Tom Lee Sees Bitcoin’s 100x Logic Now Playing Out in Ethereum

Fundstrat’s Tom Lee says Bitcoin’s 100x rise came only to those who survived “existential moments,” and Ethereum may now follow the same path. Bitwise adds that BTC’s $1.9T market cap is tiny compared to global assets, hinting at massive upside.

Bitcoin (BTC) has surged nearly 100x since Fundstrat recommended it near $1,000 in 2017, enduring six corrections exceeding 50% and three over 75%. Tom Lee, Fundstrat’s Chief Investment Officer, now points to Ethereum following a similar path.

Meanwhile, Bitwise CEO Hunter Horsley notes that Bitcoin’s $1.9 trillion market cap remains relatively small compared to the hundreds of trillions in global assets.

Tom Lee Makes the Case for Bitcoin and Ethereum’s Next Surge

Tom Lee’s experience with Bitcoin goes back almost a decade, anchored by Fundstrat’s early call around $1,000.

According to the Fundstrat executive, the initial position has delivered roughly 100-fold returns despite intense corrections that shook investor confidence.

Lee emphasizes that capturing such exponential gains requires enduring what he calls ‘existential moments, meaning times of pessimistic sentiment and major sell-offs.

Bitcoin is a volatile asset. We first recommended Bitcoin to Fundstrat clients in 2017 (1%-2% allocation)– Bitcoin 2017 ~$1,000Since then (past 8.5 years), $BTC:– 6 declines > -50%– 3 declines > – 75%2025, Bitcoin 100x from our first recommendation TAKEAWAY: To have… pic.twitter.com/xtIRGLdnWM

— Thomas (Tom) Lee (not drummer) FSInsight.com (@fundstrat) November 16, 2025

As of this writing, Bitcoin’s market capitalization was approximately $1.91 trillion. The broader cryptocurrency market reached $3.23 trillion.

Bitcoin (BTC) Price Performance. Source:

BeInCrypto

Bitcoin (BTC) Price Performance. Source:

BeInCrypto

Yet, these numbers are small compared to traditional asset classes, highlighting the strong growth potential industry leaders often mention.

Lee attributes current weakness in crypto to market makers facing balance sheet strain and forced sales. He argues these are technical, not fundamental, challenges within a large-scale supercycle.

Against this backdrop, the Fundstrat CIO advises against leverage, noting it increases downside risk during periods of high volatility.

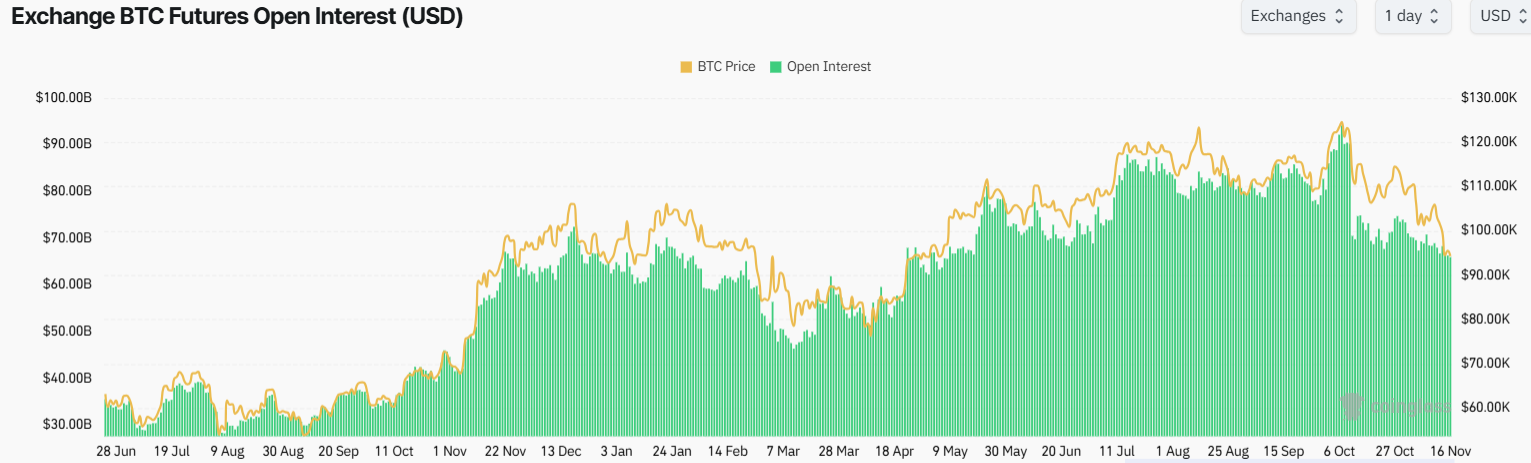

Data on Coinglass shows that Bitcoin futures Open Interest is near 100,000, indicating new positions are opening and possibly signaling bullish sentiment. However, higher Open Interest can also signal short-term volatility as traders react to shifting momentum.

Bitcoin Futures Open Interest. Source:

Coinglass

Bitcoin Futures Open Interest. Source:

Coinglass

Ethereum’s Supercycle and Volatility

Fundstrat’s outlook is not limited to Bitcoin. The firm believes Ethereum is entering its own supercycle, noting that Ethereum’s progress will not be linear. Based on this, they advise investors to expect volatility as the price appreciates in the long term. This trend mirrors Bitcoin’s history of sharp declines between rallies.

To me, the weakness in crypto has the all the signs– of a market maker (or two) with a major “hole” in their balance sheet Sharks circling to trigger a liquidation / dumping of prices $BTCIs this pain short-term? YesDoes this change the $ETH supercycle of Wall Street… pic.twitter.com/0jfkXYnfv9

— Thomas (Tom) Lee (not drummer) FSInsight.com (@fundstrat) November 15, 2025

Lee’s point about “stomaching existential moments” is equally relevant for Ethereum investors. The asset has experienced its own significant drops, at times losing over 80% from its peaks.

Nevertheless, investors who held on were rewarded with sizeable gains, strengthening the case for patient capital in high-conviction digital assets.

Bitwise’s Horsley Challenges the 4-Year Cycle Myth

Elsewhere, Bitwise CEO Hunter Horsley contextualizes Bitcoin’s potential by comparing its size with traditional markets.

Horsley points out that Bitcoin’s $1.9 trillion market cap is minimal next to $120 trillion in equities, $140 trillion in fixed income, $250 trillion in real estate, and $30 trillion in gold.

Globally, there's:~$120+ trillion of wealth in equities~$140+ trillion of wealth in fixed income~$250+ trillion of wealth in real estate~$100+ trillion in M2 / money~$30 trillion in goldThere's $1.9 trillion in Bitcoin.Bitcoin at $85k, $95k, $105k is all the same thing.…

— Hunter Horsley (@HHorsley) November 16, 2025

Given this context, Bitcoin makes up only a fraction of investable global assets. Even small reallocations from traditional assets to crypto could significantly boost Bitcoin’s valuation.

Since the launch of spot Bitcoin ETFs in early 2024, institutional adoption has increased, with pension funds, endowments, and corporate treasuries allocating capital to Bitcoin.

Horsley also touches on Bitcoin’s cycle, typically influenced by halving events. He argues that pre-2026 selling could disrupt these patterns, possibly paving the way for a strong bullish phase in 2026.

Here's what I see happening on 4 year cycles —Common view: people believe in 4 year cycles, and that 2026 will thus be a down year for BTC.First order effect: people thus sell in 2025 to avoid the down market year.Second order effect: the 2025 sellers cause 2025 to be a… pic.twitter.com/DMAjWy6UBc

— Hunter Horsley (@HHorsley) November 16, 2025

Year-to-date, Bitcoin is up 2.5% for 2025, according to available data, pointing to building momentum.

Several factors, including limited supply, growing institutional interest, and Bitcoin’s tiny share of global wealth, create a strong investment thesis.

Both Lee and Horsley note that patience is needed, as volatile markets can tempt investors to sell early.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Fosun's Visionary Move: Digital Assets Propel Insurance Toward a Technology-Enabled Tomorrow

- Fosun Finance's Minsheng Life Insurance launched a virtual asset-linked insurance product, expanding into alternative assets via regulatory-approved "Finance + Technology" integration. - The product secures upfront regulatory approval to mitigate risks, contrasting with India's strict virtual compliance requirements and positioning Fosun to lead digital finance innovation. - Competitors like Hillhouse Capital and Axis Max Life Insurance pursue traditional equity strategies, while Fosun's blockchain-drive

Legal Team Portrays Pardon as Protective Measure Amid 'Crypto Crackdown'

- Binance founder CZ's legal team denied "pay-to-play" claims, asserting his 2025 pardon followed standard procedures and regulatory review. - Attorney Teresa Guillén rejected ties to Trump's crypto ventures, calling allegations "false" and emphasizing Zhao's case was regulatory, not criminal. - Critics like Sen. Warren accused Trump of corruption over World Liberty Financial ties, while the White House defended the pardon as routine presidential authority. - Legal scholars called the pardon "unprecedented

Cardano News Update: DeFi Faces $6M Setback as Low-Liquidity Pools Consume Major ADA Trade

- A dormant Cardano wallet lost $6M via extreme slippage in an illiquid USDA stablecoin pool, spiking its price to $1.26. - The trade exposed risks of large swaps in underfunded pools, flagged by on-chain investigator ZachXBT as a "textbook" liquidity trap. - USDA's $10.6M market cap couldn't absorb the 14.4M ADA swap, costing traders $8 per token and wiping $6.05M in value. - The incident highlights DeFi's slippage risks, with analysts urging better safeguards for high-risk trades on decentralized exchang

Bitcoin News Today: Bitcoin Faces Crucial $94K Threshold: Will It Hold Steady or Plunge Further?

- Bitcoin tests critical support near $94,000 as technical indicators signal bearish momentum amid Fed policy uncertainty and liquidity strains. - Record $463M BlackRock ETF outflows and $1.1B total redemptions highlight worsening market sentiment and institutional distress. - Analysts split between bear market forecasts through 2026 and potential stabilization near $94,000 tied to 6-12 month holder cost bases. - Key resistance at $103,000 remains pivotal - a sustained break could reignite bullish trends w