VISA May Integrate with Ripple’s ILP as XRP Holds $1.85–$2 Support

VISA Transactions Could Soon Flow Through Ripple’s Interledger Protocol

A recent report, highlighted by renowned crypto observer SMQKE, reveals a potential breakthrough in payments infrastructure that VISA transactions may soon be integrated with Ripple’s Interledger Protocol (ILP).

Therefore, this development could mark a significant milestone in bridging traditional financial systems with blockchain-based payment networks.

Ripple’s ILP, a protocol designed for seamless, cross-ledger payments, enables instant transfers across different payment networks without relying on intermediaries.

By connecting traditional financial rails like VISA to ILP, financial institutions could achieve faster, more efficient, and cost-effective transaction processing. The integration promises to reduce the friction and delays that often plague cross-border payments, which currently rely on legacy systems such as SWIFT.

The report indicates that VISA could leverage Ripple’s Interledger Protocol to enable near-instant, transparent payments across banks, digital wallets, and financial networks, offering faster fund access, lower fees, and a seamless payment experience for businesses and consumers.

Notably, Ripple’s Interledger Protocol is built for seamless interoperability, enabling real-time connections across diverse ledgers. This positions VISA to modernize its payment infrastructure while maintaining regulatory compliance and operational reliability, bridging traditional finance and digital assets.

Beyond speed and efficiency, integrating Ripple’s ILP with VISA could bridge traditional finance and blockchain, creating a seamless hybrid ecosystem. This move could drive mainstream adoption of digital currencies, positioning ILP as a key infrastructure for global payments.

Therefore, the report highlights the rising convergence of traditional finance and decentralized networks. Integrating VISA transactions with Ripple’s ILP could usher in a new era of cross-border payments, delivering unmatched speed, transparency, and scalability.

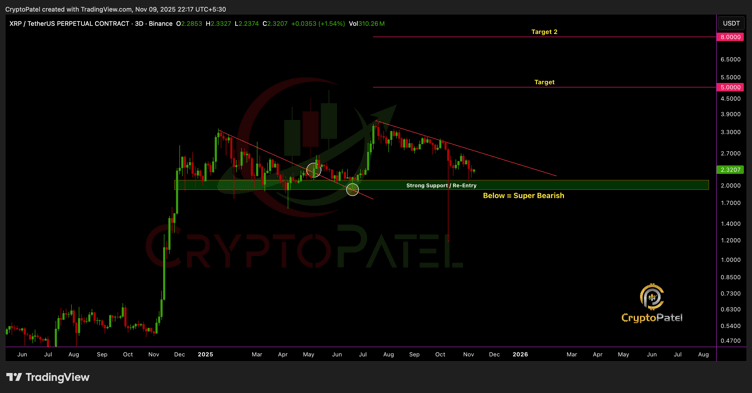

XRP Eyes $5–$8 as Strong Support Zone Bolsters Institutional Confidence

According to prominent market analyst Crypto Patel, XRP has established a decisive support zone between $1.85 and $2, signaling a robust foundation for both retail and institutional investors. This range, Patel notes, represents a strong liquidity and accumulation base, creating a favorable environment for potential price expansion in the months ahead.

XRP’s $1.85–$2 support zone is proving pivotal with the current price being $2.27. Historically, areas of high liquidity and concentrated institutional accumulation absorb selling pressure and anchor markets during volatility.

As Crypto Patel notes, XRP’s consolidation here reflects strong investor confidence and positions the coin for potential structural growth.

XRP continues its bullish momentum across multiple timeframes, with strong trading volumes and clear institutional accumulation signaling strategic positioning. Analyst Patel suggests that if the $1.85–$2 support holds, XRP could see a structural surge toward $5–$8, representing substantial upside potential.

Therefore, XRP’s $1.85–$2 support zone is more than a floor, it signals strong institutional backing, deep liquidity, and bullish momentum. If trends hold, a structural move toward $5–$8 is well-supported by market dynamics and investor activity, reinforcing XRP’s upward trajectory.

Conclusion

Integrating VISA transactions with Ripple’s Interledger Protocol could transform payments, combining traditional network reliability with blockchain’s speed, transparency, and interoperability. This leap promises a faster, more efficient ecosystem and marks a major step toward a truly connected global financial landscape.

On the other hand, XRP’s $1.85–$2 support zone highlights strong institutional interest and deep liquidity. With bullish momentum intact, this level not only defends current valuations but also positions XRP for a potential surge toward $5–$8.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Updates Today: MoonBull’s Unique Ethereum Foundation Distinguishes It in the Competitive Meme Coin Space

- MoonBull ($MOBU) surges in Stage 6 presale with 7,244% ROI potential, leveraging Ethereum's security and deflationary tokenomics. - A structured referral system offers 15% extra tokens and USDC bonuses, driving $600K+ raised and 2,000+ holders. - Unlike meme coins, MoonBull's Ethereum-based model with staking and governance aims for sustainability, contrasting with volatile alternatives like TRUMP and XRP . - Analysts caution about crypto volatility, emphasizing ROI projections depend on market condition

From Pharmaceuticals to Blockchain: Lite Strategy's $100 Million LTC Reserve Disrupts Traditional Finance

- Lite Strategy (LITS) becomes first U.S. publicly traded company to adopt Litecoin as primary reserve asset after $100M private placement. - Partnership with crypto firm GSR and Litecoin creator Charlie Lee on board aims to institutionalize digital treasury management amid volatile markets. - $12.21M working capital and 12.39 current ratio highlight liquidity strength despite 18% YTD stock decline and mixed institutional investor reactions. - Strategic shift from pharmaceuticals to crypto reserves challen

Malaysia’s Broad Trade Approach Counters Trump Tariffs, Fuels 5.2% Economic Expansion

- Malaysia navigated Trump's 2025 tariffs via trade diversification and diplomacy, avoiding panic amid global market shocks. - U.S. reduced tariffs to 19% in October 2025 after Malaysia opened markets, coinciding with 5.2% Q3 GDP growth driven by exports and fiscal discipline. - Strategic trade ties with China, Singapore, and U.S. mitigated protectionist impacts, supported by ASEAN coordination and non-retaliatory policies. - Malaysia's $250M investment in semiconductor design and renewable energy reflects

Lite Strategy’s Balancing Game in Crypto-Pharma: Is It Possible to Manage Instability and Tradition Together?

- Lite Strategy (LITS) rebranded from MEI Pharma to focus on Litecoin , acquiring 929,548 LTC via a $100M PIPE in July 2025. - The company partners with GSR for crypto treasury management and launched a $25M share repurchase program in October 2025. - LITS holds $12.21M in working capital with no debt, while balancing pharmaceutical asset sales (e.g., ME-344) with crypto investments. - Despite strong liquidity (current ratio 12.39), the stock faces volatility risks and regulatory uncertainties in its crypt