Bitcoin Faces $95,000 Challenge After $655M Liquidation Event

- Bitcoin tests $95k HODL wall post $655M liquidations.

- Market reacts with uncertainty and caution.

- Institutional involvement influences price stability and depth.

Bitcoin’s attempt to breach the $95,000 HODL wall was halted by a rapid sell-off, leading to $655 million in long liquidations. Institutional investors and dense long-term holder supplies clustered in this area contributed to the market’s volatility.

Bitcoin’s value faced critical pressure, attempting to overcome the $95,000 HODL barrier after a wave of liquidations worth $655 million hit recently. The situation unfolded on major exchanges such as Binance and Deribit.

The event underscores Bitcoin’s current market volatility and institutional influence on trading conditions. Reactions indicate watchfulness among traders, with some stability anticipation.

Market Fluctuations and Institutional Influence

A combination of long-term holder movements and institutional investment trends has led to intensified market fluctuations. Many long-term holders maintain coins around the $95k cost basis, while institutional ETFs are adjusting their positions, affecting overall stability.

The impact on individuals and market segments is notable. Deribit, Binance, and others reported significant forced liquidations, illustrating market vulnerability and triggering investor caution.

“Bitcoin volatility tests conviction. The strength of HODLers makes the difference in drawdowns. Don’t panic, build with vision and patience.” — Paolo Ardoino, CEO, Tether

The financial implications are evolving as institutional reactions remain uncertain. Funding allocations are influenced by Federal Reserve signals, reflecting broader economic conditions. The drawdown occurs without affecting Ethereum or other major cryptocurrencies significantly.

Predictions for future reactions could be shaped by continued institutional shifts, dormant BTC reactivations, or policy changes. Past precedents during market dips demonstrate potential price support forms and demand bands ahead.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The community shapes the future of blockchain gaming with SACHI

- SACHI launches "The Origin" NFT event (200 exclusive OGs) to precede $SACHI token launch, offering early access and in-game perks. - CEO Jonas Martisius emphasizes NFTs as symbols of early support, fostering community engagement ahead of November 19 TGE. - Limited availability and "Origin" status incentives aim to drive exclusivity and loyalty in blockchain gaming ecosystem. - SACHI's vision integrates blockchain to create a self-sustaining gaming universe with tokenized rewards for player contributions.

SACHI's NFTs Mark the Beginning of a Player-Led Revolution in Blockchain Gaming

- SACHI launched "The Origin," a 200-NFT mint event granting early access to its blockchain gaming platform and future rewards. - The NFTs, called "SACHI OGs," symbolize early participation and offer exclusive perks like "Origin" status and visibility across official channels. - By integrating blockchain, SACHI aims to create a self-sustaining economy where players become stakeholders through tokenized rewards and digital identity markers. - Analysts predict the limited NFT supply could drive secondary mar

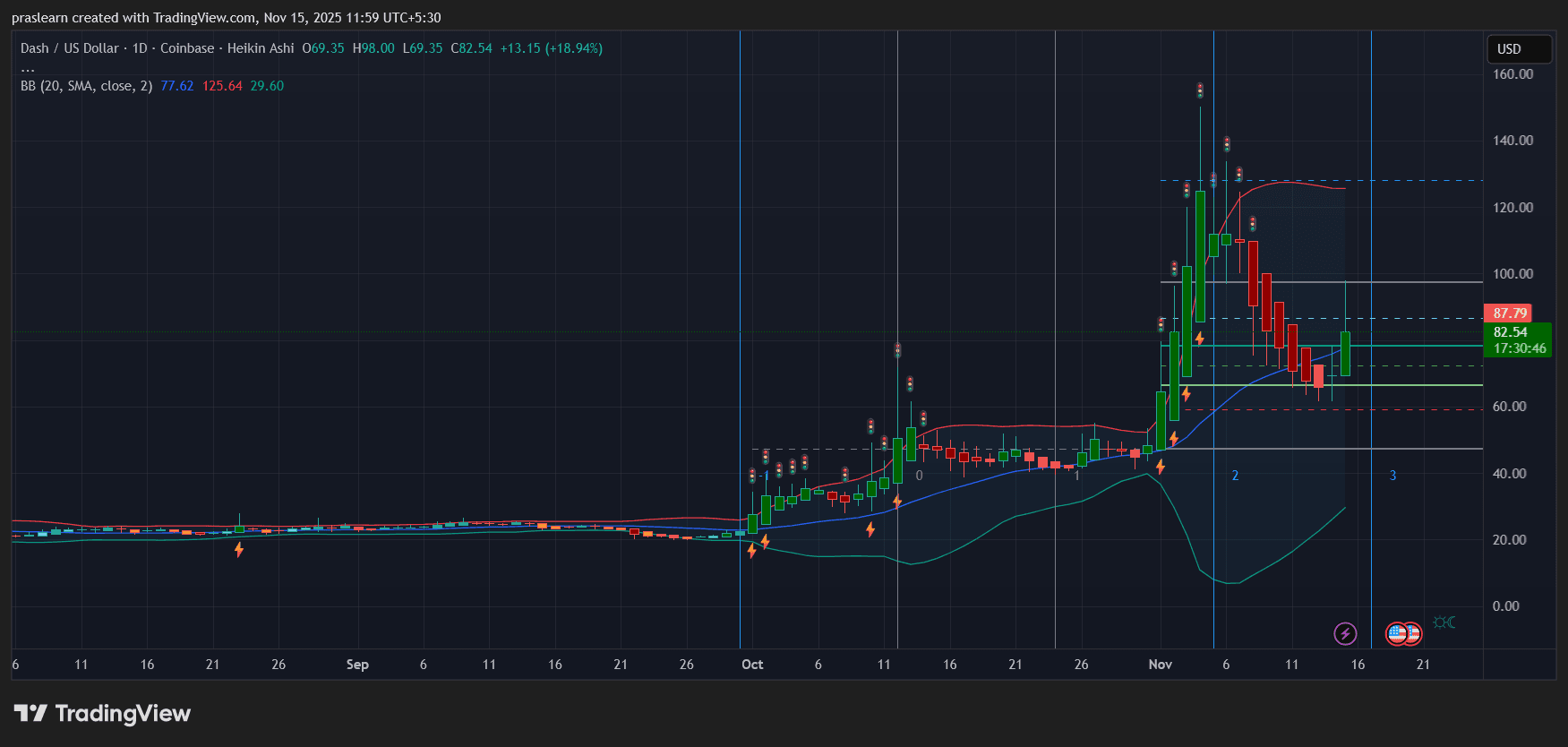

Zcash vs Dash: Which Privacy Coin Looks Stronger As Markets React to Tariff Relief?

Nigeria's Embedded Finance Experiences Rapid Growth Amidst Reforms and International Oil Market Uncertainties

- Nigeria's embedded finance market is projected to reach $4.34 billion by 2025 with a 12.2% CAGR, driven by digital adoption in e-commerce, healthcare , and education. - Economic reforms under President Tinubu led S&P to upgrade Nigeria's credit outlook to "positive," while Moody's raised its rating to "B3" in May 2025. - Fiscal challenges persist as Nigeria raised $2.35 billion via Eurobonds to address 2025 budget deficits amid global oil price volatility and implementation hurdles. - Fintech growth acce