Pi Coin’s Rare Green Streak Could Last If The Altcoin Clears One Key Level

The Pi Coin price is flashing a rare multi-timeframe green streak even while the broader market struggles. A breakout from a symmetrical triangle, a CMF surge, and improving OBV all point to growing strength. But the entire move depends on one level: $0.229. A close above it could unlock more upside.

Pi Coin just printed something unusual. Three major timeframes are green at the same time. The one-month chart is up 9.5%, the seven-day chart is up 2.1%, and the last 24 hours are up 3.5%.

This is rare because the Pi Coin price is still down almost 40% in the three-month window. The token is showing early strength while most of the market is still stuck in a slow bleed. The question now is simple: is this just a brief bounce, or the start of a larger move?

Symmetrical Triangle Breakout Surfaces As Money Flow Turns Positive

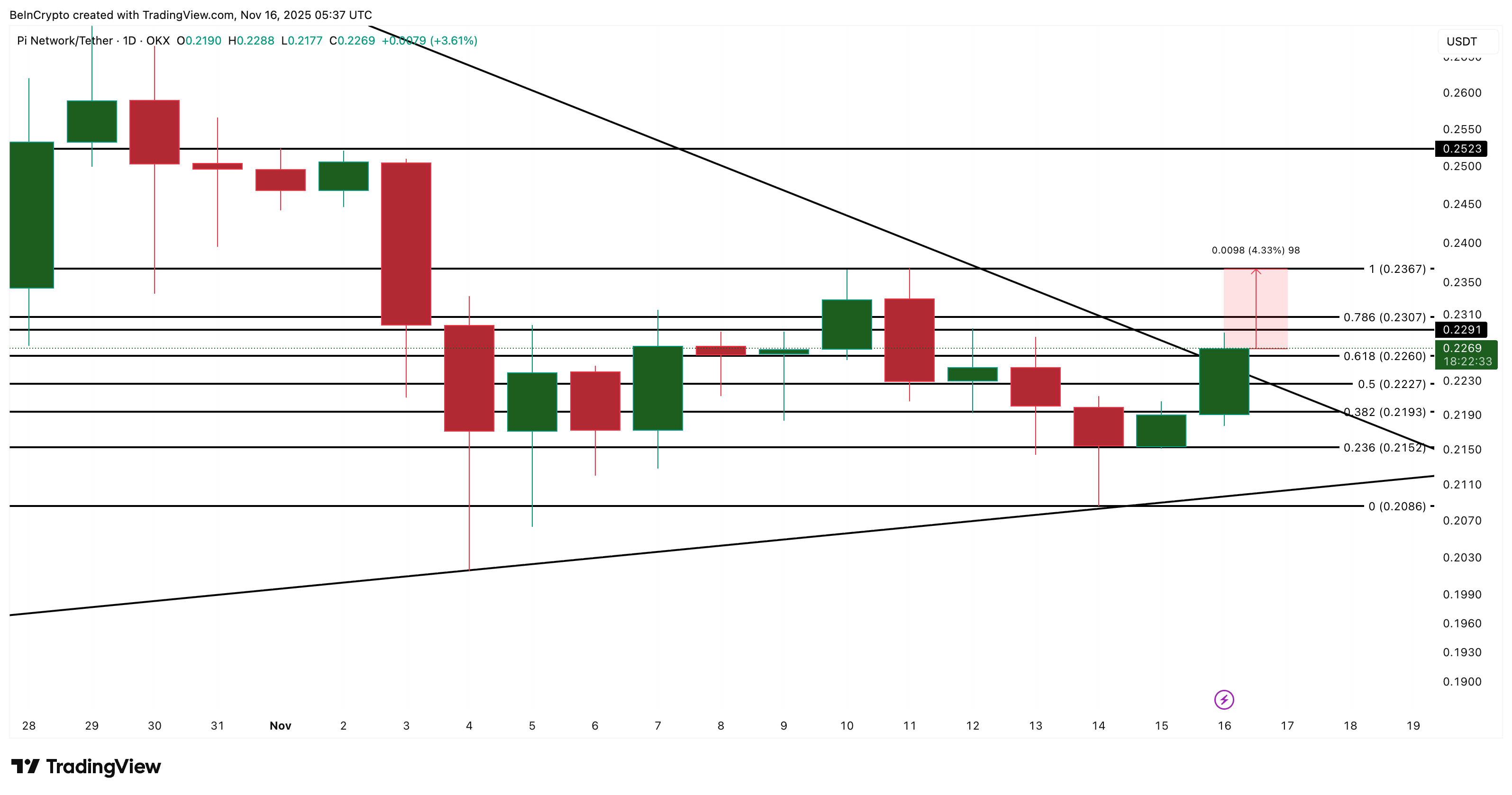

PI has been stuck inside a symmetrical triangle for weeks. This pattern typically indicates indecision, rather than a trend direction.

However, yesterday, the Pi Coin price broke through the upper boundary and is now testing the confirmation level near $0.229, a key level. A clean candle close above that line is the first sign that buyers are finally taking control.

Pi Coin Breaks Out:

TradingView

Pi Coin Breaks Out:

TradingView

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

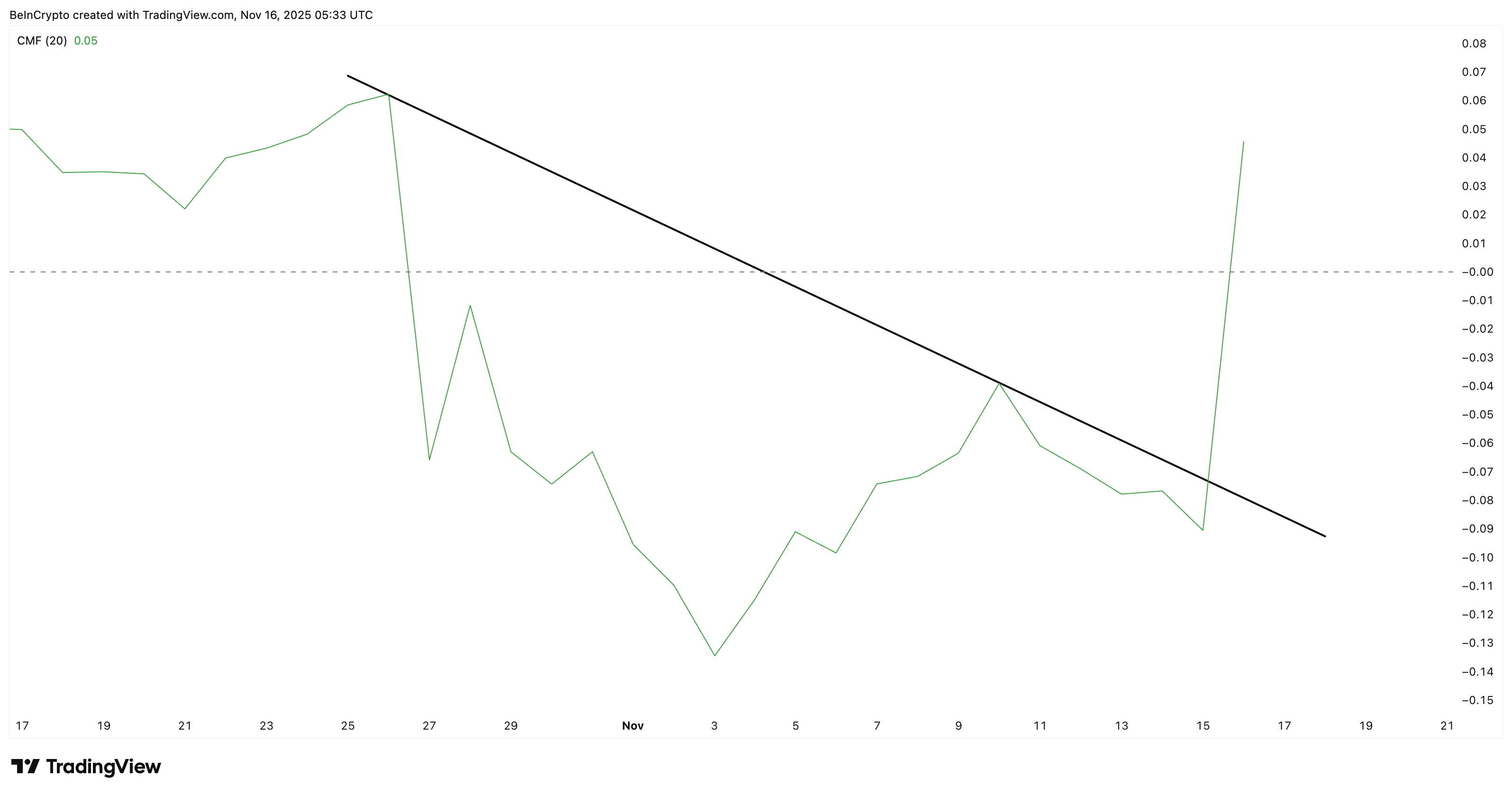

The next clue comes from the Chaikin Money Flow (CMF). CMF measures whether money is moving into or out of an asset. Two days ago, CMF broke out of its descending trend line, rising sharply from –0.09 to +0.05.

This jump shows that the breakout is not random. Bigger Pi Coin wallets may be stepping in as the pattern flips bullish.

Big Money Flows In:

TradingView

Big Money Flows In:

TradingView

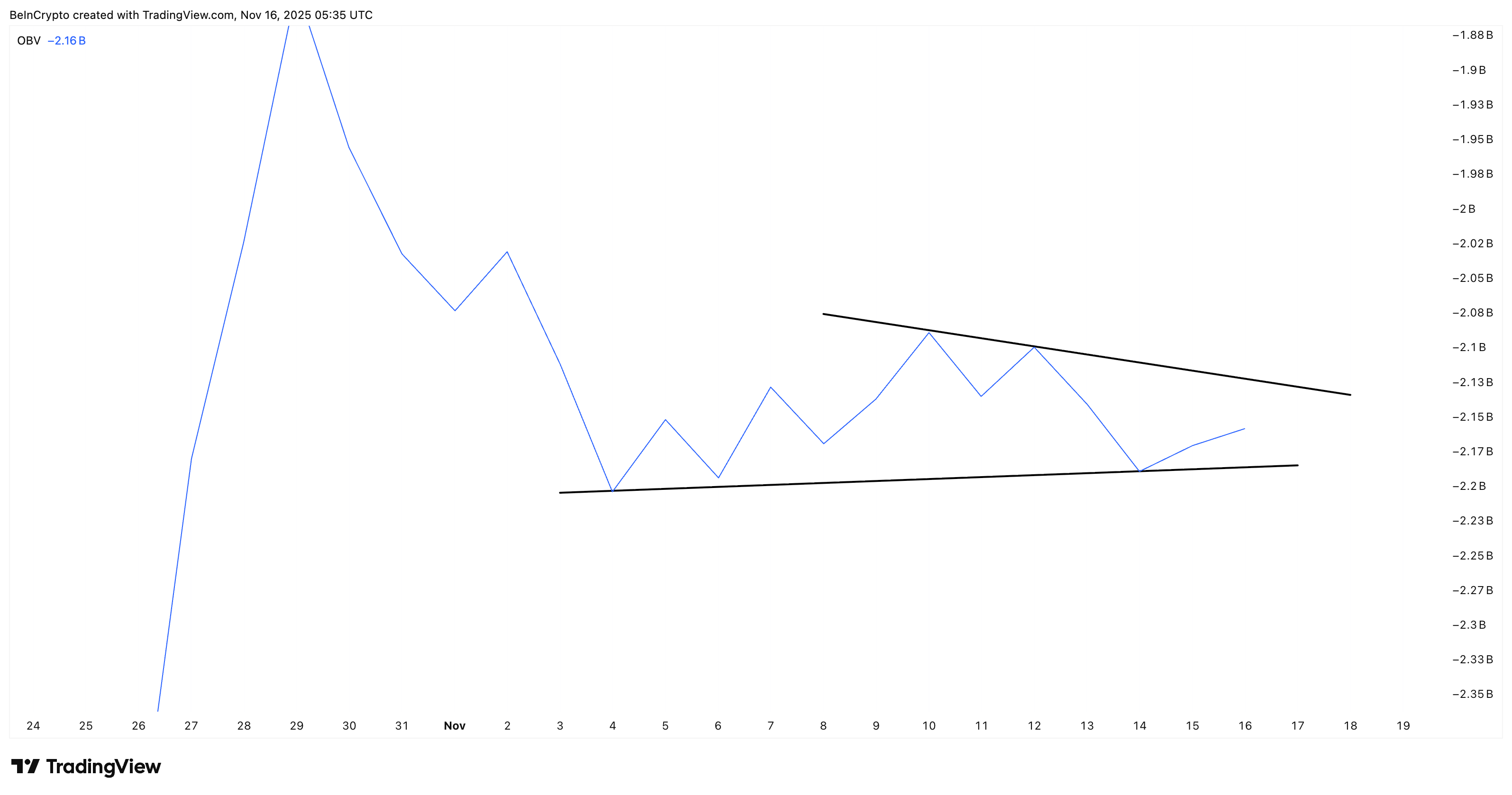

The On-Balance Volume (OBV) tells the other half of the story. OBV tracks buying and selling volume to show whether traders support the move. OBV touched lower, back to its rising trend line on November 12–13, hinting that retail volume wasn’t ready.

However, since November 14, OBV has begun to curl upward again. If OBV breaks its upper trend line, it confirms that retail Pi Coin buyers are now joining the move sparked by the CMF breakout.

Retail Volume Coming Back:

TradingView

Retail Volume Coming Back:

TradingView

The combination of a technical breakout, rising money flow, and recovering OBV gives Pi Coin its strongest setup in weeks.

Pi Coin Price Levels To Watch As Momentum Builds

If the Pi Coin price closes above $0.229, the move could extend to $0.236, representing a gain of approximately 4.2% from current levels. If momentum holds, the next target is near $0.252, which has previously acted as strong resistance.

However, the bullish setup can fail if the OBV rolls over again or the CMF slips back into negative territory. A drop below $0.215 weakens the structure and exposes a slide toward $0.208.

Pi Coin Price Analysis:

TradingView

Pi Coin Price Analysis:

TradingView

Currently, the Pi Coin price is exhibiting rare strength across multiple timeframes. Whether that strength lasts comes down to one line: $0.229. If the bulls defend it, PI’s green streak may have more room to run.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

How large a portion of the AI data center surge will rely on renewable energy sources?

Amazon satellite network receives a new name — and no longer emphasizes its low-cost promise

TechCrunch Mobility: The robotaxi growth that truly counts

Bitcoin News Update: Japan Strives to Foster Crypto Innovation While Enhancing Investor Safeguards Amid Regulatory Reforms

- Japan will reclassify cryptocurrencies as financial products under FIEA, enhancing investor protections and aligning with traditional securities regulations. - FSA proposes 20% capital gains tax, strict insider trading rules, and mandatory disclosures for 105 tokens to mitigate risks and ensure transparency. - Exchanges must provide detailed issuer and blockchain data, while banks may soon hold Bitcoin , reflecting Asia's push for tokenized finance infrastructure. - Regulatory challenges include complian