its macro higher-low structure

- Altcoins entering a broad capitulation

- XRP-specific negative catalysts (legal, liquidity, exchange delistings, etc.)

- None of those conditions are present right now.

So while traders often float extreme targets in fear-heavy markets, the chart doesn’t justify a scenario that dramatic.

The More Likely Downside Path

Based on the current structure, the realistic progression looks closer to this:

- 2.20 – First support, already weakening

- 2.00 – Stronger shelf, but vulnerable if momentum stays negative

- 1.75–1.50 – Next demand zone if volatility widens

- 1.00–0.85 – Panic zone, possible only during market-wide distress

A crash straight into 0.65 would require an event far bigger than anything visible on the chart.

What Would Invalidate the Bearish Bias?

XRP needs to prove strength, not hint at it.

A real reversal begins only if:

• It closes a daily candle above the mid-Bollinger band: This would show buyers are finally taking back control.

• It forms two consecutive strong Heikin Ashi green candles: This isn’t happening yet.

• It reclaims the blue moving-average zone: That band has rejected price multiple times. A reclaim would shift the short-term trend.

Until these conditions appear, the bias stays bearish with controlled downside.

XRP Price Prediction: Will XRP Price Crash to 0.65?

The chart points to more downside, but not a collapse to 0.65. $XRP is weak, momentum is fading, and support is slowly eroding. But the structure does not support a multi-level crash that deep unless the entire crypto market enters a panic phase.

For now, the most realistic scenario is a drift toward the lower supports between 2.00 and 1.75, not a meltdown into the 0.60s.

If market conditions worsen after this week’s earnings and economic data flood back, those lower levels become more likely—but 0.65 remains a distant extreme, not an imminent threat.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates Today: Is Bitcoin’s Drop Indicating a Bear Market or Revealing Foundational Strength?

- Bitcoin's drop below $95,000 triggered a 2.8% S&P 500 decline, raising fears of synchronized market downturns. - American Bitcoin (ABTC) reported $3.47M profit but shares fell 13% as BTC price erosion offset mining gains. - 43-day U.S. government shutdown created information vacuum, while $869M Bitcoin ETF outflows highlighted investor panic. - Fed rate cut odds dropped to 45% amid inflation concerns, with analysts warning of cascading price drops below $90,000. - Institutional ETF adoption and $835M Mic

Hyperliquid News Today: Goldman: AI's $19 Trillion Buzz Surpasses Actual Progress, Bubble Concerns Rise

- Goldman Sachs warns U.S. stock markets have overvalued AI's economic potential, pricing $19T gains ahead of actual productivity impacts. - The bank identifies "aggregation" and "extrapolation" fallacies as key risks, mirroring historical tech bubbles from 1920s/1990s over-optimism. - AI expansion extends beyond tech sectors, with blockchain compliance tools and energy management markets projected to grow via AI integration. - Regulatory challenges persist as DeFi collapses expose gaps in AI token definit

SGX Connects Conventional Finance and Digital Assets through Launch of Professional-Grade Futures

- SGX launches institutional-grade Bitcoin/Ethereum perpetual futures on Nov 24, 2025, benchmarked to CoinDesk indices. - Contracts offer no-expiry leveraged positions, targeting accredited/expert investors amid $187B+ global crypto derivatives volumes. - Aims to redirect Asian crypto flows to regulated on-exchange trading, aligning with Singapore's fintech innovation and investor protection balance. - SGX President Michael Syn emphasizes institutional adoption, restricting retail access to mitigate risks

XRP News Today: Federal Uncertainty and Worldwide Regulations Trigger $1 Trillion Crypto Market Crash

- Bitcoin fell below $92,000, erasing $1 trillion in crypto value as major altcoins faced double-digit weekly losses. - Fed rate cut uncertainty and Japan's regulatory scrutiny intensified selling, with analysts warning of further declines to $80,000–$86,000. - XRP's 14% drop and whale-driven selling pressured prices, though new ETFs sparked speculation about potential rebounds to $2.75.