- Circle minted 1 billion USDC today.

- Combined with Tether, $13.25B in stablecoins have been issued post-crash.

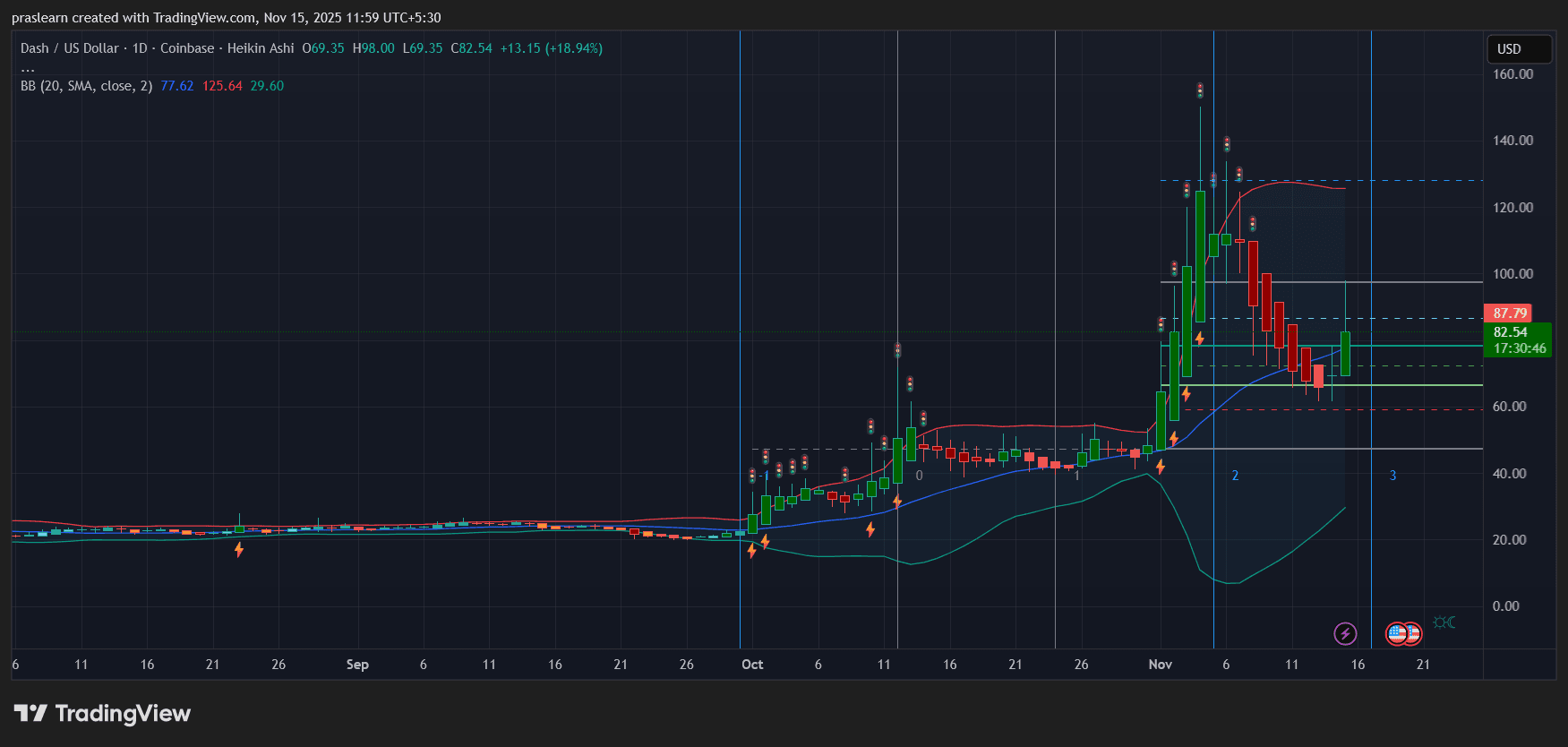

- Stablecoin demand surges after 1011 market drop.

Circle Adds $1B in USDC Amid Market Recovery

Stablecoin issuer Circle has just minted another $1 billion worth of USDC, signaling renewed demand for stable assets following the crypto market crash on October 11. This fresh mint pushes the combined total of new stablecoin issuance—by both Circle and Tether—to a massive $13.25 billion in the aftermath of the downturn.

Today’s minting activity was confirmed on-chain and quickly circulated across crypto monitoring platforms and social media, sparking conversation about what’s driving this sudden surge in supply.

Stablecoins Surge Post-Crash

The October 11 crash triggered a sharp drop across major digital assets, wiping billions in value in a matter of hours. Since then, both Circle and Tether have aggressively issued new stablecoins, with Tether contributing the majority of the $13.25 billion combined total.

Stablecoins like USDC and USDT are often minted in response to rising demand from institutions and traders looking for liquidity, especially during volatile periods. Their issuance also suggests that large players are gearing up to buy the dip or reposition funds for strategic entries across DeFi , CeFi, or OTC trades.

Circle’s $1 billion mint today adds to that momentum, hinting at increasing capital flow into the ecosystem as the market begins stabilizing.

What This Means for the Market

A surge in stablecoin issuance typically signals strong inflows into crypto. These assets are used not only for trading but also for lending, staking, and yield strategies across platforms. Large mint events often precede bullish market movements, as new liquidity tends to fuel price action.

While it’s still too early to call a full recovery, today’s minting highlights a notable shift in sentiment. The crypto market may be down, but it’s far from out—and the smart money seems to be getting ready to move.

Read Also:

- Circle Mints $1B USDC After Market Crash

- BlackRock Moves $387M in BTC & ETH to Coinbase Prime

- “Bitcoin Is Dead”… Again? History Repeats Itself

- Tether CEO Calls Market Dip ‘Bitcoin Black Friday’

- American Bitcoin Doubles Q3 2025 Revenue to $64M