Bitcoin Updates: The $93k-$97k Battle—Institutions Remain Bullish Amid Geopolitical and Technical Headwinds

- Bitcoin battles $93k–$97k survival zone amid mixed institutional inflows and geopolitical tensions, with $1.15M ETF inflow ending a $1.22B outflow streak. - Technical indicators show potential $100k local bottom with $14.1B trading volume, but bearish RSI/MACD and 50% Fibonacci level at $100k threaten further declines. - U.S.-China BTC dispute over 127,000 stolen coins (0.65% supply) intensifies regulatory risks, while BNB Chain's token falls below $1k amid selling pressure. - 72% of BTC supply remains i

Bitcoin’s latest price movements have heightened the contest for dominance within the $93,000 to $97,000 support range, as traders monitor whether institutional investments and technical signals can halt the ongoing decline. After challenging a significant resistance point near $106,500,

There was a slight uptick in institutional interest, as U.S.-listed spot Bitcoin ETFs attracted $1.15 million on Monday, following a previous week that saw $1.22 billion in outflows

Technically, the outlook remains uncertain. A strong close above $106,500 could fuel further recovery, but failing to maintain this level could prompt another test of the 50% Fibonacci retracement at $100,353. On the downside, the $97,000 to $93,000 area has become a key zone, with

Geopolitical issues have further increased market uncertainty. China has accused the U.S. of seizing 127,000 BTC—valued at $13 billion—from its LuBian mining pool in 2020, labeling it a “state hack.” The U.S. responded by stating the assets were tied to Cambodia’s Huione Group.

At the same time, altcoins have reflected Bitcoin’s challenges.

The institutional environment is still mixed. Some analysts interpret the current pullback as a mid-cycle pause—similar to previous turning points in 2024 and 2025—while others caution about deeper risks.

As Bitcoin faces this pivotal moment, investors are preparing for a test of resilience. The next few weeks will be crucial in determining whether the $93,000 to $97,000 range can serve as a solid base or if a more extended decline is ahead.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The community shapes the future of blockchain gaming with SACHI

- SACHI launches "The Origin" NFT event (200 exclusive OGs) to precede $SACHI token launch, offering early access and in-game perks. - CEO Jonas Martisius emphasizes NFTs as symbols of early support, fostering community engagement ahead of November 19 TGE. - Limited availability and "Origin" status incentives aim to drive exclusivity and loyalty in blockchain gaming ecosystem. - SACHI's vision integrates blockchain to create a self-sustaining gaming universe with tokenized rewards for player contributions.

SACHI's NFTs Mark the Beginning of a Player-Led Revolution in Blockchain Gaming

- SACHI launched "The Origin," a 200-NFT mint event granting early access to its blockchain gaming platform and future rewards. - The NFTs, called "SACHI OGs," symbolize early participation and offer exclusive perks like "Origin" status and visibility across official channels. - By integrating blockchain, SACHI aims to create a self-sustaining economy where players become stakeholders through tokenized rewards and digital identity markers. - Analysts predict the limited NFT supply could drive secondary mar

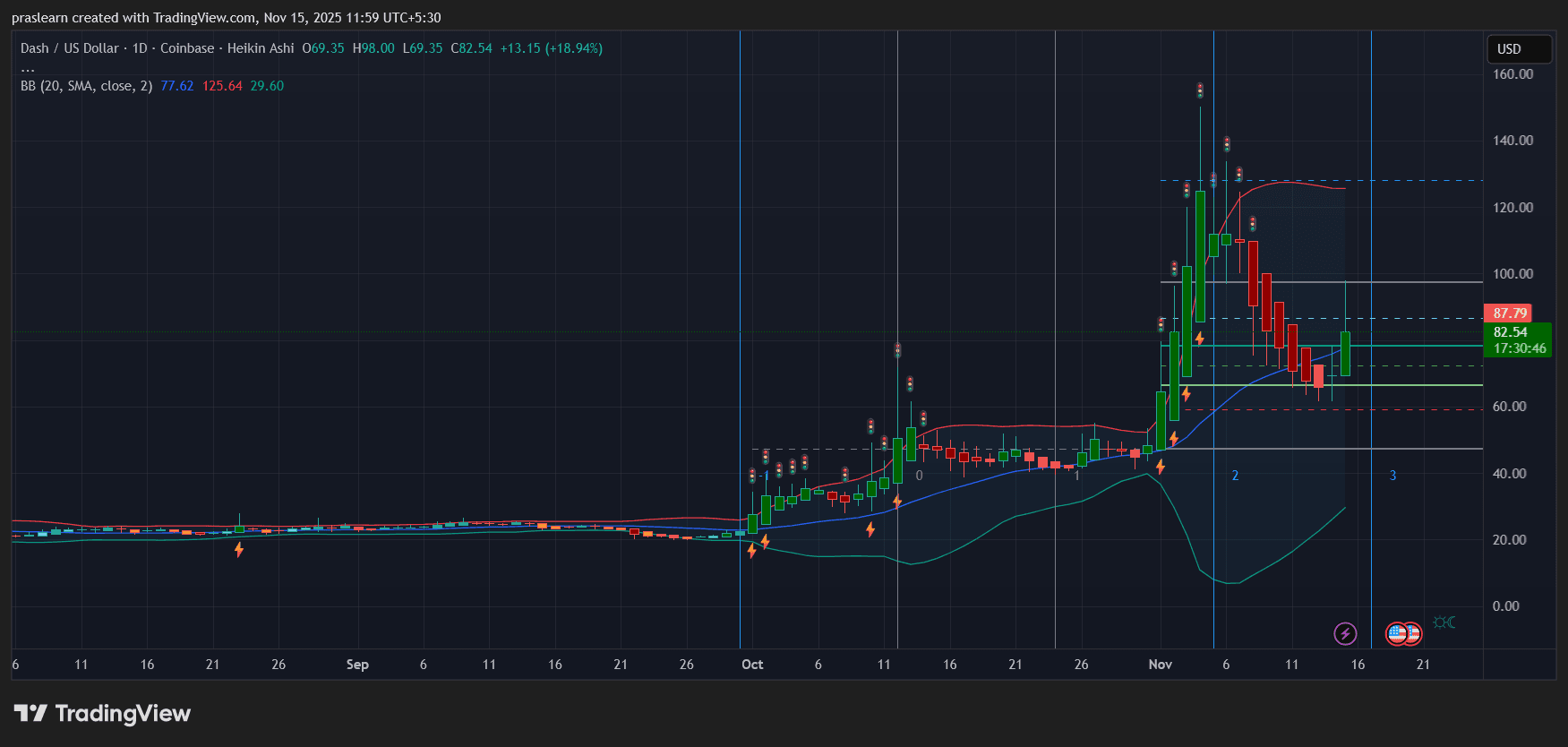

Zcash vs Dash: Which Privacy Coin Looks Stronger As Markets React to Tariff Relief?

Nigeria's Embedded Finance Experiences Rapid Growth Amidst Reforms and International Oil Market Uncertainties

- Nigeria's embedded finance market is projected to reach $4.34 billion by 2025 with a 12.2% CAGR, driven by digital adoption in e-commerce, healthcare , and education. - Economic reforms under President Tinubu led S&P to upgrade Nigeria's credit outlook to "positive," while Moody's raised its rating to "B3" in May 2025. - Fiscal challenges persist as Nigeria raised $2.35 billion via Eurobonds to address 2025 budget deficits amid global oil price volatility and implementation hurdles. - Fintech growth acce