Goldbug Peter Schiff Calls MSTR a ‘Fraud’—Analysts Say It Could Still Outperform Bitcoin

Peter Schiff claims MicroStrategy’s preferred-share model is a “fraud,” predicting it could trigger a financing collapse. Yet analysts argue MSTR’s leveraged Bitcoin exposure may still outperform BTC itself, keeping investors sharply divided.

MicroStrategy (MSTR) is at the center of a heated debate, as Peter Schiff labels the company’s business model a fraud. Schiff warns that MSTR’s reliance on high-yield preferred shares and income-oriented funds is unsustainable, predicting that the company could eventually go bankrupt.

Yet analysts and traders argue that MSTR’s strategy may still offer unique leveraged Bitcoin exposure, fueling a split in market sentiment.

Schiff Slams MSTR as ‘Fraud’ but Analysts Argue It May Outrun Bitcoin

According to Schiff, MicroStrategy’s preferred-share financing model could trigger a “death spiral,” with the goldbug terming the firm’s entire business model a fraud.

MSTR’s entire business model is a fraud. Saylor and I will both be speaking at Binance Blockchain Week in Dubai in early December. I challenge @saylor to debate this proposition with me. Regardless of what happens to Bitcoin, I believe $MSTR will eventually go bankrupt. Let’s go!

— Peter Schiff (@PeterSchiff) November 16, 2025

Schiff’s sentiment stems from concerns over MicroStrategy’s business model, which relies on income-oriented funds buying its “high-yield” preferred shares. According to Schiff, those published yields may never actually be paid.

“Once fund managers realize this, they’ll dump the preferreds & MSTR won’t be able to issue any more, setting off a death spiral,” he noted.

MicroStrategy stopped issuing new convertible bonds in February 2025, shifting instead to preferred share offerings (the STR series), which commenced in September 2025.

These preferred shares carry significantly higher interest rates, suggesting investors now demand stronger incentives amid tightening market conditions.

Schiff’s broader argument emphasizes the structural risks inherent in the company’s approach. His bone of contention is that even if Bitcoin rises, MSTR’s debt-fueled model could fail, putting the firm at risk of insolvency.

Crypto trader KillaXBT highlighted a potential Black Swan scenario. According to the analyst, a 50–60% drop in BTC could lead to tighter loan rules, collateral calls, and forced Bitcoin sales, especially if liquidity dries up.

He likened MicroStrategy to a stack of cards built on Bitcoin, noting that leverage amplifies both gains and losses, and a major market correction could strain the company’s financing.

This is my hypothetical scenario regarding the collapse of $MSTR MicroStrategy’s value depends heavily on $BTC. It does well when prices are rising, but becomes very vulnerable if the market crashes.Their debt works fine… until it doesn’t. A 50–60% drop in BTC could trigger…

— Killa (@KillaXBT) November 16, 2025

Analysts Defend MSTR’s Leverage Model

Despite the warnings, some investors view MSTR as a leveraged play on Bitcoin that outperforms standard ETFs (exchange-traded funds). Adam Livingstone argued that MSTR combines 1:1 Bitcoin exposure with annual increases in BTC per share, a form of convexity that compounds returns without liquidation risk.

He illustrated a decade-long hypothetical: $100,000 in IBIT could grow to $1.38 million, whereas the same investment in MSTR could reach $3.56 million. This translates to a 158% outperformance.

Why I like buying MSTR over IBIT:IBIT = 1:1 Bitcoin exposure.MSTR = 1:1 Bitcoin exposure PLUS consistent growth in Bitcoin per share.BTC grows at whatever CAGR the market gives you.MSTR grows BTC holdings per share on top of that.That’s convexity.That’s leverage…

— Adam Livingston (@AdamBLiv) November 16, 2025

Another popular user on X (Twitter), Rohan Hirani, added that MSTR’s premium exists because investors are buying a management team with global capital access capable of acquiring additional BTC efficiently. This is in contrast to simply buying Bitcoin.

He emphasized that MSTR’s 2025 preferred stock offerings represent a pivot toward more sustainable financing, striking a balance between execution risk and long-term upside.

For those new here, here’s why $MSTR should trade at a premium to the value of the Bitcoin it holds.If you put $100 into a Bitcoin ETF, that $100 will always represent the same amount of Bitcoin. Your value only grows if Bitcoin’s price goes up (which is great btw).If you put…

— Rohan Hirani (@rohanhirani_) November 16, 2025

Financing Momentum and Market Dynamics

MicroStrategy has gradually shifted from convertible bonds to higher-interest preferred shares (STR series) since September 2025, reflecting cautious investor sentiment amid tightening markets.

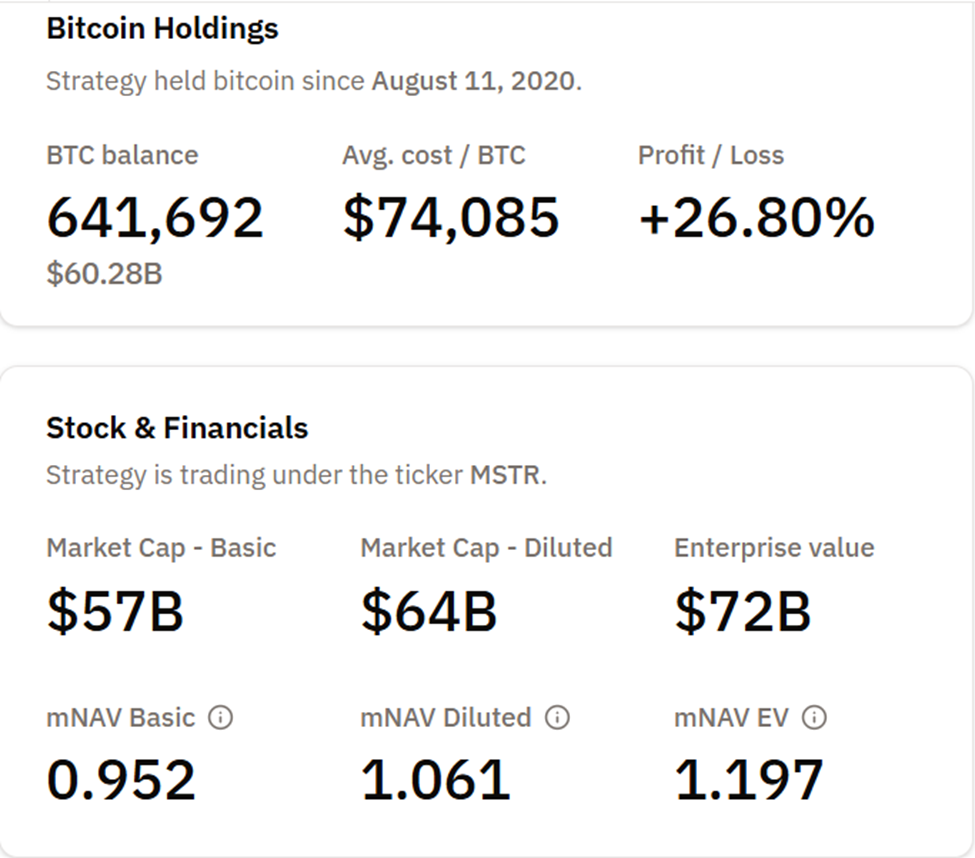

As of this writing, the firm holds 641,692 BTC at an average cost of $74,085 per coin, retaining roughly 26% unrealized gains even if BTC retraces sharply.

MicroStrategy BTC Holdings. Source:

MicroStrategy BTC Holdings. Source:

Analysts note that MSTR functions as a de facto leveraged Bitcoin ETF, where share value depends heavily on both Bitcoin prices and successful financing.

Despite temporary setbacks, such as the loss of the MSTR Bitcoin premium last week, investors highlight the company’s strategic positioning in digital credit markets as a driver of long-term value. MSTR’s model, while risky, provides double exposure:

- Bitcoin price appreciation, and

- Incremental BTC per share.

MicroStrategy’s hybrid strategy must weather volatility, maintain financing momentum, and continue outpacing Bitcoin exposure to assuage skeptical concerns. Nonetheless, the company remains a notable example in corporate Bitcoin strategy, striking a balance between leveraged opportunities and systemic risk.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana Latest Updates: VanEck's SOL ETF Custody Agreement Indicates Growing Institutional Adoption of Blockchain Assets

- VanEck partners with SOL Strategies to custody its Solana (SOL) ETF, advancing institutional blockchain adoption. - SOL Strategies' ISO 27001/SOC 2-certified validator node secures $4.37B in assets for the ETF's staking operations. - The ETF builds on existing $382M in inflows from competing Solana funds, signaling growing institutional demand for crypto exposure. - The partnership validates SOL Strategies' infrastructure capabilities and highlights rising interest in compliant staking solutions.

Investors Are Now Able to Buy and Sell Digital Shares of a Maldivian Resort Prior to Its Construction

- Trump Organization and Dar Global launch world's first tokenized hotel project in Maldives, using blockchain for real-time asset-backed token trading. - The 80-villa resort allows investors to buy digital shares during development, enabling fractional ownership and liquidity in luxury real estate. - This model democratizes access to high-end investments, building on Dar's 2022 Oman NFT experiment and Trump's crypto-focused corporate strategy. - Analysts predict $4 trillion in tokenized real estate by 203

CZ Shifts Focus to Collaboration as Cryptocurrency Faces Regulatory Turning Point

- Binance founder CZ received a Trump pardon after a 2023 $4.3B U.S. settlement, including $2.5B forfeiture and $1.8B fine. - CZ pledged to reinvest any potential refund into the U.S. economy, emphasizing gratitude amid political backlash over "pay-to-play" claims. - Legal experts clarify presidential pardons don't void corporate penalties, as Binance remains barred from U.S. customers under Treasury oversight. - Critics accuse Trump's administration of regulatory favoritism, while CZ's team denies crypto

Investors Rush to Acquire Mutuum Tokens Ahead of Price Increase

- Mutuum Finance (MUTM) targets Q4 2025 V1 launch, raising $18.8M in presale with 18,000 holders. - Token price surged 250% to $0.035 in Phase 6, nearing 99% allocation amid fixed-price presale competition. - V1 protocol introduces ETH/USDT liquidity pools, mtTokens, and liquidator bot on Sepolia testnet. - CertiK audit (90/100 score) and $50K bug bounty reinforce security, while 24-hour leaderboards boost community engagement. - Automated smart contracts eliminate intermediaries, positioning MUTM as a DeF