'Some Bad Shit. Very Bad': Jeffrey Epstein Was Worried About Bitcoin and Crypto Taxes, Emails Reveal

Jeffrey Epstein was becoming increasingly concerned about tax policy in the United States related to Bitcoin and other cryptocurrency towards the end of his life—and hoped Steve Bannon could help, according to newly released emails from the convicted sex offender’s estate.

In a February 2018 correspondence, Epstein pressed Bannon, President Donald Trump’s onetime confidant and chief strategist, on his ability to get answers from the U.S. Treasury Department about crypto.

“Will [T]reasury respond to you re: crypto or do we need another way in for advice,” Epstein wrote to Bannon.

Bannon replied that the issue was then being mulled at the federal level by the “NSC,” or National Security Council, not the Treasury Department.

“Understood,” Epstein replied. “But there is an office of terrorism finance at [T]reasury that has thought about tax.”

The alleged sex trafficker, who was the subject of a federal money laundering probe according to emails revealed last month, went on to recommend to Bannon that the Treasury Department create a voluntary disclosure form for realized crypto gains to “fuck all the bad guys.”

Much about Epstein’s finances and personal investments remains shrouded in secrecy, years after his death in a Manhattan prison cell while awaiting trial on sex-trafficking charges. But the late financier was widely known to have shown an interest in Bitcoin and other cryptocurrencies.

His correspondences with Bannon suggest a growing concern about the regulatory fate of crypto, years before the U.S. government had established a clear view on the issue.

In a followup email to Bannon, Epstein used the presumably hypothetical example of buying furniture with Bitcoin on Overstock—then known as the first major retailer to accept Bitcoin as payment—and realizing a taxable gain on the disposed crypto.

In another email, Epstein described “our cr[y]pto coin issues” as U.S.-based and “predominantly” related to tax, regulation, and disclosure. It is unclear who Epstein was referring to then, beyond himself, when describing “our crypto coin issues.”

“World wide, a whole different bag,” he added. “Some bad shit. Very bad,” Epstein wrote.

In 2019, the Wall Street Journal reported that a source familiar with Epstein’s business practices said the financier claimed to work for the U.S. Treasury Department on “cryptocurrency and anti-hacking efforts.”

Crypto comes up numerous times in the more than 20,000 Epstein-focused emails and text messages released by Congress on Wednesday—and in most situations, the documents indicate the wealthy criminal was intent on getting crypto regulations pushed through the first Trump administration.

In one text correspondence from September 2018, Epstein told an associate that “crypto needs to be thought of [as] similar to the internet,” and approached with international agreements and “coordinated understandings.”

“Otherwise it is a Ponzi scheme outside of the law,” he said.

In June 2019, less than two weeks before he would be arrested and charged with sex trafficking minors, Epstein went on a tirade against Libra, Facebook’s failed stablecoin project.

“Libra is not a currency!! It is money… not the same,” Epstein wrote in an iMessage to an associate, arguing emphatically that the project “could take down [the] financial system” if put in the “wrong hands.”

The sex offender then went on to assert: “That’s the reason I didn’t pursue.”

It’s unclear if Epstein was referring to Libra specifically, or stablecoins generally. Decrypt reached out to David Marcus, Libra’s co-creator, regarding whether the project ever sought or received interest from Epstein about a potential investment, but did not receive a response.

Years prior, sometime before March 2015, Epstein apparently met at his Manhattan townhouse with Brock Pierce, co-founder of the stablecoin giant Tether, according to other emails released by Congress this week.

In another correspondence with an associate, dated April 2018, Epstein appeared tickled by how digital assets were starting to find a broader user base.

“Interesting crypto, everyone wants in,” Epstein texted the associate. “So amusing.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The community shapes the future of blockchain gaming with SACHI

- SACHI launches "The Origin" NFT event (200 exclusive OGs) to precede $SACHI token launch, offering early access and in-game perks. - CEO Jonas Martisius emphasizes NFTs as symbols of early support, fostering community engagement ahead of November 19 TGE. - Limited availability and "Origin" status incentives aim to drive exclusivity and loyalty in blockchain gaming ecosystem. - SACHI's vision integrates blockchain to create a self-sustaining gaming universe with tokenized rewards for player contributions.

SACHI's NFTs Mark the Beginning of a Player-Led Revolution in Blockchain Gaming

- SACHI launched "The Origin," a 200-NFT mint event granting early access to its blockchain gaming platform and future rewards. - The NFTs, called "SACHI OGs," symbolize early participation and offer exclusive perks like "Origin" status and visibility across official channels. - By integrating blockchain, SACHI aims to create a self-sustaining economy where players become stakeholders through tokenized rewards and digital identity markers. - Analysts predict the limited NFT supply could drive secondary mar

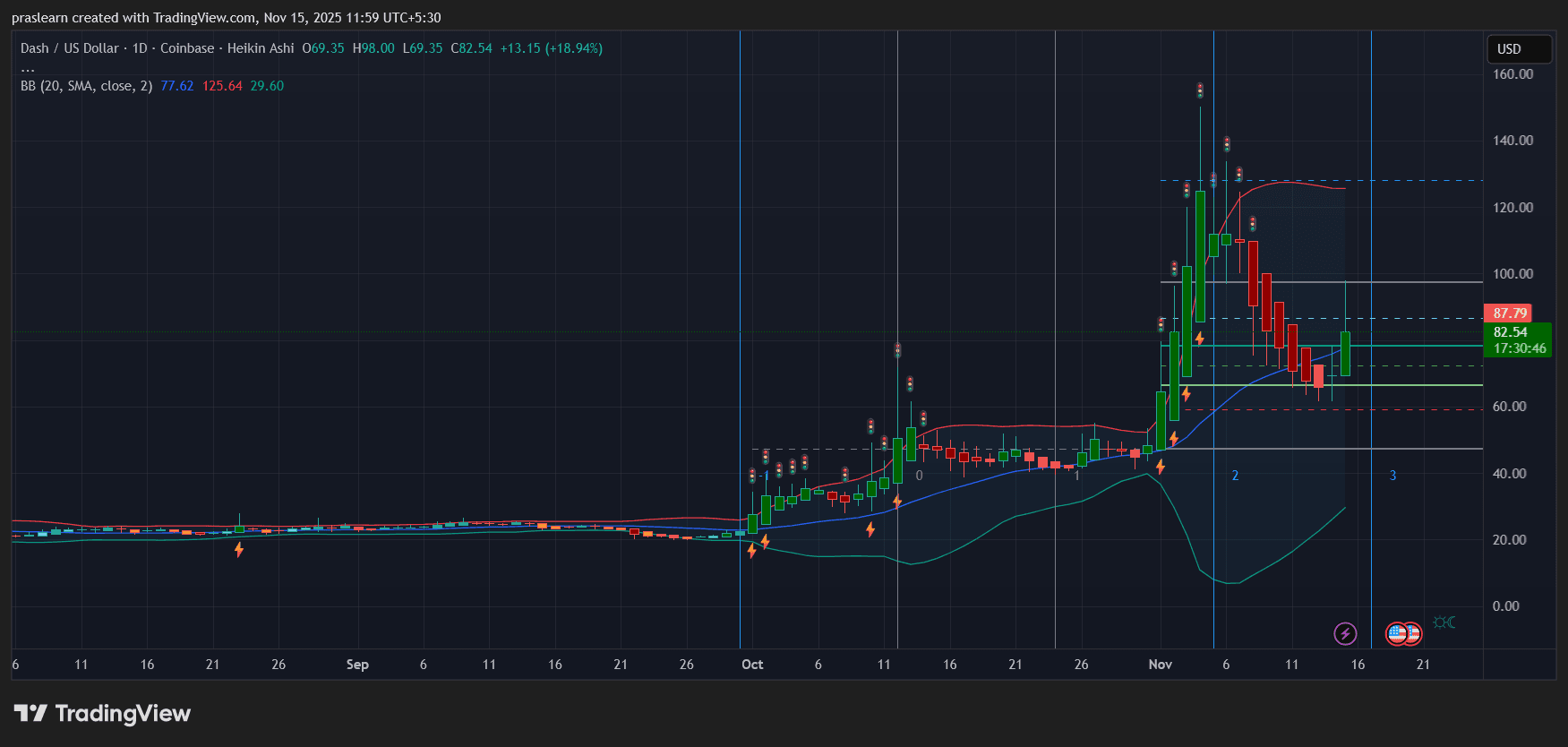

Zcash vs Dash: Which Privacy Coin Looks Stronger As Markets React to Tariff Relief?

Nigeria's Embedded Finance Experiences Rapid Growth Amidst Reforms and International Oil Market Uncertainties

- Nigeria's embedded finance market is projected to reach $4.34 billion by 2025 with a 12.2% CAGR, driven by digital adoption in e-commerce, healthcare , and education. - Economic reforms under President Tinubu led S&P to upgrade Nigeria's credit outlook to "positive," while Moody's raised its rating to "B3" in May 2025. - Fiscal challenges persist as Nigeria raised $2.35 billion via Eurobonds to address 2025 budget deficits amid global oil price volatility and implementation hurdles. - Fintech growth acce