Ethereum Whales Snap Up $1.6 Billion ETH As Selling Declines

Ethereum shows early recovery signs as whales accumulate heavily and long-term holder selling drops. ETH now faces a crucial test at the $3,607 resistance level.

Ethereum is attempting to stabilize after an extended decline that raised concerns about its ability to stage a recovery. ETH has struggled to generate upward momentum for most of the month.

However, shifting investor behavior now suggests the situation may be changing. Declining selling pressure and aggressive whale accumulation are creating early signs of strength.

Ethereum Whales Show Their Strength

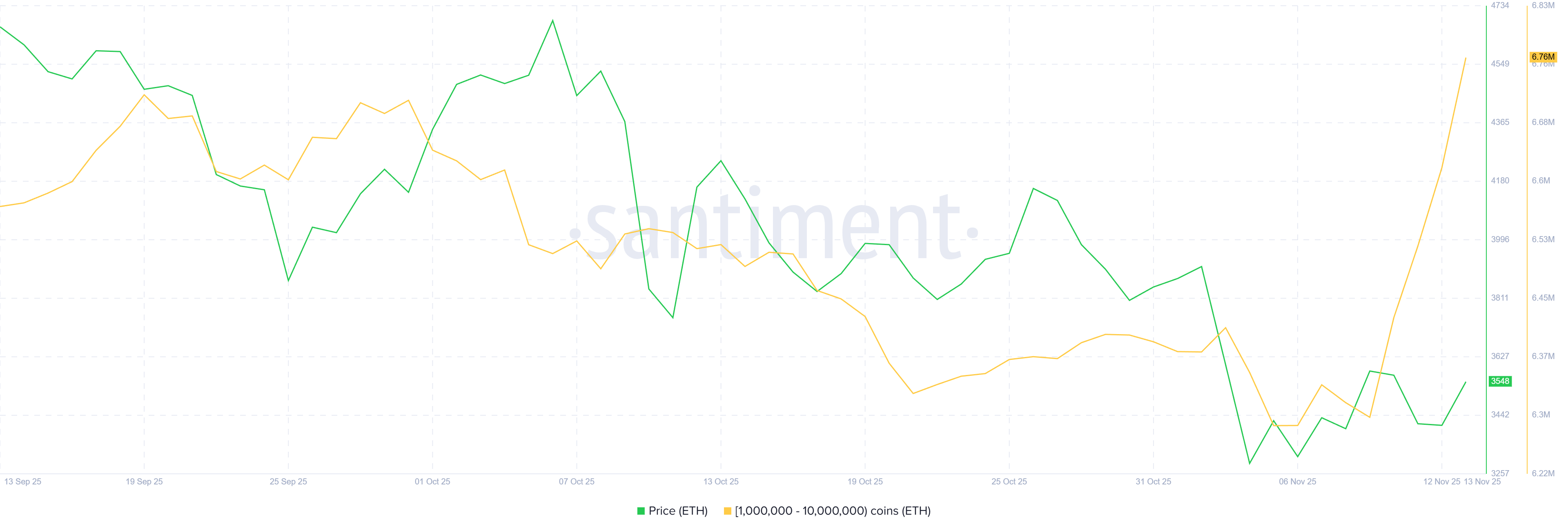

Whale activity has become a key driver of Ethereum’s current market sentiment. Addresses holding between 1 million and 10 million ETH have accumulated nearly 460,000 ETH in the last four days. This haul, valued at more than $1.6 billion, indicates strong conviction among large holders that Ethereum is positioned for a rebound. Their behavior often sets the tone for broader market direction, and this scale of accumulation signals renewed confidence.

This buying spree also highlights that whales see ETH’s discounted prices as an opportunity rather than a warning. Large purchases during periods of market weakness often precede recovery phases.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

Ethereum Whale Holdings. Source:

Ethereum Whale Holdings. Source:

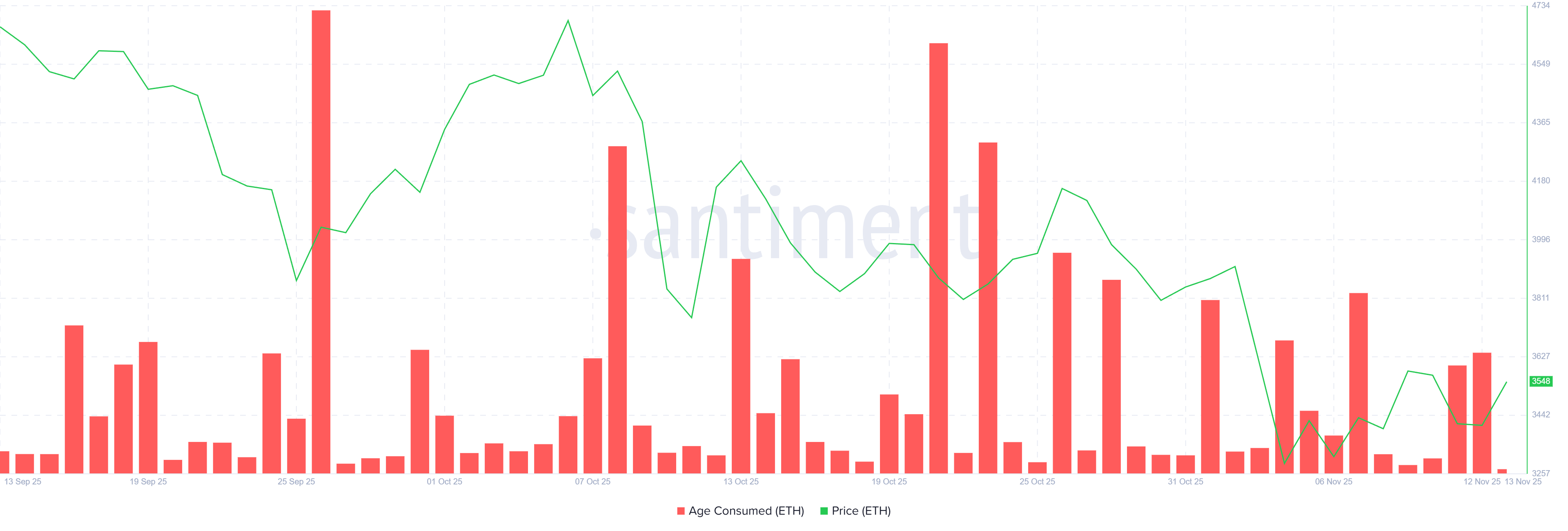

Beyond whale accumulation, Ethereum’s macro momentum shows additional improvement. The Age Consumed metric is declining, reflecting a noticeable slowdown in long-term holder selling. The indicator tracks the movement of older coins, and smaller spikes suggest fewer long-standing investors are parting with their holdings. This behavior is critical, as LTH selling, historically, amplifies market downturns.

The reduced movement among dormant coins gives Ethereum breathing room. When LTHs hold instead of distributing their supply, selling pressure eases, helping stabilize price action. Combined with whale accumulation, this creates a more resilient foundation that could allow ETH to recover once favorable conditions return.

Ethereum Age Consumed. Source:

Ethereum Age Consumed. Source:

ETH Price Faces Downtrend

Ethereum’s price is at $3,540 at the time of writing as it attempts to break above the $3,607 local resistance. ETH remains under a month-long downtrend, but this ceiling is the first key level that must be reclaimed before bullish momentum can return.

If the factors mentioned earlier continue to strengthen, Ethereum could successfully clear $3,607 and advance toward $3,802. Reaching this level would help ETH challenge the prevailing downtrend and potentially open the door to further gains.

ETH Price Analysis. Source:

ETH Price Analysis. Source:

However, if ETH fails to breach $3,607, the altcoin could slide toward the $3,287 support level again. Losing that floor would expose the price to a deeper drop toward $3,131, invalidating the emerging bullish outlook.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Crypto Market Finds "Fertile Ground" Post-Drop as Buyers Take in Capitulation Sales

- Bitcoin fell below $95,000 in late November 2025, triggering panic as the Fear & Greed Index hit a nine-month low of 10. - Waning institutional demand, macroeconomic uncertainty, and $600M in forced liquidations accelerated the selloff, with spot ETFs losing $1.1B in outflows. - XWIN Research warned the correction could persist until mid-2026 if key $92,000–$94,000 support levels fail, while 96 of top 100 cryptos declined. - Political tensions emerged after Trump pardoned Binance's Zhao, who received a $

Bitcoin News Update: "Institutions' Confidence or Meme Frenzy: Crypto Faces the $110,000 Turning Point"

- Bitcoin rebounds from $100k lows amid U.S. government reopening, with analysts eyeing $110k as potential target driven by regulatory clarity and ETF optimism. - MoonBull ($MOBU) emerges as high-risk speculative play, projecting 7,244% ROI through Ethereum-based tokenomics including liquidity locks and 2% holder reflections. - Market duality highlighted by institutional-grade BTC consolidation vs. community-driven meme tokens, with $MOBU's 23-stage presale raising $600k and 1,900+ holders. - Technical ind

Ethereum News Update: Ethereum’s Unsteady Recovery: Weighing Optimism Against Ongoing Downward Pressures

- Ethereum rose 2.36% to $3,533 on Nov 13, 2025, with $37B trading volume, showing a rebound from $3,373 lows amid crypto market volatility. - Technical analysis warns of fragile recovery, with key support at $3,053 holding but bearish signals from MACD and a broken upward channel. - Broader crypto pressure persists as Bitcoin and Ethereum ETFs face outflows, while macroeconomic uncertainties like U.S. government shutdown risks dampen institutional participation. - Analysts advise caution below the 200-day

Uniswap News Today: Uniswap's UNIfication Launches a New Era of DeFi Leadership for the Next Decade

- Uniswap's UNIfication proposal introduces protocol fees, token burns, and buybacks to transform UNI into a deflationary asset. - The plan drives UNI's 63% weekly price surge and allocates 0.3% trading volume to liquidity providers and buybacks. - Whale accumulation and $38M/month buyback projections signal strong market confidence in Uniswap's governance overhaul. - The proposal unifies Uniswap's ecosystem, introduces fee discounts, and launches CCA for institutional-grade liquidity infrastructure. - DeF