Date: Sun, Nov 16, 2025 | 08:24 AM GMT

The broader crypto market is showing some weekend relief after the sharp sell-off earlier this week that dragged Ethereum (ETH) down to $3069 before bouncing back above the $3200 mark.

Following this bounce, Dogecoin (DOGE) has also turned slightly green with modest gains — but what stands out more than the price action is the well-defined harmonic pattern forming on DOGE’s chart, hinting that a potential rebound could be in the making.

Source: Coinmarketcap

Source: Coinmarketcap

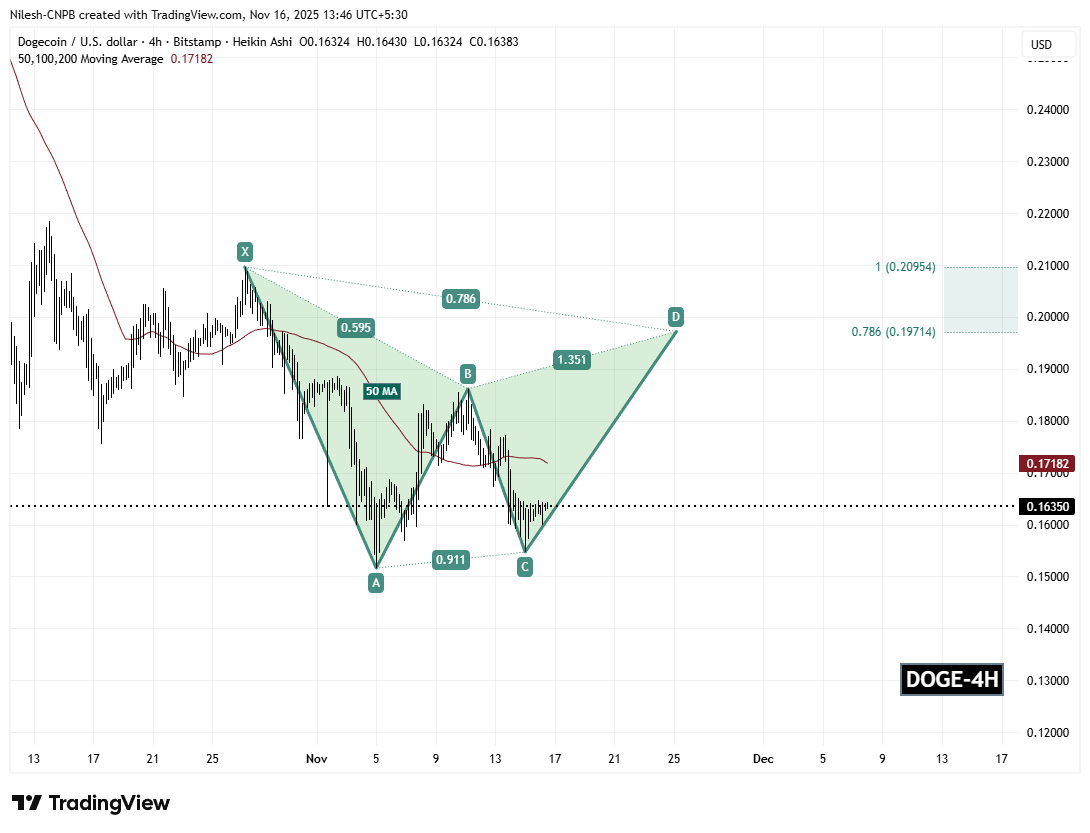

Bearish Gartley Pattern in Play?

On the 4-hour chart, DOGE appears to be shaping a Bearish Gartley harmonic pattern — a structure known for signaling potential reversal zones once its final leg (Point D) completes. Although labeled “bearish,” this pattern often results in a temporary upside move toward the PRZ before the broader trend resumes.

The formation began at Point X near $0.20963, followed by a sharp decline into Point A, a relief bounce to Point B, and then another corrective move that brought DOGE down to Point C around $0.15469. After tagging this level, DOGE has shown early attempts to stabilize, currently consolidating around $0.16350 as traders wait for a clearer directional signal.

Dogecoin (DOGE) 4H Chart/Coinsprobe (Source: Tradingview)

Dogecoin (DOGE) 4H Chart/Coinsprobe (Source: Tradingview)

To add to this setup, DOGE is also wrestling with the 50-hour moving average, currently sitting near $0.17182. A successful breakout and hold above this MA would be an early confirmation that buyers are regaining momentum.

What’s Next for DOGE?

For the bullish interpretation of this harmonic structure to remain valid, DOGE must hold above the $0.15469 support at Point C — a key level that anchors the entire pattern.

If buyers manage to reclaim the 50-hour MA and sustain momentum, the Gartley pattern projects an upside move toward the Potential Reversal Zone (PRZ) between: $0.19714 (0.786 Fibonacci) and $0.20954 (1.0 Fibonacci)

This PRZ aligns with the structural completion of Point D and represents a potential 28% upside from current levels — suggesting that DOGE may be gearing up for a meaningful rebound if broader market conditions hold steady.

However, caution is essential. The pattern is still mid-formation, and any decisive break below Point C ($0.15469) would invalidate the structure, opening room for deeper downside before a stronger recovery base emerges.