Aster Clarifies Tokenomics After Confusion Over Token Unlock Delays

Aster clarified its tokenomics after a CMC update caused confusion over unlocks, saying no changes were made and unused tokens remain out of circulation.

Aster moved to calm its community after a miscommunication on CoinMarketCap (CMC) led users to believe the project had quietly changed its token unlock schedule.

The team said the tokenomics remain unchanged and blamed an update on CMC for creating the confusion.

ASTER Token Unlock Confusion

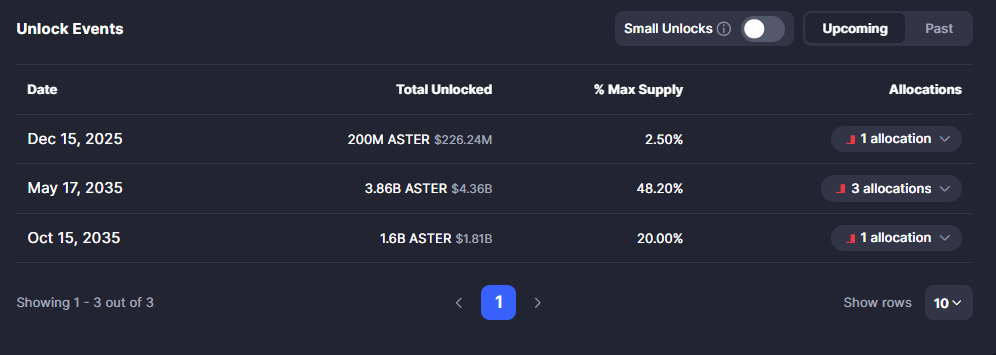

The clarification came hours after Aster community members noticed major upcoming unlocks listed on CMC — including one for December 2025 and two massive releases scheduled for 2035.

This contradicts earlier statements from the exchange about delaying 2025 unlocks to mid-2026.

A recent update to the tokenomics of ASTER on CoinMarketCap (CMC) has caused confusion within the community. This confusion stemmed from a miscommunication, and we sincerely apologize for the inconvenience caused. We want to clarify that the ASTER tokenomics remain unchanged.…

— Aster (@Aster_DEX) November 15, 2025

The uncertainty started when updated CMC data showed 200 million ASTER scheduled to unlock on December 15, 2025, followed by 3.86 billion ASTER and 1.6 billion ASTER unlocks in 2035.

Those figures implied that 75% of the token supply was still locked, with 24% currently circulating.

Aster said the CMC update was meant to correct circulating supply information and clarify how unused ecosystem tokens were being treated.

Original Post That Caused Confusion About Aster Tokenomics. Source:

Original Post That Caused Confusion About Aster Tokenomics. Source:

The team said the tokens that unlock monthly under the ecosystem allocation have never entered circulation and have remained untouched in a locked address since TGE.

To avoid further confusion, Aster will now transfer these unlocked-but-unused tokens to a public, dedicated unlock address to separate them from operational wallets.

The team said it has no plans to spend from this address.

Why This Matters for ASTER Holders

The episode highlights a recurring issue in crypto markets. Inconsistent or unclear circulating supply data can influence price action, investor expectations, and perceived dilution risk.

Upcoming ASTER Token Unlocks. Source:

Upcoming ASTER Token Unlocks. Source:

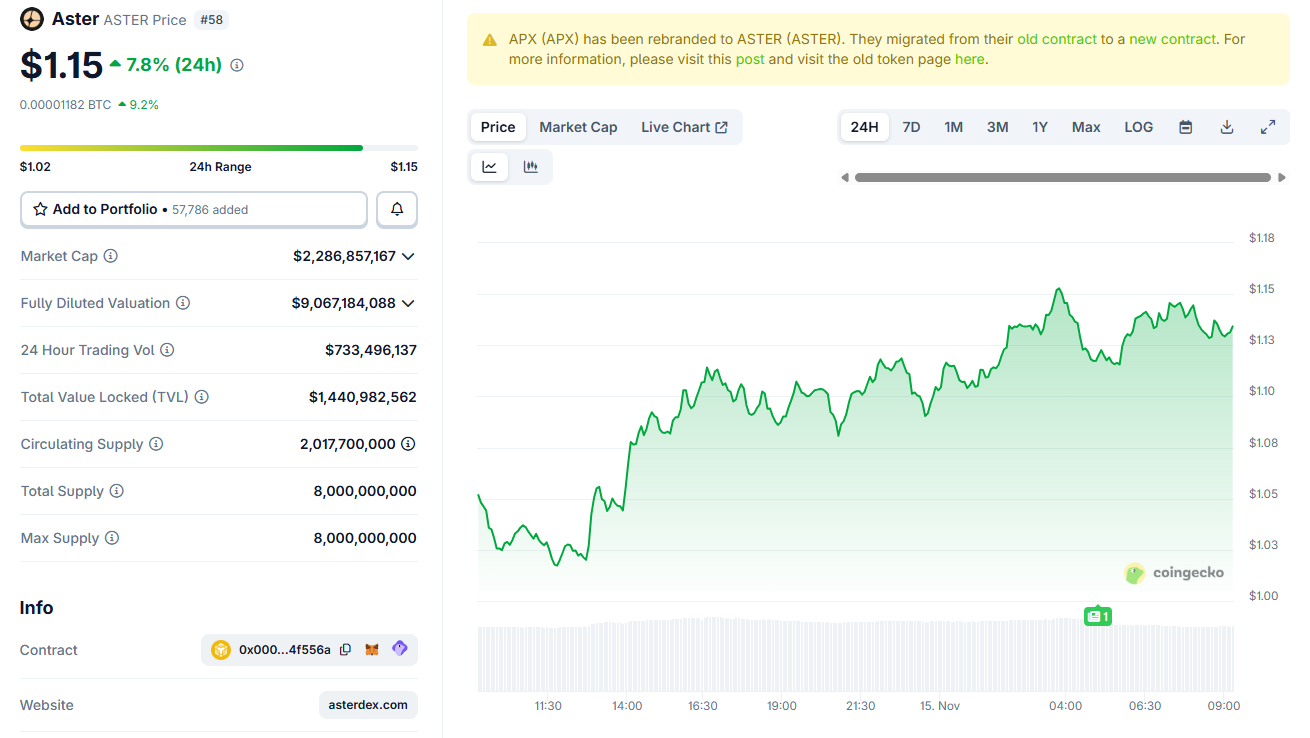

Aster’s circulating supply sits around 2.017 billion ASTER, with 6.06 billion still locked. Market cap is roughly $2.28 billion, while the fully diluted value exceeds $9 billion.

A sudden interpretation that large unlocks were imminent may have fueled speculation about dilution, especially as the project recently saw heavy trading volume and rising volatility.

ASTER Daily Price Chart. Source:

ASTER Daily Price Chart. Source:

Despite the confusion, ASTER traded higher on the day, moving around $1.14, up about 8% in 24 hours. The price has fluctuated between $1.02–$1.15, stabilizing after an early-morning sell-off.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Updates Today: BitMine's Acquisition of Ethereum Reflects the 1990s Telecom and Internet Boom

- BitMine acquires 3.5M ETH ($11.2B), becoming largest publicly traded Ethereum holder, surpassing Bitcoin-focused treasuries. - Institutional buying drives Ethereum's exchange balances to multi-year lows, with BitMine's purchase marking a major institutional acquisition. - JPMorgan and ARK Invest boost BitMine holdings amid regulatory progress enabling Ethereum staking ETPs with 3-5% yields. - CEO Chi Tsang compares Ethereum's potential to 1990s telecom/internet revolutions, targeting 5% supply ownership

Bitcoin Updates: Tether Rises While Bitcoin Drops, Indicating Investors Seek Safe Havens

- Tether CEO labels November 2025 "Bitcoin Black Friday," signaling heightened crypto volatility and Tether's record $184B market dominance amid Bitcoin's 11% monthly decline. - Stablecoin market expands to $300B as traders shift to safer assets, mirroring historical patterns where Tether's share rises during Bitcoin bearish phases. - Bitcoin's BVIV index breaks key resistance, indicating prolonged turbulence driven by thinning liquidity and macroeconomic risks like U.S. credit rating downgrades. - Institu

JPMorgan is unwilling to cover the legal expenses of Frank founder Charlie Javice

Ethereum Updates: Arthur Hayes Sells $2.45M ETH/DeFi Holdings, Indicating Negative Market Sentiment

- Arthur Hayes sold $2.45M in Ethereum and DeFi tokens, including 260 ETH and 2.4M ENA, signaling potential bearish sentiment. - Blockchain analysts highlight risks of price dips as large ETH sales often trigger short-term market declines, with $3,000 support levels under scrutiny. - Simultaneous offloading of AAVE, UNI, and LDO tokens suggests profit-taking amid rising traditional finance rates and DeFi liquidity shifts. - Zcash (ZEC) whale activity and leveraged ETH short positions further amplify crypto