Only four protocols in the DeFi space have a TVL exceeding $10 billion.

according to DeFiLlama data, as of now, there are only 4 protocols in the entire DeFi ecosystem with a TVL (Total Value Locked) exceeding 10 billion USD, namely:

Aave (approximately 31.059 billion USD)

Lido (approximately 26.481 billion USD)

EigenLayer (approximately 12.656 billion USD)

Binance staked ETH (BETH) (approximately 10.848 billion USD)

With the market correction, most protocols have experienced varying degrees of TVL decline, causing the "10 billion TVL club" members to further shrink.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Millions of individuals now qualify for this tax-beneficial savings account

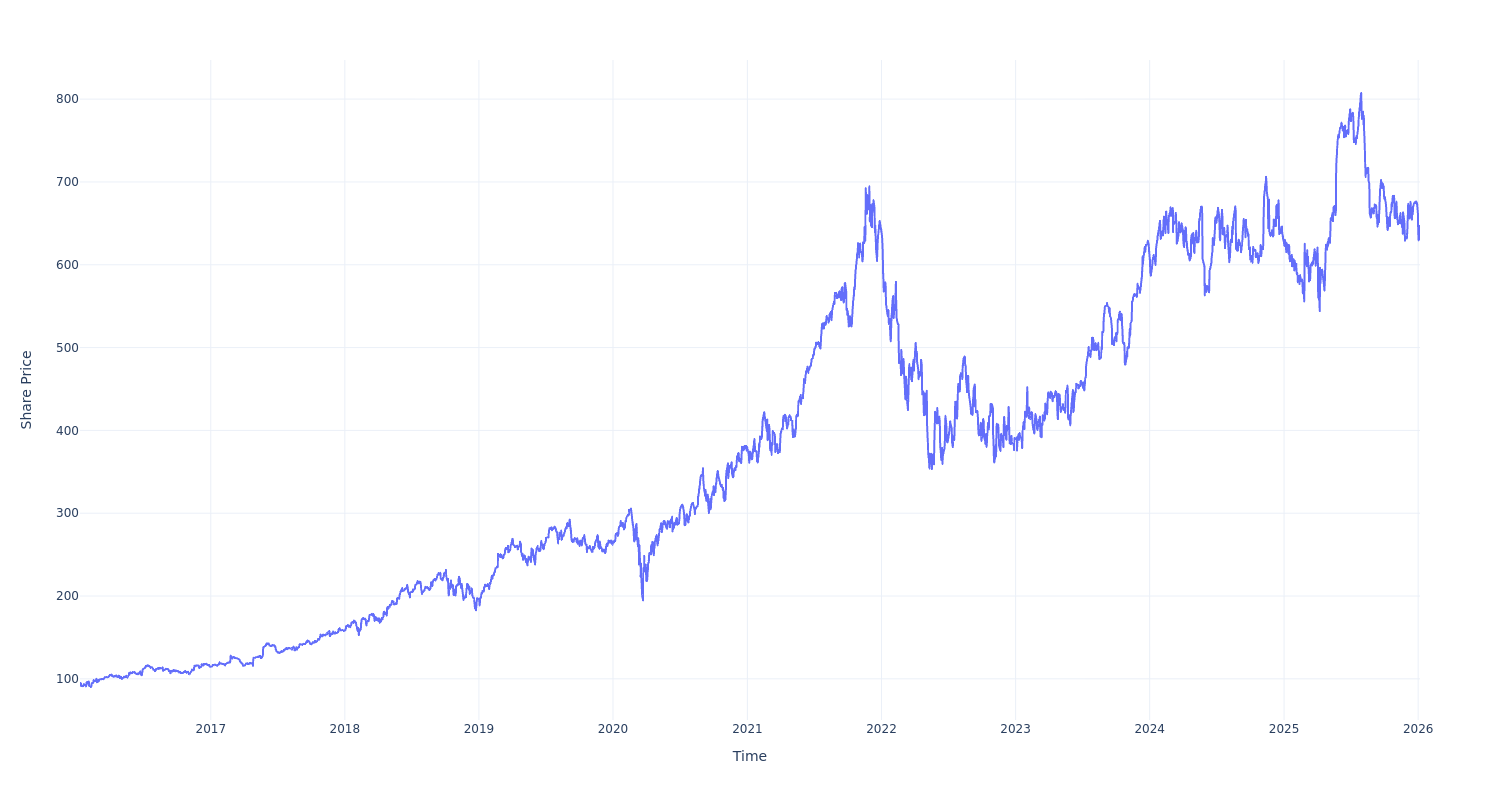

$1000 Placed in Intuit a Decade Ago Would Have Grown to This Amount Now

XRP price 'starting to respond' to gold's multiyear 180% boom: Analyst

How the main US stock indices performed on Tuesday, January 6, 2026