How Grayscale Holds XLM as the Price Drops More Than 50%

Stellar faces steep market fear, yet Grayscale’s firm position and rising ecosystem activity signal potential stabilization ahead. The network’s payments push and RWA growth could help buffer continued pressure.

From its 2025 peak, Stellar (XLM) has fallen from $0.52 to $0.26. Grayscale — one of the leading crypto investment funds — has notably managed its XLM holdings during this downturn.

Extreme market fear at the end of the year continues to fuel negative expectations. What does Stellar (XLM) have to face these headwinds?

Grayscale Holds More Than 116 Million XLM

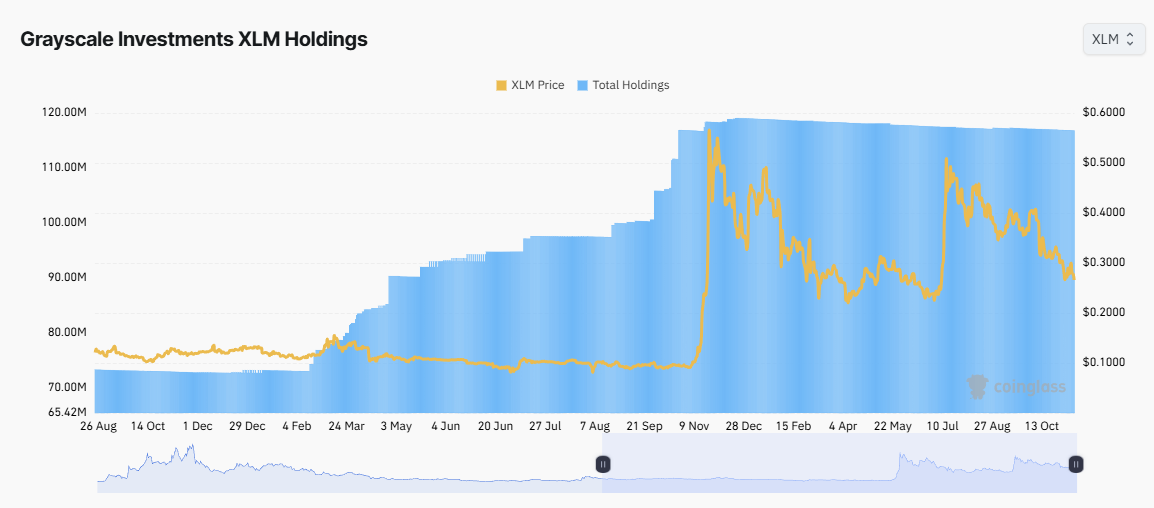

According to the latest data from Coinglass, Grayscale’s XLM holdings increased from last year, before XLM printed a “god candle” in November 2024 with nearly 600% growth.

Grayscale successfully accumulated XLM from 70 million to 119 million ahead of the rally. This move highlights the fund’s effectiveness as a smart-money participant that positioned itself before major market swings.

Grayscale Investments XLM Holdings. Source:

Coinglass

Grayscale Investments XLM Holdings. Source:

Coinglass

However, since early 2025, the fund has stopped accumulating. XLM’s price has stopped setting new highs and entered a downward trend. Compared to the 2025 peak, Grayscale’s XLM holdings slightly decreased to 116.8 million.

The fund’s refusal to sell aggressively reflects its investors’ long-term perspective. They appear to view XLM as a valuable asset in the cross-border payments sector.

More notably, shares of Grayscale Stellar Lumens Trust (GXLM) trade at a premium over its actual Net Asset Value (NAV).

Grayscale Stellar Lumens Trust Performance. Source:

Grayscale

Grayscale Stellar Lumens Trust Performance. Source:

Grayscale

GXLM’s market value sits at $24.85, while its NAV per share is $22.29.

The market price is about 10–15% higher than NAV. This premium indicates that investors are willing to pay above the underlying asset value. This condition has dominated most of the trading sessions in 2025.

However, when comparing Grayscale’s XLM holdings to the more than 32 billion XLM circulating supply, the fund only controls about 0.36% of the supply. This share remains too small to create any decisive impact on the market.

What Does Stellar (XLM) Have to Counter Selling Pressure?

November 2025 marked a pivotal moment when seven major crypto players — Fireblocks, Solana Foundation, TON Foundation, Polygon Labs, Stellar Development Foundation, Mysten Labs, and Monad Foundation — officially launched the Blockchain Payments Consortium (BPC).

This alliance aims to promote blockchain-based payment standards. BPC focuses on cross-chain integration, enabling XLM to reach millions of users across other ecosystems. These developments could boost demand in 2026.

“During Q3, the Stellar network saw 37% growth in full-time developers, 8 times faster than the industry growth rate,” Stellar stated.

In parallel, the Stellar ecosystem continues to see explosive growth in Real-World Assets (RWA). Total RWA value on the network reached a record $654 million in November 2025, up from $300 million at the beginning of the year.

Tokenized Asset Value on Stellar. Source:

RWA

Tokenized Asset Value on Stellar. Source:

RWA

Charts from RWA.xyz show significant contributions from tokenized funds, including Franklin OnChain US Government Fund and WisdomTree Prime.

However, real adoption stories do not always align with market sentiment. Recent analysis indicates that XLM has historically performed poorly in November. With altcoins drowning in extreme fear, XLM may struggle to escape the broader negative trend.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Today: Are Bitcoin Futures Indicating a Market Bottom or a Potential Trap for Investors?

- Rare Bitcoin futures signal emerges as open interest drops below $8B and funding rates turn negative, sparking debate about a potential market bottom. - Derivatives experts note this rare alignment of metrics historically precedes crypto market consolidation or reversals, but caution against over-interpretation. - On-chain data shows whale accumulation rising 12% in a month, contrasting with broader market weakness and weak Bitcoin fundamentals. - Analysts warn macroeconomic factors like inflation could

Druckenmiller’s $77 Million Investment Sparks Momentum in Blockchain Lending, Analysts Raise Their Projections

- Billionaire Stanley Druckenmiller's $77M investment in Figure (FIGR) triggered a 15% stock surge, signaling institutional confidence in its blockchain lending model. - Analysts raised price targets to $55-$56 after Q3 results showed 70% YoY loan growth to $2.5B and 55.4% EBITDA margins, surpassing estimates by 40-200%. - Figure's AI-driven capital-light model and RWA tokenization (e.g., $YLDS stablecoin) are highlighted as growth catalysts, with 60% of loans now via its Connect platform. - Institutional

Solana Latest Updates: VanEck's Collaboration on a Staked Solana ETF Reflects Growing Institutional Trust in Blockchain's Prospects

- VanEck partners with SOL Strategies for staking in its new Solana ETF (VSOL), enhancing institutional blockchain integration. - SOL Strategies' ISO-certified validators secure $437M+ in assets, chosen for operational expertise and institutional focus. - VSOL offers staking rewards with fee waivers until $1B AUM, reflecting growing demand for Solana-based funds like Bitwise's BSOL. - VanEck's $5.2B digital asset portfolio expands with VSOL, though staking risks and regulatory uncertainties remain for inve

Blockchain and AI Open Up Pre-IPO Wealth Opportunities to Everyday Investors